What did Morningstar subscribers buy and sell during July?

Investors are piling into an undervalued stock, and two gold medalist ETFs.

Mentioned: Apple Inc (AAPL), BHP Group Ltd (BHP), iShares S&P 500 ETF (IVV), Microsoft Corp (MSFT), Vanguard Australian Shares ETF (VAS), Vanguard MSCI Intl (Hdg) ETF (VGAD), Vanguard MSCI Intl ETF (VGS), Woodside Energy Group Ltd (WDS)

What do our analysts think about Morningstar Investor subscriber's top trades during July?

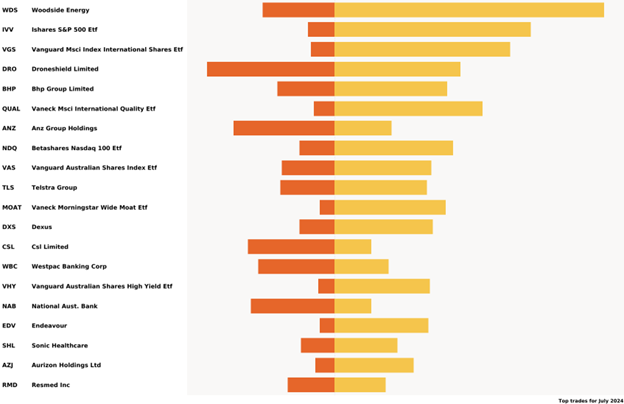

Sharesight is a portfolio tracker that is integrated into Morningstar Investor. Their data shows the top 20 trades by Morningstar users in July 2024. Last month was peculiar. It was the first month where the top 4 trades had been ETFs. 9 out of the top 20 trades were ETFs, all heavily weighted to the buy side.

July is back to the status quo, with direct equities making up a fair share of the list. When we look at July’s top buy trades, we can see Woodside WDS topped the list. iShares S&P 500 ETF IVV was second, with Vanguard MSCI Index International Shares ETF VGS rounding out our top three.

Figure: Morningstar's top trades for July, 2024. Source: Morningstar Investor/Sharesight

Here is what our equity and manager research analysts think about our top buy trades.

Woodside Energy WDS ★★★★★

As Australia's premier oil player, Woodside Petroleum's operations encompass liquid natural gas, natural gas, condensate and crude oil. However, LNG interests in the North West Shelf Joint Venture, or NWS/JV, and Pluto offshore Western Australia are the mainstay, and the low-cost advantage of these assets form the foundation for Woodside. Future LNG development, particularly relating to the Pluto project, encompasses a large percentage of this company's intrinsic value.

Woodside is unique among Australian energy companies in that it has successfully managed the development of LNG projects for more than 25 years—unparalleled domestic experience at a complicated and expensive task. Adding to Woodside's competitive advantages are the long-term 20-year off-take agreements with the who's who of Asia's blue chip energy utilities, such as Tokyo Electric, Kansai Electric, Chubu Electric, and Osaka Gas. These help ensure sufficient project financing during development and should bring stability to Woodside's cash flows once projects are complete.

Woodside's development pipeline is deep, enabling it to leverage the tried and trusted project-delivery platform as a template for other world-class gas accumulations off the north-west coast of Australia. Woodside is well suited to the development challenge. With extensive experience, it remains a stand-out energy investment at the right price. It is currently a five star stock, trading at a meaningful 38% discount to fair value.

Top buy trade: iShares S&P 500 ETF IVV

Morningstar Medalist rating: Gold

Many passive Australian investors are anything but. They deviate from this strategy by making active decisions to be overweight in certain sectors, themes or geographies. It is no secret that Australian investors prefer and are heavily invested in domestic markets.

However, Australian investors have started to double down on the US as well. This may be due to the US outperforming almost every other market since the GFC. It is no surprise that iShares S&P 500 ETF IVV makes the top three.

Given the breadth of coverage and the cost efficiency, iShares S&P 500 ETF IVV is a fine choice for investors seeking US-specific equity exposure. Our manager research analysts think it is the best in class option for large cap investors. The strategy is expected to outperform its peers over the long term and remains the clear choice for investors to gain US exposure. It can be paired with other ex-US products to form a balanced global equity portfolio.

