Rising debt threatens Chinese financial system

China's expanding debt raises concerns given similarities with other credit booms that crashed, dominance of state-owned enterprises, shadow-banking, and its dangerously distorted property market.

The rapid expansion in China's debt-to-GDP ratio has raised concerns among many observers, including us, because it is reminiscent of prior credit booms that have ended badly. Having watched Beijing repeatedly stimulate its way to higher growth, investors ask why this can't continue. Bluntly, if credit continues to outpace GDP growth significantly, we expect one of two scenarios to eventually occur.

The first scenario is a full-blown credit crisis. Here, we'd see credit availability sharply contract, leading to a decline in investment spending. Overall economic activity would then slow amid a wave of borrower defaults. As the bad debt is recognized and written off by banks, lending growth can resume, helping the economy return to growth.

The second scenario is persistently weak economic growth. In this scenario, we'd see a rising share of credit continue to flow to "zombie" state-owned enterprises and local governments and debt rolled over at banks, papering over losses.

In turn, less credit would be available to private companies, which have been very productive and generated higher returns on equity than SOEs. With less credit flowing to productive investment, the credit returns continue to falter, leading to lower levels of productivity as more-productive sectors are starved of credit.

Where China is now

We see a rising debt burden as the single-greatest risk to the overall Chinese system as we ponder the economy's growth prospects. Unless China can slow the rate of credit growth, we believe the system will become increasingly unstable, culminating in a financial crisis.

China has been through this before with the early 2000s bailout, which eventually cost around 50 per cent of its 1999 GDP. The costs of a bailout will be distributed throughout the system, including households, banks, and the government, and broadly suggest that a sharp slowdown in GDP growth for China is inevitable.

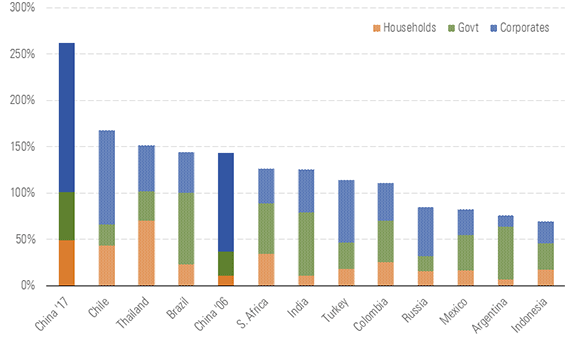

We expect real GDP growth to slow to around 4.5 per cent over the coming decade. Before the 2007-09 crisis, China's debt-to-GDP ratio was relatively stable in the low 140s. However, this has changed dramatically since 2009, and the ratio had increased to around 260 per cent at the end of 2017, by our estimates.

In fact, the growth in China's debt has accounted for roughly a third of the global growth in debt over the same time frame. On a sector basis, nonfinancial corporate debt, which is primarily state-owned enterprises and local government financing vehicles, is primarily responsible for the increase.

China stands alone

The increase in debt means that China is alone among its peers. That said, household debt is relatively low at around 49 per cent of GDP, and the Chinese consumer is not overleveraged, though consumer debt has been increasingly rapidly recently, which is why we favour increasing consumer consumption as a key reform for the Chinese economy.

At 51 per cent of GDP, government debt is also low compared with other major developed countries, yet we still see it as problematic because of the central government's support of SOEs, which means classifications between government and corporate debt can be skewed by anywhere from 10 per cent to 30 per cent.

Exhibit 1 China's credit/GDP makeup compared with other countries

Source: BIS. Morningstar

China's credit-to-GDP ratio is extremely high by middle-income country standards. Globally, we observe a tendency for credit-to-GDP to rise with income growth, reflecting an economy's financial deepening. The general pattern suggests a country at China's level of development might have a total credit-to-GDP ratio (private nonfinancial) of roughly 75 per cent, rather than just over 250 per cent.

BRIC mates Brazil, Russia, and India--while hardly models of efficient capital allocation--boast far lower credit-to-GDP ratios than China, at 144 per cent, 84 per cent, and 125 per cent, respectively.

Through year-end 2017, China's credit-to-GDP ratio had expanded 115 percentage points from preboom levels. Only Thailand's experience comes close to China in terms of the scale of the credit boom (93 percentage points), although preboom Thai credit-to-GDP (89 per cent) was lower than that of China (145 per cent) or any of the other booms we reviewed. At 260 per cent by year-end 2017, by our estimates, Chinese credit-to-GDP far outstrips the average "peak" seen in prior episodes (165 per cent of GDP) and is roughly 78 points greater than the next highest (Thailand at 182 per cent).

