Buy now, regret later? How Afterpay is dividing punters and pundits

Its record run has seduced retail investors, but fund managers are less willing to jump on.

Mentioned: Firetrail Absolute Return (42189), Airlie Australian Share (24681), Antares Ex-20 Australian Equities (43474), Ten Cap Alpha Plus Class A (15451), BlackRock Advantage Australian Equity (3005), Monash Investors Small Companies Class A (40953), Aristocrat Leisure Ltd (ALL), Barrack St Investments Ltd (ECP), CSL Ltd (CSL), Humm Group Ltd (HUM), Mirrabooka Investments Ltd (MIR), Telstra Group Ltd (TLS), Zip Co Ltd (ZIP)

Afterpay is proving to be a popular stock among retail investors, but it’s had a far less hospitable reception among Australian fund managers.

Only two of Morningstar's medallist active Australian equity fund managers feature the market darling in their published top holdings, preferring to focus their attention on household names like CSL (ASX: CSL), Telstra Corp (ASX: TLS), and gambling machine manufacturer Aristocrat Leisure (ASX: ALL).

Silver-rated BlackRock Advantage Australian Equity includes the buy-now pay-later firm, as does the Bronze-rated listed investment company Mirrabooka Ord (ASX: MIR), Morningstar data shows. However, the positions are very small. Advantage, a quantitative fund that takes small active positions in a plethora of companies, devotes just 0.24 per cent of its portfolio to Afterpay, while Mirrabooka's weighting is 0.86 per cent.

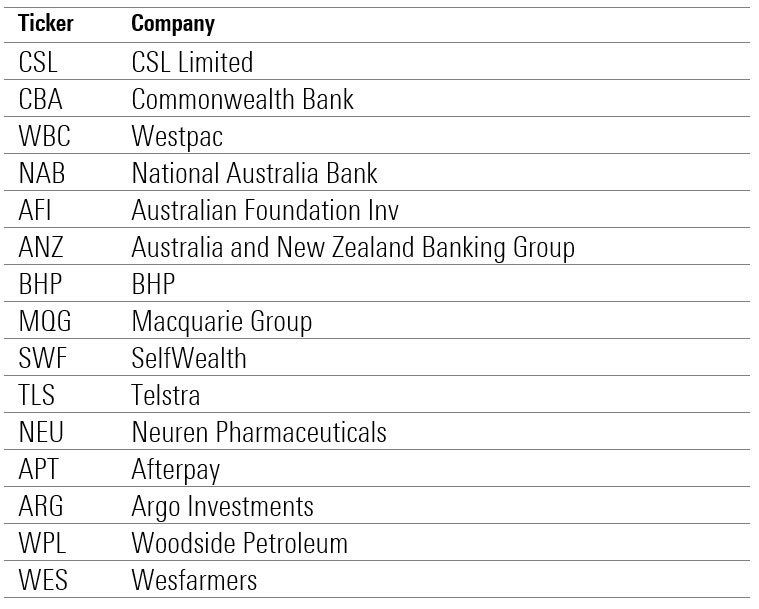

Retail investors, on the other hand, can't seem to get enough of Afterpay (ASX: APT). The stock showed up as one of the most held among SelfWealth users in May 2020, coming in at number 12 on the online broker's top 15 holdings list. APT beat out larger names including Wesfarmers (#15), Fortescue Metals (#19) and Rio Tinto (#18).

