Copper’s back but electric vehicles may not be the best way to play it

The ubiquitous metal is a bit like iron ore in that its fortunes hinge on activity in China.

The Copper Age ended several thousand years ago, but the metal, used in everything from electrical conduction to machinery of all sorts, is again having a moment.

The Sydney Morning Herald reported last Wednesday that big investment banks are advising investors to “load up” in anticipation of copper’s use in renewable energy and electric-vehicle infrastructure.

But investors should keep in mind that, unlike lithium, copper is still predominantly a mundane metal, says Morningstar equity analyst Seth Goldstein.

“EVs are the biggest driver of lithium demand, but transport is roughly only 20 per cent of copper use in China,” Goldstein says.

“The bigger driver is fixed investment, so EVs will help but it won’t be to the same extent as a resource like lithium.

“I don’t think copper is as good a way to get EV exposure.”

Fixed investment means machinery, infrastructure, buildings, and other physical assets.

That means talking about China, which consumes about 60 per cent of the world’s copper. Some of that copper will be used for EVs and renewable energy says Goldstein, but a lot will go into fuelling investment in infrastructure and real estate.

“Similar to commodities like iron ore, once Chinese demand drops or slows drastically, prices plunge.

“That creates a risk for copper prices.”

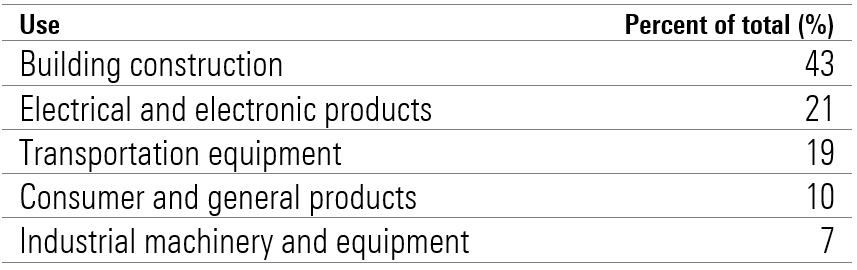

Copper use in the United States (2020)

Source: USGS Minerals Yearbook 2020

Copper prices have soared this year. Prices are up 35 per cent, from US$7918 a tonne in January, to a peak of US$10,724 on 10 May, according to data from the London Metal Exchange.

Copper isn’t alone. The Bloomberg Commodity Index, which tracks 23 different commodity futures, is up 45.48 per cent year on year.

Part of the story is supply constraints. Producers cut back when the pandemic hit. Demand has since rebounded, but production can’t double in a day; mines take a while to restart, says Goldstein.

Prices were hit by volatility this week and have fallen 6 per cent off their highs.

In a nod to the importance of China, prices fell when Chinese authorities announced measures this week to rein in “unreasonable” price gains in commodity markets.

The importance of China makes the copper story a little less sexy, but a lot more familiar, says Morningstar Australia direct of equity research Mathew Hodge.

“If you look at today’s prices through the traditional lens, not the sexy EV story, it explains a lot of where we are,” says Hodge.

“The near-term outlook for infrastructure and housing is really good because interest rates are low and infrastructure spending is up. That’s good for copper.”

