11 undervalued defensive US stocks

Veeva, Clorox, and Kellogg are among the defensive stocks trading below our analysts’ fair value estimates.

Mentioned: Clorox Co (CLX), Dominion Energy Inc (D), The Estee Lauder Companies Inc (EL), Kellanova (K), Medtronic PLC (MDT), Altria Group Inc (MO), Merck & Co Inc (MRK), PepsiCo Inc (PEP), Constellation Brands Inc (STZ), UnitedHealth Group Inc (UNH), Veeva Systems Inc (VEEV), West Pharmaceutical Services Inc (WST), Zimmer Biomet Holdings Inc (ZBH), Zoetis Inc (ZTS)

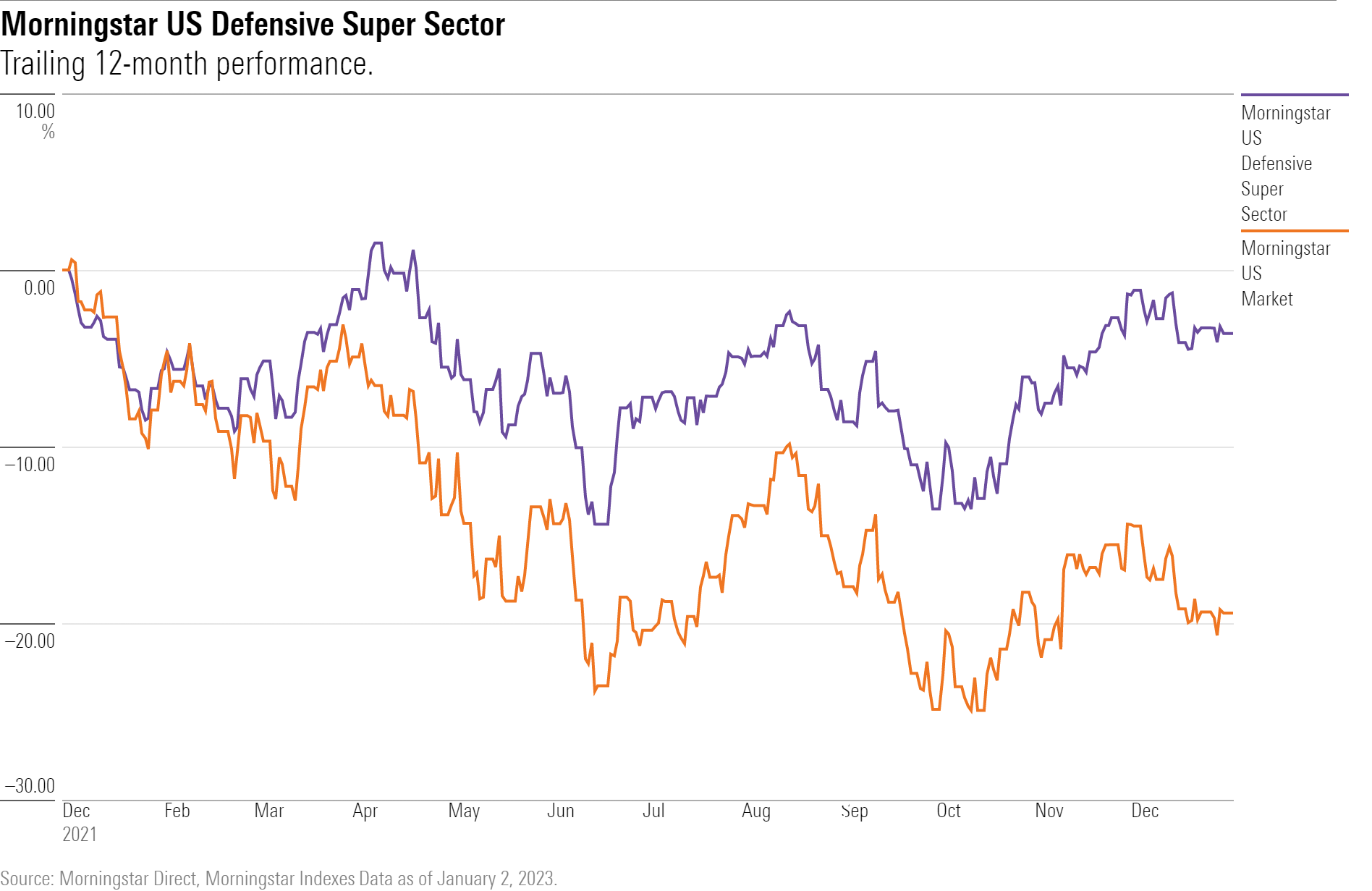

The past year was a rough one for the stock market, although defensive stocks fared well.

