How to invest in nuclear power’s renaissance

The evolution of sustainable investing has led to a rethinking of nuclear energy.

Nuclear energy has been a hotly debated topic in sustainable investing circles for decades. Nuclear power emits zero carbon, but challenges with waste disposal, occupational safety, and high-profile accidents have led to immense backlash.

For many in the sustainable investing realm, nuclear has been an easy “no” when building a portfolio.

But opinions can change. As carbon has become the primary focus in efforts to stem climate change, a reassessment of the role of nuclear as a baseload power source—alongside more-volatile wind and solar clean energy—has led to a series of recent about-faces.

In 2022, Europe included the energy source as part of its sustainable investment taxonomy, recognising its role as a transition fuel to a fully renewable power grid.

Japan also confirmed last year that it would restart its nuclear fleet after seeing rising carbon emissions power prices since the 2011 Fukushima Daiichi nuclear accident.

Last year, California reversed its plan to close its last nuclear plant, Diablo Canyon, and now will keep the plant running at least through 2030 owing to slower-than-expected renewable energy development. And in the investing sphere, sustainability-focused investor Parnassus just a few weeks ago voted to drop nuclear from its list of exclusions.

Nuclear power’s growth set to rebound, led by Asia

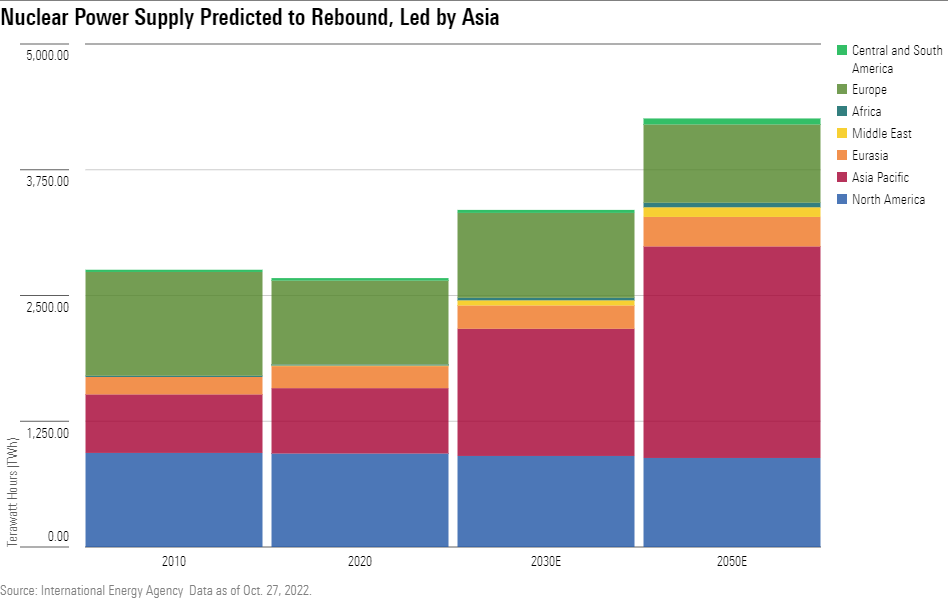

Nuclear power capacity has remained stagnant over the past decade. Per the International Energy Agency, total global nuclear generation supply flatlined in the period from 2010 through 2021, despite total energy growing at about 2.5% annually, on average. This has led to the energy source falling to about 10% of total power generation from 13%.

However, this is set to change, particularly in emerging markets. Even the IEA’s most-conservative scenario (which takes into account only stated policies rather than a realized net-zero emissions world) projects nuclear power growing at a compound rate of about 2% to 2030, as rising demand for electricity is met with a further focus on reducing carbon emissions.

This growth isn’t likely to be spread equally, however. More than 90% of new worldwide nuclear power capacity will come from Asia through 2030, with 7% annual average growth, the IEA predicts. This increase is substantially higher than the 1.7% compound annual growth rate seen in the region over the past decade, and is expected to be led by China (roughly 5% annual growth), India (about 13% yearly gains), and Japan (14.5% per year). Conversely, both the U.S. and Europe are likely to see flat to slightly declining nuclear supply.

How to invest in nuclear energy

Several individual companies covered by Morningstar equity analysts are worth keeping on your watch list to gain exposure to renewed nuclear growth.

Using product involvement data from Sustainalytics, we can see that the largest production exposure instead stems from international players, particularly in Asia and Europe.

This includes China General Nuclear, or CGN (HKG: 01816) and EDF (PAR: EDF), the largest power producer in France. (The U.S. firm with the largest contribution is Constellation Energy CEG, a spinoff from Exelon EXC with nearly two thirds of its generation from nuclear, though it’s not covered by Morningstar.)

Per the above chart, CGN and EDF appear fairly valued, but are worth keeping an eye on should market volatility offer a more-sizable margin of safety.

Some nuclear power risks may be overstated

At this point, many readers may be thinking: “Sure, nuclear offers zero carbon electricity and baseload power, but what about the safety issues? And what do we do with the waste?”

I’m no nuclear engineer—my work is primarily done in spreadsheets, not power plants—but my reading suggests these concerns may be misunderstood.

