REITs rebound but lockdowns curb retail recovery

The best performing were fund managers with earnings related to e-commerce logistics, writes Nicki Bourlioufas.

Listed real estate investment trusts (REITs) have rebounded strongly over the last year, but the renewed lockdowns pose risks for the Australian sector, especially for retail REITs, while industrial and data centre trusts are faring much better.

With almost half of Australia’s population subject to stay-at-home orders, many Australians have stopped spending in shopping malls. Retail REITs are likely to be hurt most by the lockdowns in Sydney and Melbourne, with many difficult months ahead, according to analysts.

“Among the major REITs, the impact of lockdowns is likely to be most felt by the high-end shopping mall operators such as Scentre Group, operator of Westfield in Australia, and Vicinity Centres, operator of Queen Victoria Building and The Strand in Sydney, and Chadstone in Melbourne, amongst others,” Morningstar equity analyst Alexander Prineas says.

“Not only do restrictions impact trading, but the recently reinstated landlord code of conduct in NSW and Victoria will force landlords to provide rental waivers and deferrals to some SME tenants.”

Neighbourhood shopping centres will also suffer, but not to the same extent as high-end malls, says Prineas.

“Some tenants are prevented from trading, such as hairdressers, beauty salons, and gyms. However, this is somewhat offset by supercharged foot traffic at the non-discretionary tenants, notably supermarkets."

“The two major operators of neighbourhood shopping centres are Charter Hall Retail REIT and Shopping Centres Australasia, and both have a proportion of their supermarket tenants paying rent linked to turnover. So, when supermarket sales increase, more rent is payable."

REIT yields in recent times have fallen because REIT prices have rallied “but the increase in distributions has not gone up at the same pace, so the yield has not gone up,” says Dr Don Hamson, managing director of Plato Investment Management. Over the 12 months to September 3, 2021, the S&P/ASX 200 A-REIT delivered a total return of 30.2 per cent, compared to 27.3 per cent for the S&P/ASX 200.

The A-REIT index has recovered its losses from the pandemic

Source: Morningstar Direct

Whereas online commerce has hurt retail trusts, it has favoured industrial REITs. Both Hamson and Iddo Snir, senior investment analyst at Resolution Capital like industrial property REIT Goodman Group, and diversified property fund manager Charter Hall. Both have strong growth forecasts for the next year ahead, they say.

“COVID-19 accelerated structural tailwinds including higher online sales penetration, resulting in greater demand for industrial real estate to distribute inventory. COVID-19 has also disrupted global supply chains, prompting tenants to hold more inventory to shore up resiliency,” says Snir.

AMP Capital Head of Global Listed Real Estate, James Maydew, says the best performing segments of the listed property market have been those fund managers with strong earnings growth such as those related to e-commerce logistics.

“The sectors with the highest long term total return to us are those invested in less followed real estate sectors such as data centres, life science/healthcare and manufactured housing and those that can deliver superior earnings growth such as the fund management cohort.”

However, housing REITs, like retail trusts, could also be hurt by the pandemic given our closed borders and lower population growth. Morningstar’s Prineas says no-moat Stockland, for example, faces an uncertain future.

“Beyond the next two years, we wonder where customers will come from, as government stimulus, low rates, and working-from-home appears to have pulled forward demand for housing. With population growth curtailed by 18 months of border restrictions, eventually this should become visible in Australia's rate of household formation.

Mirvac, he says, has a better outlook given its office division. “No-moat Mirvac's fiscal 2021 result showed it has one of the best office portfolios in the sector. It has among the longest lease profile, and a modern portfolio of buildings, many of which have been recently built or refurbished.”

Record payouts

REITs are popular with investors for the income they provide and the liquidity they offer. According to Iddo Snir, yields are typically higher than those offered by equities.

“REITs that own tangible real estate typically provide higher yielding and more stable, longer duration cashflows than general equities. These physical assets particularly benefit from population growth and urbanisation,” he says.

James Maydew adds that one of the key benefits is “the inflationary hedge it plays as the underlying investments are tangible assets that pay a reliable income yield, typically linked to inflationary style annual increases.”

Prineas says most REITs in 2020 suspended or drastically reduced distribution payments. In contrast, “in 2021, most REITs have reinstated distributions, albeit at levels below 2019, and with either no forward guidance, or conservative guidance.”

In contrast to falling REIT yields, Australian equity yields have jumped this year, with dividend yields sitting above REIT yields. Over $38 billion in equity dividends have been declared in the recent reporting season, $17 billion more than last year, and $10 billion more than 2019 in the recent reporting season, according to Plato’s Hamson. “We are having a record year for dividends across the board,” he says.

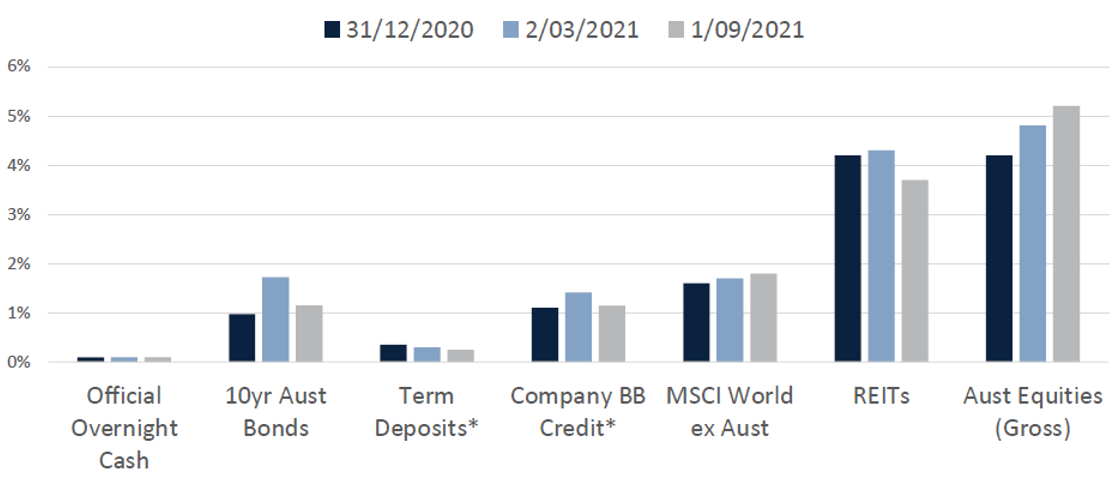

Plato's asset class outlook for income

Forecast 12 month income as at 01/09/2021

Source: Plato, Bloomberg, RBA*

It's important to note that REITs, unlike equities, do not pay franked dividends. REITs pay their “distributions” from income that is not yet taxed, and they must pay out 90 per cent of their earnings to unitholders. That contrasts to companies which pay dividends out of income already taxed at the company tax rate, which is paid back to shareholders in the form of franking credits.