Top holdings across SelfWealth members’ trading accounts throughout May 2020

Source: SelfWealth

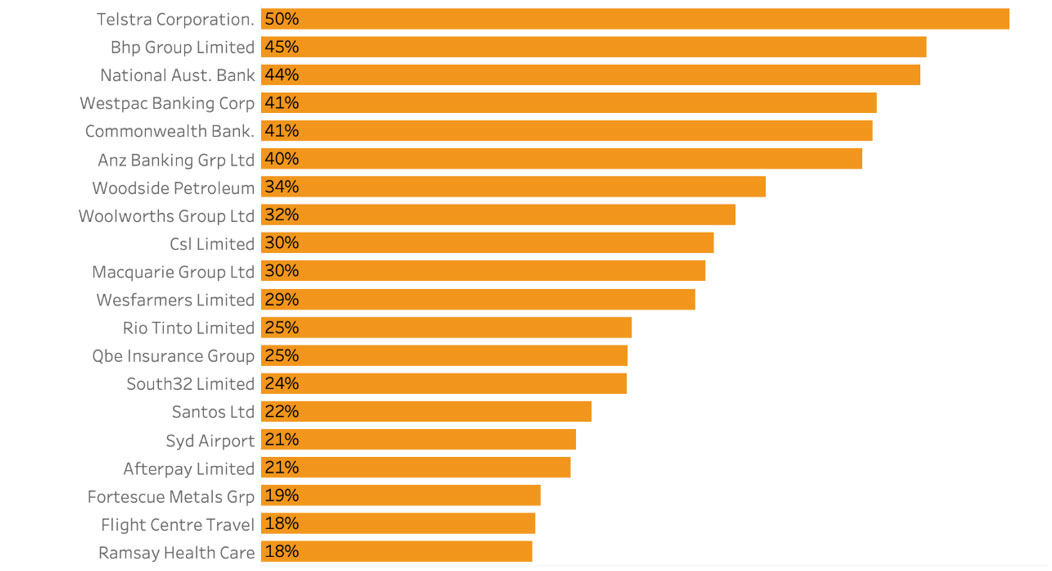

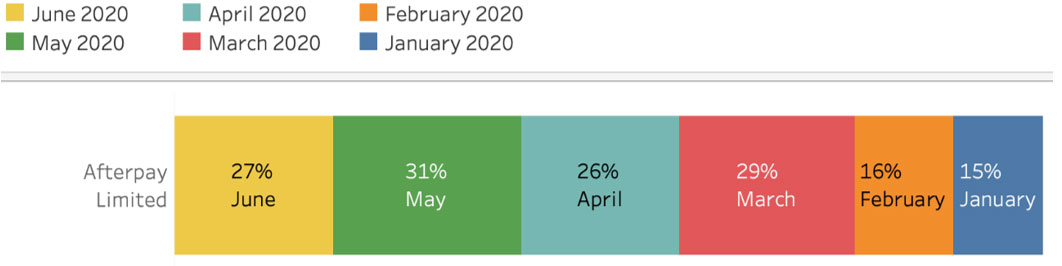

The BNPL company is also popular among Sharesight users, 21 per cent of whom hold the stock in their portfolio. The stock’s popularity has doubled since the COVID-19 dip, growing from 15 per cent of users in January to 29 per cent in March.

Top holdings by Sharesight users, June 2020

Source: Sharesight

Percentage of users in each month that held Afterpay in their portfolios

Source: Sharesight

Investors who have bought Afterpay since the market's fall have been richly rewarded. Since March 23 lows the stock has risen 551 per cent, trading between $8 and $50 in the space of two months and giving the company a market capitalisation of more than $15 billion. Even investors who held the stock ahead of the COVID-19 crash are in the green: it has surpassed $50, with a year to date return of 89 per cent.

Reasons behind Afterpay's recent share price rally include its partnership with eBay Australia, its inclusion in the MSCI Australia Index, a positive third quarter update, and the news last month that Chinese fintech giant Tencent Holding's had bought a 5 per cent stake in the company.

And retail investors may be on the right track. New research by Goldman Sachs shows a group of stocks favoured by US retail investors outperformed picks by hedge funds and mutual funds in the COVID-19 rally. Goldman, using data from Robinhood, Robintrack and FactSet, compiled a portfolio of popular stocks among retail investors. The basket of equities is up 61 per cent since March, outpacing Goldman’s hedge fund basket by more than 15 per cent over the same period.

MORE ON THIS TOPIC: Easy money: download Robinhood, buy stonks, bro down

The investor rush coincides with Afterpay’s expansion in to the US, the UK, and New Zealand. The brand has proved popular with millennials, replacing the credit card with digital layby, and iconic brands have followed. Management estimate about 27 per cent of Australia’s millennial population (born after 1981), the targeted cohort, and about 16 per cent of the entire Australian population, have transacted with Afterpay. Afterpay generally earns a margin of about 4 per cent and above for small to medium size merchants and below 3 per cent for larger enterprises. $1000 invested in the stocks in October 2017 would today be worth over $21,000.

