Sydney airport acquisition could succeed, but at what price?

A consortium of infrastructure investors have their sights set on Sydney's international airport.

Sydney Airport has received a $22.3 billion proposal from a consortium to acquire 100 per cent of the entity at a price of $8.25.

We think the proposal has reasonable odds of success but is likely to be drawn out. Should today's proposal evolve to a bid, the price will likely be updated for good or bad, based on insights from other nations “living with the virus" before Australia. Long-term earnings are critical for valuation, but Sydney Airport's high debt load makes the recovery trajectory important.

We see few regulatory or national security stumbling blocks arising from taking Sydney Airport private, or from the identity of the consortium bidders - IFM, QSuper and Global Infrastructure Management.

IFM owns circa 25 per cent of privately-owned Melbourne Airport, a stake large enough to suggest authorities are comfortable with it, but not so large as to present competitive concerns, especially as a second government-owned airport in Sydney is due to open in 2026.

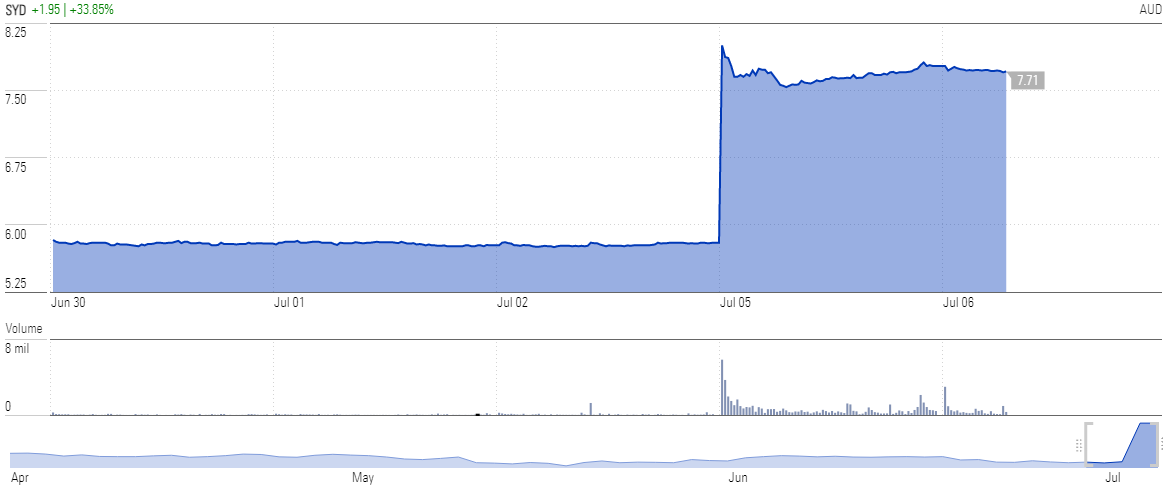

Shares in Sydney Airport (ASX: SYD) surged 34 per cent following the takeover offer

5 day price chart

Source: Morningstar

Likewise, QSuper has an interest in Brisbane airport, through QIC, who manages a 25 per cent stake in the airport. Global Infrastructure Management, owns or manages numerous important infrastructure assets around the world.

We note the proposal's conditions, with notable stumbling blocks being the consortium's requirement for due diligence, and unanimous support from Sydney Airport's board. The likely timeframe for this to play out is months.

The indicative offer price of $8.25 is a large 42 per cent premium to the share price immediately before the offer, of $5.80. It might be easy to assume that premium will get investors and the Sydney Airport Board over the line. However, we think the consortium, Sydney Airport management and shareholders, and the market, will be closely watching other nations that are further ahead in the vaccine rollout for evidence of a recovery in international travel.

We continue to expect vaccination in Australia to have covered most eligible adults by early 2022, however there are issues other than the virus to consider. For example, 8 per cent of arrivals into Australia (pre-Covid-19) were from China. But passenger levels from there are likely to remain somewhat depressed until trade tensions ease.

We retain our estimate that domestic passenger numbers in Australia will surpass 2019 numbers in 2022, and international passenger traffic reaches 2019 levels by 2024.

Sydney Airport shares today have traded within a 5 per cent discount of the acquisition proposal price of $8.25, implying a high likelihood of the proposal proceeding. Shares currently screen as modestly overvalued with risks skewed to the downside.

Read Prineas' full analyst note at Morningstar Premium