The good news for long-term investors looking to put money to work in defensive stocks is that there are still plenty of cheap defensive stocks worth considering. Morningstar equity analysts see room for growth in a number of high-quality, defensive names such as Veeva Systems VEEV and Medtronic MDT.

To look for undervalued defensive stocks, we turned to the Morningstar US Defensive Super Sector Index, which measures the performance of stocks from traditionally defensive sectors such as utilities, consumer defensive, and healthcare.

In 2022, the index lost 3.6% for the trailing 12-month period, while the broader market fell 19.4%, as measured by the Morningstar US Market Index.

Of the 323 defensive stocks in the index, 156 are covered by Morningstar analysts. Of those, 73 were undervalued as of Dec. 31, 2022, compared with 75 at the end of 2021.

What Is a Defensive Stock?

Defensive stocks are normally resistant to economic cycles because their products are necessary in good times or bad.

Consumer defensive companies are engaged in the manufacturing of food and beverages, household and personal products, packaging, and tobacco.

Some consumer defensive companies provide education and training services. UnitedHealth Group UNH, Merck MRK, and PepsiCo PEP are among the largest companies in the defensive Super Sector index.

Defensive Stocks to Buy Now

We looked for the most undervalued stocks in the Morningstar US Defensive Super Sector Index that currently carry a Morningstar Rating of 4 or 5 stars. Then we looked for stocks that have earned a Morningstar Economic Moat Rating of wide in order to screen for companies with durable competitive advantages.

These were the 11 most undervalued stocks in the Morningstar Defensive Super Sector Index as of Jan. 2:

The most undervalued defensive stock is Veeva Systems, trading at a 39% discount to the fair value estimate set by Morningstar analysts. The least undervalued on the list is Estee Lauder, trading at a 10% discount. Morningstar stock analysts believe that these 11 are high-quality and undervalued in the market.

Veeva Systems

- Fair Value Estimate: $265

- Morningstar Economic Most Rating: Wide

“Veeva is the leading provider of cloud-based software solutions tailored to the life sciences industry. It provides an ecosystem of products to address the operating challenges and regulatory requirements that companies in the space face. Instead of focusing on a general, one-size-fits-all system, Veeva has created platforms that are purely designed to serve one industry.”

“We assign Veeva a wide moat rating because we believe the firm’s high retention rate and its customers’ unlikeliness to move to a different product (switching costs) should continue to support economic profits for at least the next 20 years.”

“We expect the commercial business to grow at a modest to high single-digit rate over the next five years. For research and development solutions, we expect revenue growth to soften, but we still expect a very strong growth for this defensive stock in the healthcare industry over the next five years with a revenue CAGR of 22%.”

—Keonhee Kim, equity analyst

Medtronic

- Fair Value Estimate: $112

- Morningstar Economic Most Rating: Wide

“Medtronic’s standing as the largest pure-play medical-device maker remains a force to be reckoned with in the medtech landscape. Pairing Medtronic’s diversified product portfolio aimed at a wide range of chronic diseases with its expansive selection of products for acute care in hospitals has bolstered Medtronic’s position as a key partner for its hospital customers.

“Medtronic has historically focused on innovation, designing and manufacturing devices to address cardiac care, neurological and spinal conditions, and diabetes.”

“Overall, we now include the following in our assumptions for Medtronic: a more gradual resumption of prepandemic procedure volume in fiscal 2023 and 2024, hospital labor constraints that will prevent significant expansion of capacity through the midterm, and the anticipated launch of renal denervation by early 2024.”

“We project 3% average annual top-line growth through fiscal 2027, as procedure volume returns and stabilizes closer to prepandemic levels over the next 18 months.”

—Debbie S. Wang, senior equity analyst

Zimmer Biomet Holdings

- Fair Value Estimate: $175

- Morningstar Economic Most Rating: Wide

“Zimmer’s strategy is two-pronged. First, it is focused on cultivating close relationships with orthopedic surgeons who make the brand choice. High switching costs and high-touch service keep the surgeons closely tied to their primary vendor, and the surgeons bring in enough profitable procedures to keep hospital administrators at bay.”

