Is Meta still a buy after its big rally?

The stock is up some 140% from its November low, and it looks like there’s still room to run.

Mentioned: Apple Inc (AAPL), The Walt Disney Co (DIS), Meta Platforms Inc (META), Alphabet Inc (GOOG), Microsoft Corp (MSFT), Shopify Inc (SHOP)

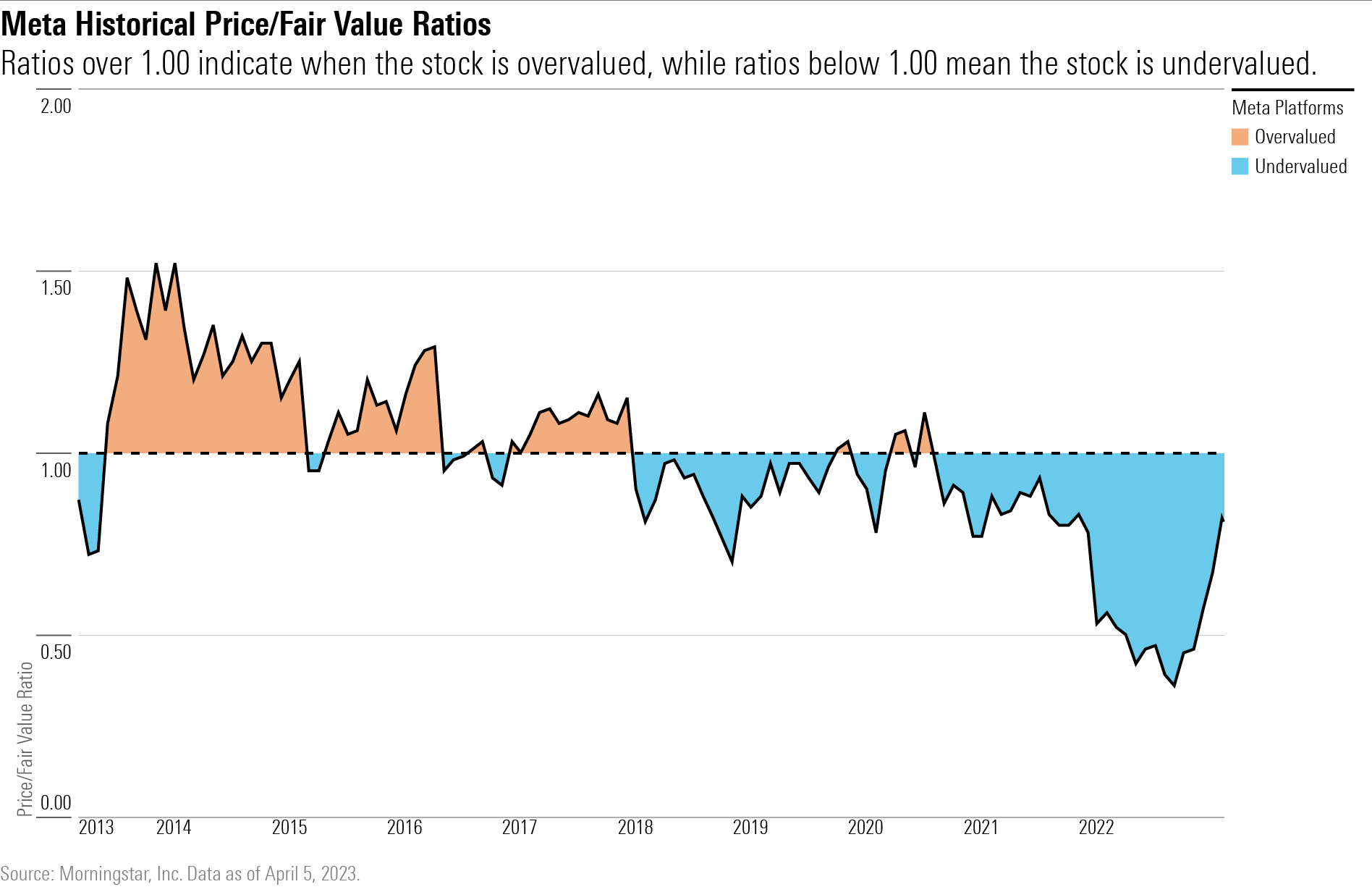

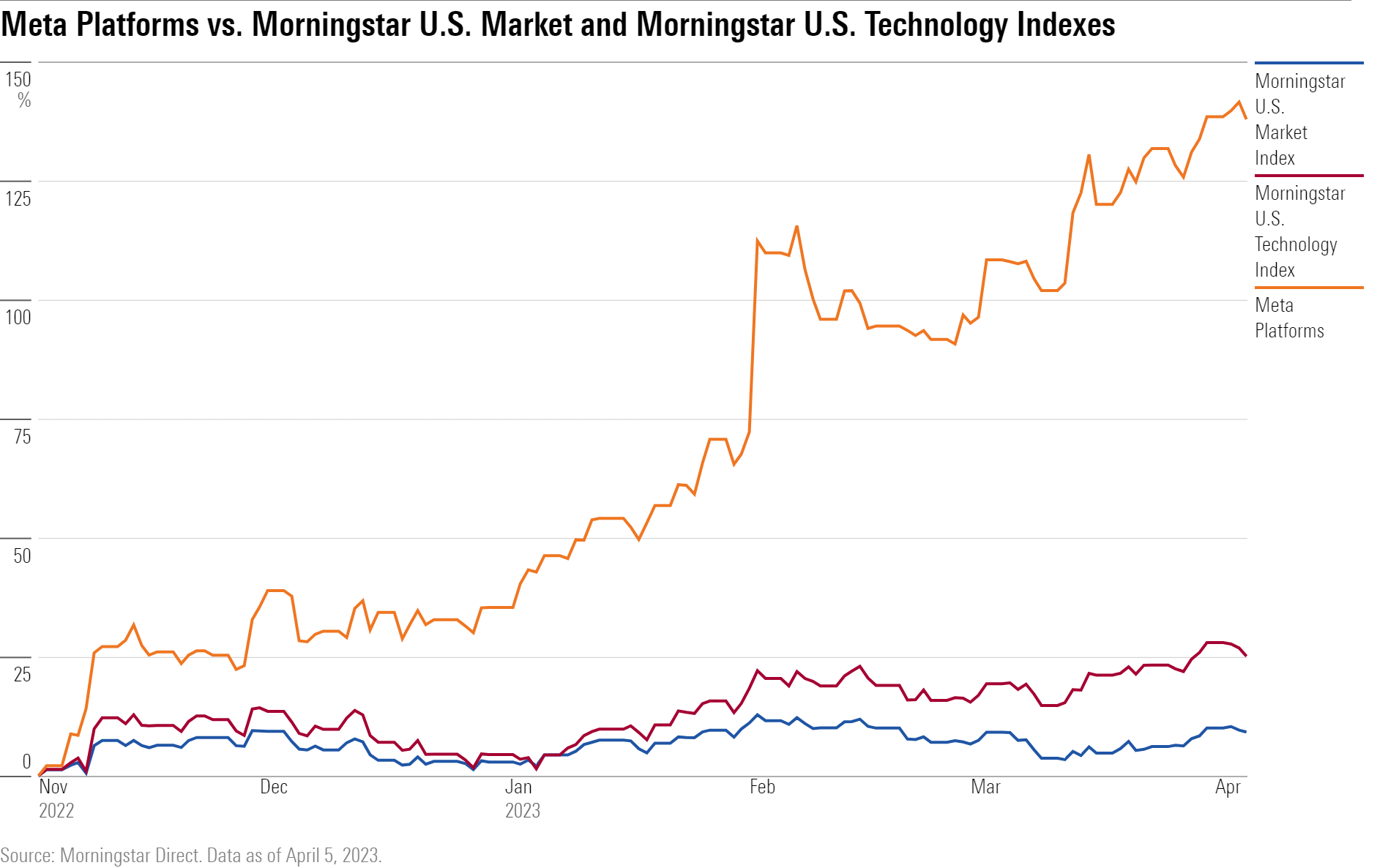

Meta Platforms (META) turned in a mega performance in the first quarter, rallying a whopping 76%. The stock is up some 140% from its November low. And it looks like there’s still room to run.