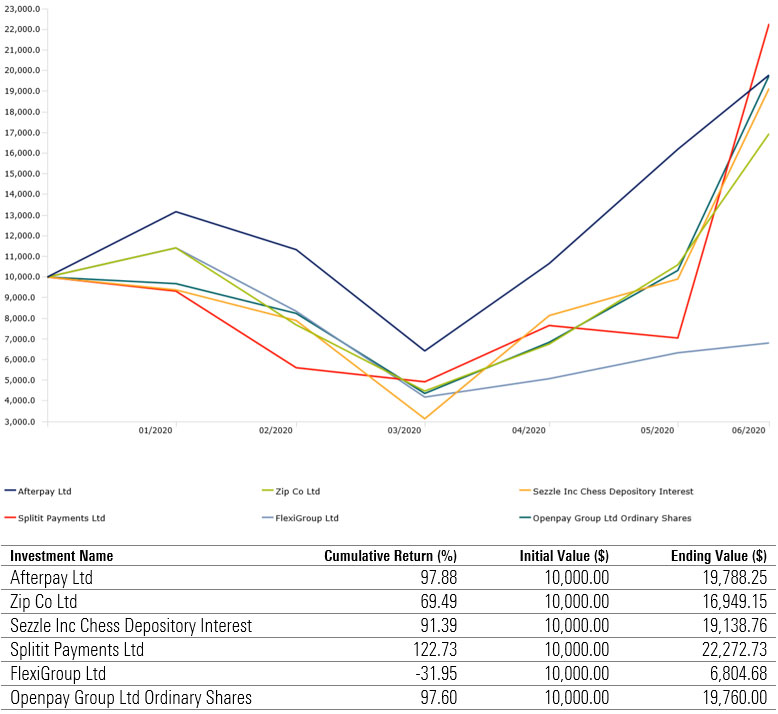

ASX Buy Now, Pay Later Stocks, Growth Chart, Year to Date

Source: Morningstar Direct

But you'd be hard pressed to find a researcher who would recommend buying the stock at its current price. Shaun Ler, associate equity analyst at Morningstar, has a $20.50 per share fair value on the stock, which means it’s 183 per cent overvalued. While he believes Afterpay has good growth potential, he is cautious about how leveraged it is to consumer spending, especially the discretionary and fast fashion sectors that Afterpay focuses on.

"The COVID-19 economic downturn is driving up unemployment," he says. "I feel the current share price is optimistic and is overlooking the near-term risks, which assumes that bad debts won’t rise, and discretionary spending will keep rising. To me it looks like another hyped-up FOMO rally."

Ler notes that Afterpay is operating in a highly competitive space, up against BNPL names like Zip, Latitude, and the global player Klarna and has not assigned a moat to the company. Retail investors have also been buying Zip (ASX: Z1P) following its plans to acquire the remainder of US BNPL provider QuadPay.

Swiss banking giant UBS downgraded APT to sell in April, with a target price of $14 citing risks stemming from COVID-19; Macquarie has a $36 valuation.

Matt Williams from Airlie Funds Management (ASX: AASF) gave a similarly frank assessment of Afterpay's prospects earlier this year.

"It's a great concept. I wish I'd thought of it, but it's a sell," he said in an interview with Livewire when the stock was trading around $39.

"It's priced for perfection. The forecasts are for $500 million in EBIT in three or four years' time. I don't think that's going to happen.

"There's plenty of competition. There's five or six even listed competitors here in Australia. The big guy, Klarna, is on its way as well. And that also assumes that the 4 per cent that they take from the merchants doesn't move. If that 4 per cent becomes less, and a lot less, then that's really problematic."

Afterpay is not however without manager support. Outside of Morningstar analyst coverage, small-mid cap investor ECP Emerging Growth is highest on a short list of asset managers within the database who include it in their top 10 holdings. ECP Emerging Growth has a 5.55 per cent portfolio weighting to the stock.

The Monash Absolute Investment fund also holds the stock, as does the Firetrail Absolute Return fund and the newly launched Antares ex-20 Australian Equities.

Monash portfolio manager Simon Shields said his fund cut back on its weight by about 2 per cent after Tencent’s buy-in and after APT’s announcement that it had reached 5 million active customers in the US. However, Shields says it remains one of the fund's largest holdings.

Tribeca Alpha Plus fund held the stock in its top 10 in its March 2020 quarterly update, but the stock was nowhere to be found by May 2020. Portfolio manager Jun Bei Liu says she hasn't fallen out of love with Afterpay but sees more opportunity in its smaller rivals.

"We've loved Afterpay for many years, having bought into it many years ago," she told Morningstar.

"In the shorter term we felt that the share price has rallied a lot. We increased our holding during the March dip, when the share price went below $10, and made big returns for our investors. Now, we've taking some profit off the table.

"Subsequently, we increased our holding in ZIP as we felt it has been left behind, which has been fortuitous following its 70 per cent rise this month.”

Liu says the fund still has a holding in APT but outside of the top 10.

"I feel the BNPL sector still has an enormous growth potential," she says. "Most of the players are only touching the surface of the flexible payments market.

"If there was another sell-off, considering the volatility of the stock, we'd be more than willing to step up and support it."

Brokers Bell Potter and Ord Minnett have set price targets of about $65 for the company.

Afterpay's rise comes as the retailers it relies upon have been forced to close their doors and lay off staff amid the COVID-19 shutdowns. Subdued economic conditions are also likely to restrain discretionary spending. Many retailers have switched their focus online to keep cash flowing.

Morningstar analyst Mark Taylor has delayed his forecast for profitability by one year, citing the challenged near-term outlook.

"It’s hard to imagine the historically strong growth persisting amidst the COVID-19 outbreak as it will likely lead to subdued consumer spending, widespread unemployment and potentially a global recession," he says.

"[Afterpay’s] financial viability and earnings potential will be tested materially for the first time, which brings greater unknowns and risk."