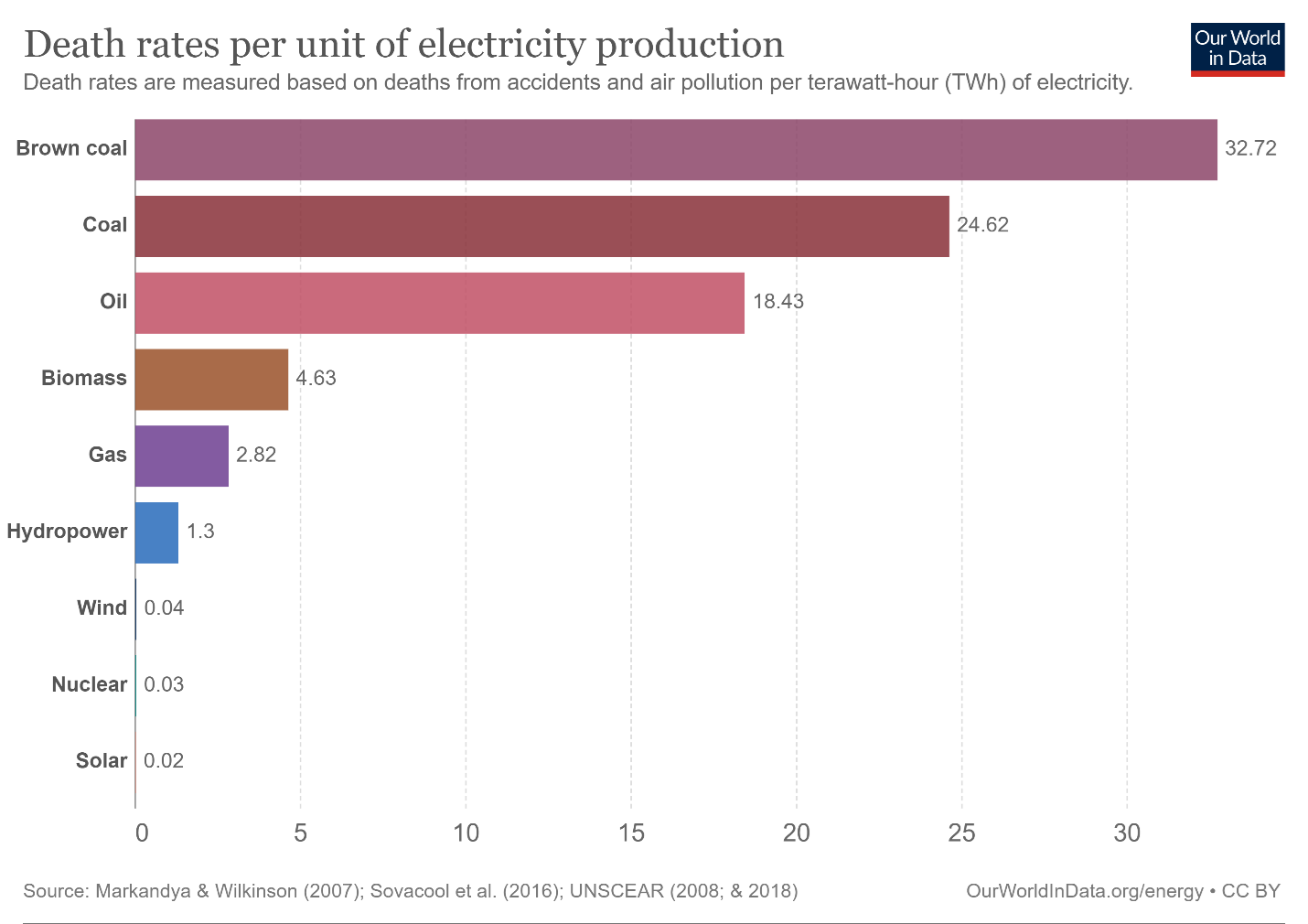

I don’t mean to overlook individual failures that can have outsize effects on particular areas. Chernobyl and Fukushima were tragedies, no doubt. But these two incidents were highly localized, and the only accidents with associated fatalities in the relatively long history of nuclear energy. Even using conservative mortality totals (which include deaths from radiation exposure and—in the case of Fukushima—from the effects of the evacuation of the city), estimates from Our World in Data show that nuclear is the second-safest energy source only to solar power when viewed on the basis of per-terawatt hour of electricity generation.

Outside of operational safety, any discussion of nuclear power also involves the handling of resulting waste. But here again, it seems perception doesn’t always match reality. Per the World Nuclear Association, the amount of waste generated by an average American’s power use in a year would be the size of a brick, and the high-level, most-radioactive nuclear waste would be equivalent to the weight of a piece of paper.

It’s also worth noting that all forms of electricity production produce waste. If anything, I view the fact that nuclear power’s waste is storable is a feature, not a problem—imagine if we could easily and cheaply bottle up all the carbon that coal plants seep into the atmosphere.

Casks holding nuclear waste are extremely durable, with capability to withstand earthquakes, tornadoes, or projectiles. And with high safety standards, there have been no recorded harmful incidents owing to storage or transportation of the waste.

The biggest challenge to nuclear seems to be economic; it’s expensive and complicated to build a new nuclear plant. Highlighting the challenges of building new nuclear, U.S. utility Southern Company’s SO Vogtle plant in Georgia, scheduled to be fully online in late 2023 or early 2024, is five years behind schedule and more than double the initial cost estimate.

New nuclear technologies could be game changers, but are still far away

The barriers to entry to getting a large nuclear plant running on time and on budget will likely keep the largest publicly traded utilities from leading new construction. But new technologies are aiming to reduce these upfront costs, such converting coal plants to nuclear (like Bill Gates’s TerraPower startup) or building smaller, modular facilities. Over time, these solutions may migrate from the private markets to public companies, although our analysts don’t estimate this to be a near-term development.

Nuclear fusion is also an oft-discussed and exciting prospect, but is similarly long-tailed. The solution uses an abundant fuel (hydrogen) with none of the radioactive waste produced from current nuclear production. Recent breakthroughs in the past six months have marked significant milestones, including getting more energy via fusion than was put in. Continued advancements could improve nuclear energy’s economics, but even the most optimistic forecasts don’t have commercially viable fusion within the next decade.