The underlying benchmark, the S&P 500, is a market-cap-weighted index of the largest 500 companies in the United States. Thus, it offers giant- to mid-cap exposure, covering about 80% of the free-float-adjusted market cap of the US equity market. This results in a well-diversified index at the stock and sector levels. As such, passive strategies that track the S&P 500 stand as above-average options in a market segment where active managers have generally struggled to outperform. Consisting of highly liquid stocks, material stock-specific valuation information is quickly incorporated into stock prices.

From an Australian perspective, IVV gives exposure to a broad portfolio of some of the world’s most noteworthy companies, including sectors that are underrepresented in Australia such as technology and healthcare. The S&P 500’s correlation to Australian equities has come down in recent years, effectively adding to diversification for Australian equities exposure. It earns a silver medalist rating.

At an annual fee of 0.04%, the fund is priced attractively compared to active and passive peers.

When we look to the index’s exposure, 34% of the index is in the top 10 holdings, 6.86% of the index is in one holding – Apple AAPL, 6.76% in another, Microsoft MSFT. The index is highly concentrated in tech, with over 30% of the index in this sector (at 1 August 2024).

Vanguard MSCI Index International Shares ETF VGS

Morningstar Medalist rating: Gold

Vanguard MSCI Index International Shares ETF provides Australian investors with an affordable and efficient gateway to the global equity markets. This exchange-traded fund (VGS) and its AUD-hedged version (VGAD) mirror the MSCI World ex Australia Index (and AUD Hedged version for the hedged class), incorporating net dividends reinvested, setting a challenging benchmark for active fund managers to surpass. With its low expense ratio and Vanguard's expanding scale, the strategy presents a formidable challenge for active managers to beat.

The underlying index has universal appeal for constructing a diversified portfolio that spans 22 developed economies represented by approximately 1,500 holdings. The index is skewed toward the United States (a common feature across most global indexes) but given the majority of its holdings are multinationals earning sizable revenue from international markets, concentration is not a notable risk here.

The strategy will wax and wane with the index and is chained to its notable biases. Of late, it has faced intense competition from skillful active managers who, with their enhanced risk-management skills, can weather the market volatility better to beat the index. However, in terms of long-term performance, Vanguard edges past most managers in the cohort. The vehicle may receive currency diversification benefits from investing internationally as the currency is not hedged to AUD, but for those who are currency risk-averse, the AUD-hedged version is also available at a modestly higher price.

In summary, Vanguard MSCI Index International Shares ETF stands out as a best choice for Australian investors seeking global market exposure. Its cost efficiency (0.18% Total Cost Ratio), broad diversification across multiple developed markets, and solid performance record, especially in a competitive landscape with skilled active managers, highlight its appeal. It earns a gold medalist rating, the highest rating our manager research analysts award.

Get Morningstar insights in your inbox

Terms used in this article

Star Rating: Our one- to five-star ratings are guideposts to a broad audience and individuals must consider their own specific investment goals, risk tolerance, and several other factors. A five-star rating means our analysts think the current market price likely represents an excessively pessimistic outlook and that beyond fair risk-adjusted returns are likely over a long timeframe. A one-star rating means our analysts think the market is pricing in an excessively optimistic outlook, limiting upside potential and leaving the investor exposed to capital loss.

Fair Value: Morningstar’s Fair Value estimate results from a detailed projection of a company's future cash flows, resulting from our analysts' independent primary research. Price To Fair Value measures the current market price against estimated Fair Value. If a company’s stock trades at $100 and our analysts believe it is worth $200, the price to fair value ratio would be 0.5. A Price to Fair Value over 1 suggests the share is overvalued.

Moat Rating: An economic moat is a structural feature that allows a firm to sustain excess profits over a long period. Companies with a narrow moat are those we believe are more likely than not to sustain excess returns for at least a decade. For wide-moat companies, we have high confidence that excess returns will persist for 10 years and are likely to persist at least 20 years. To learn about finding different sources of moat, read this article by Mark LaMonica.