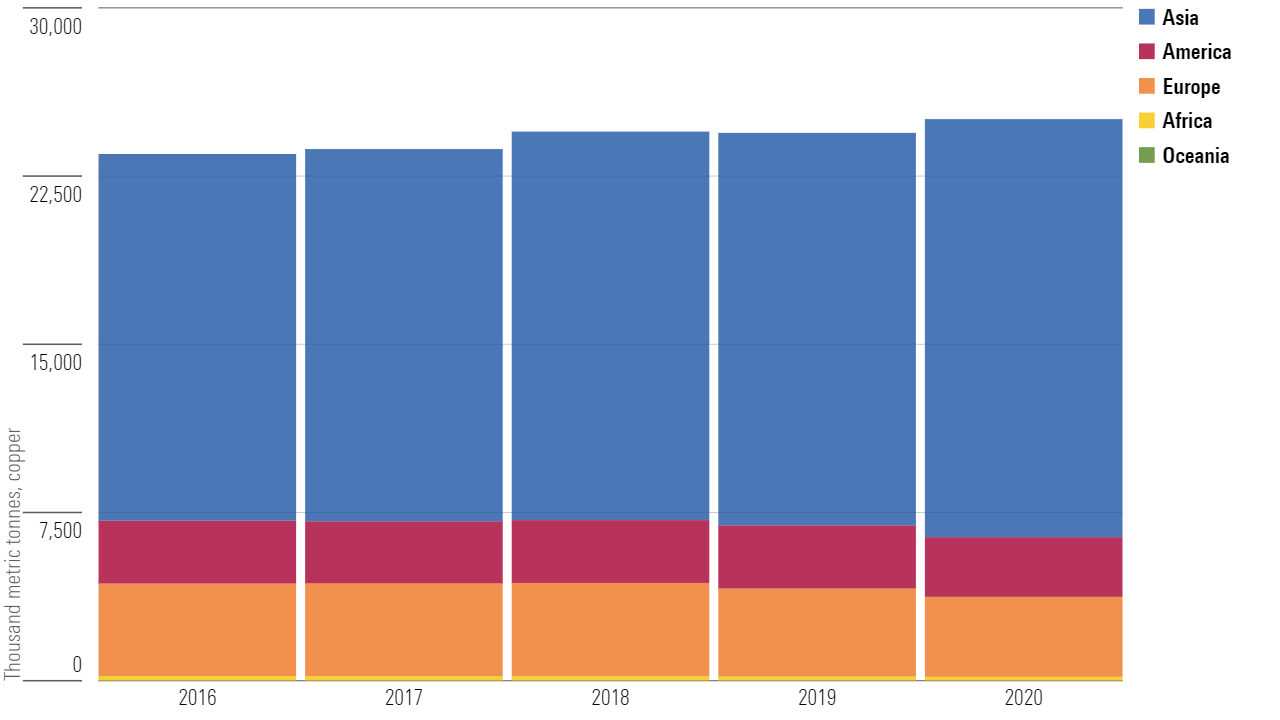

Copper use worldwide

Source: International copper study group

Stocks for a bet on copper

Copper will still play an important role in the EV revolution, says Goldstein. It’s the best electricity conductor, and electric vehicles have double the wiring of an internal combustion engine vehicle.

There’s also the building of the charging infrastructure, which will require copper.

Based on these factors, Ernst & Young, a consultancy, forecasts copper demand rising 12 per cent to 15 per cent, in a December report.

Meeting this demand are a mix of large, diversified miners such as BHP (ASX: BHP), and Glencore (GLEN), and pure-plays like Southern Copper or Freeport-McMoRan.

In 2020, copper made up about 25 per cent of top line revenue for BHP, and 42 per cent for Glencore’s industrial business.

Southern Copper and Freeport-McMoRan are outside Morningstar coverage.

Morningstar recently raised its fair value estimate for Rio Tinto (ASX: RIO) by 11 per cent. It closed Friday $122.12, a 40 per cent premium on the fair value estimate.

Glencore closed at GB$311.70 on Thursday and is trading in a range considered to be fairly valued.

Hodge says Newcrest (ASX: NCM), is another option. About 20 per cent of its revenue comes from copper, but it’s a third of its resource profile.

Newcrest closed Friday at $27.78 and is trading in a range considered to be fairly valued.

Asset flows suggest commodity enthusiasm is growing. Flows into Australian mining ETF VanEck Vectors Australian Resources were up 40 per cent between October and April, hitting a record high of $128 million. In the same period, flows into BetaShares Australian Res Sect (QRE) more than doubled, to $99 million.

But Goldstein advises caution when it comes to chasing commodity prices up.

“Mining ETFs tend to be some of the most cyclical. Prices tend to rise very fast, but it’s a riskier part of the market.

“Make sure you’re comfortable with that risk.”