Commodity prices set for a short sprint not a long boom

Higher commodity prices today are unlikely to become a long-term trend, says Morningstar’s Mathew Hodge.

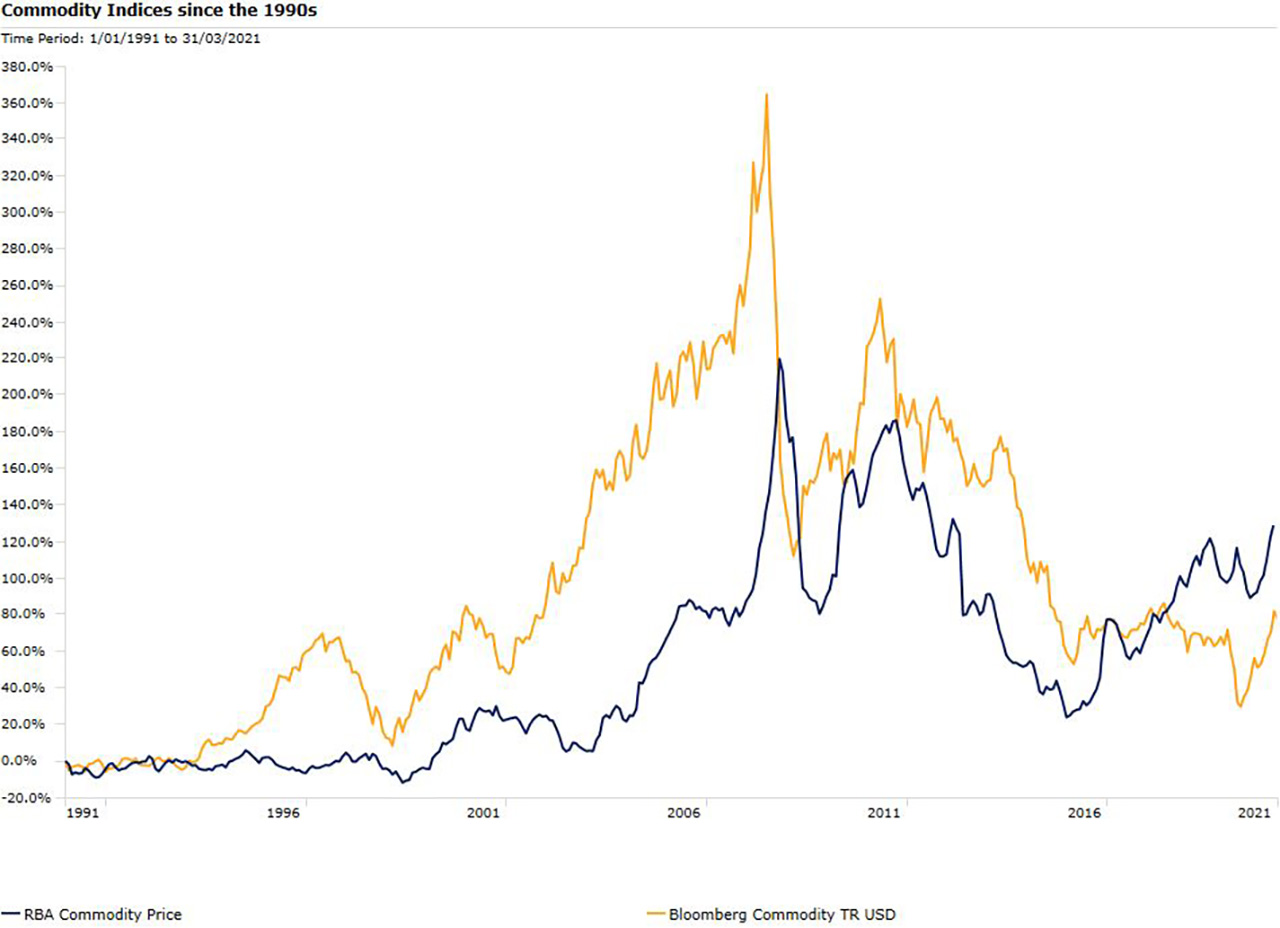

Between 2011 and 2013, China poured more concrete than the US did over the entire 19th century—a century punctuated by two world wars and the creation of the US national highway system. Thanks to China’s growth spurt over the 2000s, commodity prices surged into a “super cycle.” In Australia, this manifested in the mining boom. But by 2011, prices were already falling, and the cycle was over.