Around its current price of $213 per share, Meta stock continues to be attractively valued, some say, especially with its new focus on keeping costs down.

Meta Platforms Stock Key Stats

- Fair Value Estimate: $260

- Uncertainty Rating: High

- Morningstar Rating: 4 Stars

- Economic Moat Rating: Wide

Improvements in Meta’s ability to measure the effectiveness of ads that run on its platforms should also help boost revenue. That’s critical because digital advertising composes about 90% of Meta’s revenue.

Rival TikTok’s woes also could wind up being Meta’s gain. Amid threats of banning TikTok in the United States, or selling its US operations to a US company, users and content creators could move to other platforms, including Meta, bringing advertisers with them.

Meta is the social media company formerly known as Facebook; it also owns the Instagram platform and instant messaging networks WhatsApp and Messenger.

Facebook is the largest social network in the world, with nearly 3 billion active users.

Meta seen with more upside

“Despite the runup, there’s still more upside,” says Ali Mogharabi, Morningstar senior equity analyst for media and telecom, noting the stock trades at a 20% discount to the fair value estimate of $260 per share he has maintained on Meta stock since it reached seven-year lows last fall.

Meta trades at 9.4 times 2023 consensus adjusted estimates for enterprise value to EBITDA, and 8.1 times 2024 estimates, well below the 12 times 2023 and 10 times 2024 estimates on which Mogharabi’s fair value estimate is based.

Mogharabi lists three developments that bode well for Meta stock:

- New focus on controlling costs.

- Improvements in measuring the effectiveness of ads on its platforms.

- Potential for monetizing its Reels short-video features.

Meta's big reversal

Meta’s recent stock gains mark a stunning comeback after an equally surprising reversal of fortune to the downside in 2022 as the company reported its first-ever sales decline amid serious challenges to its business model. Meta shares fell from a high of $379 in August 2021 to a low of about $88 by October 2022, a 77% drop.

Meta posted $32.2 billion in revenue in the fourth quarter of 2022, down 4% from the $33.7 billion it registered in 2021. For the full year, revenue dropped by 1% to $116.6 billion from $117.9 billion in the prior year.

Meta was blindsided by changing economic conditions driven by high inflation, interest-rate hikes, and changing customer behaviors after ramping up staffing and spending during the pandemic years.

It was also caught off guard by the damaging effects on its advertising revenue from privacy protection features that Apple (AAPL) introduced in 2021, known as App Tracking Transparency, which made it more difficult for third parties to collect data from customers. At the same time, rival TikTok, known for its popular short-form videos, was surging in popularity and attracting advertising.

Meta is reeling in ads

In the wake of last year’s troubles, Meta reworked its digital advertising model to connect directly with advertisers. The company teamed with e-commerce platform Shopify (SHOP) to work with merchants through Facebook and Instagram, providing them with tools to target customers directly and quantify the effectiveness of their ads. It’s also started a paid business messaging platform on WhatsApp in which businesses contact their customers directly through text messages.

In addition, Apple has tinkered with its privacy feature to allow advertisers more access to data after certain thresholds are met, which has somewhat softened the impact from its original version.

Meta is especially focused on incorporating ads into its fast-growing short-form video content known as Reels, using artificial intelligence to target customers with more-personalised ads based on their behavior and the context of the sites they visit.