SOEs, local governments major contributors to problem

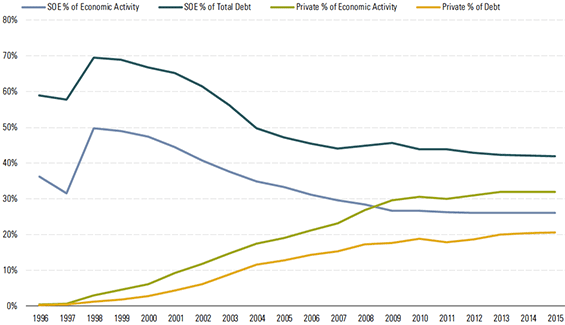

China has one of the largest state sectors in the world. According to the Ministry of Finance, China has about 150,000 state-owned enterprises (SOE), accounting for about 20 per cent of total employment and 30 per cent-40 per cent of GDP.

About one-third of these are controlled by the central government, and the remainder by the local governments. Reforming the SOEs is critical if China is to successfully rebalance, as they are often inefficient entities supported by the central government for political and social reasons. Banks overwhelmingly lend to them, as SOEs are responsible for over half of the corporate debt and about one fourth of economic activity.

Exhibit 2 State-owned enterprises as a percentage of economic activity and debt

Source: CEIC

We need to see sustainable reform around improving SOE efficiency using hard budget constraints, among other items. There are hundreds of coal and steel firms, for example.

SOEs by their nature are often used as extensions of the central government and thus wield significant political power; this makes it more complex to encourage them to become efficient and profitable while ensuring they remain loyal to the government.

Local government financing vehicles are also a major source of the increase in credit and system instability. Much of this instability is because the Chinese fiscal system is one of the most decentralised in the world, with local governments contributing 55 per cent of revenue yet responsible for 71 per cent of expenses, because of reforms introduced in the mid-1990s.

Real estate most likely crisis trigger point

Banking systems can vary in quality around the world, and banking crises can occur for a variety of reasons, including regulatory, political, and competitive--not just economic shocks.

Also, banking crises don't occur just because a system is insolvent. They are triggered by a liquidity event that exposes the underlying insolvencies. We think the most likely trigger event would be negative developments in the Chinese real estate market, given its overall importance to China's economy as well as its web of interconnections among banks, SOEs, local governments, and shadow banking.

The actual trigger events, in our view, are likely to be driven by a collapse in investor confidence around the real estate market. Confidence-sapping events would include property developer defaults on debt, difficulty obtaining capital, trust or wealth management product defaults, or increased levels of SOE defaults, which would in turn boost bank and local government loan losses.

However, similar concerns have been raised about the Chinese real estate market for at least a decade. Implicit government support of the real estate market appears to be in place for the near term, as we see new regulations designed to rein in frothy markets on a regular basis.

As a result, we don't anticipate a real estate crash in the next few years, though a readjustment period for the Chinese real estate market in which prices and real estate activity slow and decline is a near certainty over our 10- year forecast horizon.

Dangerous distortions

We believe the Chinese real estate market is very distorted for several reasons, and dangerous interconnections among SOEs, local governments, and shadow banks increase the risk of a crisis, in our view.

The growing interconnectedness of the Chinese financial system increases the risk of contagion and makes it more difficult for regulators to manage risks. Chinese real estate property investment is about 20 per cent of China's GDP, and about 40 per cent of government revenue, making it the most important real estate market in the world.

Urban housing completions have tripled since the late 1990s, whereas housing prices have quadrupled over the same time frame.

By themselves, those numbers wouldn't be a significant concern. However, price/income ratios have increased substantially in many cities.

The only offsets at this point are that down payments are typically over 30 per cent, with housing debt typically comprising less than 50 per cent of annual income; and Chinese consumers are arguably underleveraged, with mortgage debt at 18 per cent of GDP versus over 70 per cent of GDP for U.S. consumers in 2006.

In other words, a downturn in the real estate market is unlikely to be driven by consumer-specific factors, such as mortgage defaults. Instead, it will be driven by a lack of investor confidence in the market, caused by a variety of credit defaults because of the lack of reasonably priced capital.

More from Morningstar

• Make better investment decisions with Morningstar Premium | Free 4-week trial

Stephen Ellis is an equity strategist within Morningstar's equity and credit analysis team, based in Chicago, US.

© 2018 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This information is to be used for personal, non-commercial purposes only. No reproduction is permitted without the prior written consent of Morningstar. Any general advice or 'class service' have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892), or its Authorised Representatives, and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Please refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a licensed financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782 ("ASXO"). The article is current as at date of publication.