Some say it is happening again. Copper, a bellwether commodity, is up 85 per cent since this time last year. Possible factors that could drive a new cycle include massive government spending, the “green energy” transition, and underinvestment in supply. And if the world’s internet search engine is any guide, “Commodity super cycle” hasn’t trended this high on Google since 2015.

But Morningstar director of equity research Mathew Hodge is sceptical.

“It isn’t like 2000,” Hodge says. “Iron ore was $20 then, it’s $160 now. Pre-2000s were some of the worst commodity prices since the Great Depression. Today, there isn’t cheap stuff lying around or a giant economy waiting to emerge.”

Big-ticket infrastructure packages and electric vehicles have helped prices this year, but they are unlikely to offset the effect of a maturing Chinese economy, says Hodge. The recycling of commodities such as steel and copper in the developed world is also curbing demand.

There is still value out there, but it’s more likely to be found in niches than in broad-based price rises. Hodge cites Australian miners such as Newcrest Mining (ASX:NCM), Whitehaven (ASX:WHC), or Iluka (ASX:ILU).There are also ways to get exposure to electric vehicles, in particular.

Source: Morningstar Direct

The 2000s super cycle

Between 2000 and July 2008, the Bloomberg Commodity Index TR rose by 234.1 per cent. Stagnating prices since the 1980s and declining production costs combined with the economic miracle of the 21st century: the rise of China.

“If you go back 20 years ago, commodities were basically at their lowest level since the Depression,” says Hodge, “When I was at university in the late 1990s, we assumed that prices would deflate in real terms, or go nowhere.”

“China emerged to consume, roughly speaking, pretty much half of any commodity you’d like to point out with the exception of oil.”

China wasn’t alone. Emerging economies enjoyed a growth decade, buoyed by a declining US dollar—most commodities are priced in US dollars, so a weaker US dollar lowers the price of commodity exports.

Source: Morningstar Direct

The situation today

Today looks different. The major consumer of commodities, China, is maturing and unlikely to be replaced. China achieved a lot of growth through fixed investment—roads, chemical factories, high-speed rail, airports. But a country only needs so many airports. With Chinese fixed investment steady, it is unlikely another emerging economy could step in as a replacement, says Hodge.

“India is not developing anywhere near the same way in terms of scale. It’s also much more of a service-based economy. In Africa, even if steel consumption were to grow by 10 per cent a year, it would barely move the needle.”

According to the World Steel Association, in 2019, Africa and India together used 7.8 per cent of world steel. China used 51.3 per cent.

Global steel consumption 2019

Source: World Steel Association

Could the green energy revolution create enough commodity demand to replace China? Hodge thinks that’s unlikely.

“Take copper, which is an important conduit for electricity. Its use is still primarily linked to construction or power infrastructure.

“Yes, some does end up in your toaster. The question is how that balances against the withdrawal of China.”

In 2019, according to United States Geological Survey, 50 per cent of copper is used in construction or industrial machinery. Electronics only make up 20 per cent.

At the same time, developed economies often recycle such large quantities of commodities like steel or copper that they become “almost circular”, Hodge says. You get a situation where lots of demand can be met through scrapping and recycling.

What’s behind today's surging prices

Those that see a new super cycle point to big infrastructure spending in the US—Biden announced US$2 trillion on Wednesday—but Hodge cautions about reading too much into it. Covid stimulus has hit prices of iron ore and copper because they are used in infrastructure and real estate. But the US is still a small consumer by global standards. China has accounted for most of the incremental demand in the last 20 years.

The price rises have also been helped by underinvestment in supply. Data from the Australian Bureau of Statistics shows mining investment has declined by about 50 per cent since late 2015.

“I don’t think anyone expected China to continue increasing the rate of investment,” Hodge says “The miners probably, rightly, thought that this is pretty mature.”

Investors could be forgiven for having doubts watching prices soar for battery components like lithium or cobalt over the last year. While Morningstar expects the price of lithium to continue growing into 2021, that doesn’t necessarily mean an all-inclusive super cycle.

Getting investment exposure to commodities

Nor does caution over another commodity super cycle mean a lack of value.

No-moat Australian miner Whitehaven Coal closed 31 March at $1.77, a 45 per cent discount on the fair value estimate of $3.20. Iluka Resources, the world’s largest producer of zircon, a metal widely used in ceramic, closed at $7.21, slightly below fair value estimate of $7.40. Newcrest Mining is one of the world’s largest gold miners and closed $24.42, below the fair value estimate of $28.50.

Still, investors hoping for a sustained and rapid surge in prices should look elsewhere, says Hodge,

“I don’t think we’re going to double steel production again in the next 20 years. If you look at long-term demand for copper, there are long periods of stagnation.”