Reels plays on Facebook and Instagram have more than doubled in the past year, and the number of people resharing Reels has more than doubled in the past six months, according to the company. Measured by revenue generated by minute watched, Reels is currently unprofitable but the company expects it to break even by the end of this year or early next year. “After that we should be able to profitably grow Reels while keeping up with the demand that we see,” chief executive Mark Zuckerberg said.

Meta’s focus on efficiency

Meta’s changes are already showing up in results. Meta benefited in the three months ended March 31 by reporting better-than-expected fourth-quarter results and presenting a rosier outlook for first-quarter revenue. Investors also welcomed a $40 billion increase to its share repurchase program. Declaring 2023 as Meta’s “year of efficiency,” Zuckerberg outlined further cost-cutting measures, including 10,000 more layoffs in addition to the 11,000 previously announced.

Meta expects to report first-quarter revenue in the range of $26 billion to $28.5 billion. It now sees total expenses for the full year 2023 in the range of $89 billion to $95 billion, from a previous forecast of $94 billion to $100 billion. It projects restructuring charges of $1 billion in the year, down from a prior estimate of $2 billion after recording some of the charges in the fourth quarter. Capital spending was lowered to $30 billion-$33 billion, from $34 billion-$37 billion.

“It’s an incredible moneymaking machine,” says Wally Weitz, co-chief investment officer of Weitz Investment Management, noting its $41 billion in cash and relatively little debt. “It’s not wildly cheap but if they really have gotten a little bit of spending discipline and this is the year of efficiency as Mark Zuckerberg has said, then stock buybacks can do wonders.”

Weitz has owned Meta stock since the first quarter of 2018, when it was trading between roughly $160 and $187 per share. His firm bought more in 2022 as the stock slid into the $90 range.

Artificial Intelligence is the new Metaverse

The company now is concentrating on its AI systems to improve engagement and advertising effectiveness, and drive profitability on its Facebook and Instagram platforms, keeping it competitive with the likes of Microsoft (MSFT) and Alphabet (GOOG). It’s created a new product team devoted to generative AI that uses machine-learning algorithms to produce text, visual content, and audio that appear to be made by humans.

“AI is the foundation of our discovery engine and our ads business,” Zuckerberg told analysts following the release of its fourth-quarter results in February. “We also think it’s going to enable many new products and additional transformations within our apps.”

Hype around the money-losing virtual world known as the metaverse—which had been the company’s primary focus in recent years, and into which it has poured billions and even renamed itself after—has diminished. It was the last product area Zuckerberg addressed in his remarks to analysts and he referred to it as a “longer term” priority.

“Right now is not the right time to invest as aggressively in the metaverse,” says Mogharabi, noting that Walt Disney (DIS) has shuttered its division devoted to metaverse development and Microsoft has also ended much of its virtual reality efforts.

Risks Facing Meta Stock

Antitrust regulations pose a threat to Meta. The company has been in the crosshairs of the Federal Trade Commission, which has alleged Meta has engaged in anti-competitive activity and gained a monopoly through its purchases of Instagram and WhatsApp. The FTC also sought to block Meta’s acquisition of virtual reality company Within but the deal closed in February.

Still, if under some circumstance Meta was forced to break itself up, Morningstar’s Mogharabi said the company would be valued 10%-15% higher than his fair value estimate on a sum-of-the-parts basis.

The biggest risk to Meta, as it is for any advertising company, is a potential slowdown in consumer spending and possible recession. While its strong balance sheet will help the company ride out a downturn, Meta won’t be immune to a pullback. Still, with its shares trading at a discount, Weitz says they are already pricing in a downturn.

On the advertising front, too, companies are already braced for slower growth.

Digital advertising now accounts for more than 70% of all ad budgets and “the transition from traditional advertising to digital is complete,” says Mogharabi.

“For that reason, we shouldn’t expect digital ads to grow 15% to 25% a year as has been the case for the past decade,” he says, noting that growth is decelerating and projected to be in the mid- to high-single digit range.

“That’s why these companies are focusing more on cost controls,” says Mogharabi.