“Second, the firm aims to accelerate growth through innovative products and improved execution. The latter is critical, in our view, to realizing the firm’s potential.”

“Zimmer’s wide economic moat stems from two major sources. First, there are substantial switching costs for orthopedic surgeons. The extensive instrumentation, or tool sets, used to prepare bones and install implants are specific to each company. The learning curve to become proficient in using one company’s instrumentation is significant.”

“We’re holding steady on our fair value estimate at $175 per share, which reflects our expectation that more-normal procedure volume will be able to flow through after 2022 thanks to widespread vaccinations and some level of COVID-19 immunity acquired by extensive infection by previous variants.”

—Debbie S. Wang, senior equity analyst

Dominion Energy

- Fair Value Estimate: $78

- Morningstar Economic Moat Rating: Wide

“We are maintaining our $78 fair value estimate for Dominion Energy but increasing our Uncertainty Rating to Medium on heightened management and political risk. Our wide moat and stable trend remain unchanged.”

“While we think Dominion Energy offers an attractive valuation trading at just 13.3 times our 2023 earnings estimate and a 25% discount to most of its utilities peers, we think the uncertainty related to management’s strategic review will remain an overhang on the stock well into 2023. Additionally, we think management will need to work to regain investor confidence, which we believe has been significantly impacted since the strategic review announcement. This could take years.”

“Like its peers, Dominion has accelerated its capital expenditure growth program. Over the next five years, management plans to invest $37 billion of growth capital, with nearly 90% focused on decarbonization. We exclude some of that growth capital from our forecast as key stakeholders have raised concerns about customer affordability.”

—Andrew Bischof, senior equity analyst

West Pharmaceutical Services

- Fair Value Estimate: $280

- Morningstar Economic Most Rating: Wide

“West Pharmaceutical Services is the global market leader in primary packaging and delivery components for injectable therapeutics.”

“Packaging must ensure drugs don’t leak into the surrounding material and vice versa. Because of the mission-critical nature of these components, it’s important for customers to trust the quality of manufacturing and design.”

“West has carved out a wide economic moat in the field of complex injectable device packaging from a proven level of expertise in the space and the durability of profits supported by packaging-specific regulatory approvals.”

“We are maintaining our fair value estimate of this defensive healthcare stock with West Pharma of $280. We think West’s growth is likely to be fairly resilient once COVID-19 sales begin to roll off the top line.”

—Karen Andersen, sector strategist

Zoetis

- Fair Value Estimate: $170

- Morningstar Economic Most Rating: Wide

“Shares remain undervalued from our perspective. Despite these near-term constraints, we see little to alter our confidence in Zoetis’ wide economic moat, including its intangible assets and cost structure.”

“Zoetis is the undisputed leader in the global animal health industry, and we believe it possesses the widest moat of all the competitors. Zoetis has set itself apart based on its impressive innovation that shows up across its product portfolio, including a number of drugs for specific pet ailments such as separation anxiety.”

“We expect Zoetis to grow faster than the industry and maintain above-average margins due to its scale and its shift toward the faster-growing companion animal segment. Zoetis’ investments in dermatology, parasiticide, and monoclonal antibody innovation have been paying off handsomely here.”

—Debbie S. Wang, senior equity analyst

Constellation Brands

- Fair Value Estimate: $274

- Morningstar Economic Moat Rating: Wide

“While Constellation Brands historically made its bones as a winery and distillery, we now view the firm as one of the most stellar brewers across our global coverage. After parlaying AB InBev’s antitrust quandary (allowing it to acquire Mexican brewer Grupo Modelo) into exclusive U.S. ownership rights to brands like Corona and Modelo, we see the firm’s overall Mexican beer portfolio as auspiciously situated at the confluence of unwavering secular and demographic trends. With an enviable growth profile and best-of-breed margins, we have confidence that the beer business can thrive even amid an evolving industry landscape.”

“The firm is not resting on its laurels, however, as it continues to expand its addressable market by widening the gamut of categories in which it competes. One of the primary avenues through which it is seeking to do this is innovation, with line extensions like Corona Refresca and Fresca Mixed being quintessential illustrations. Management seeks 25% of its growth to be driven by innovation, a mark we think is achievable given the broad resonance of its trademarks.”

“The firm’s wine and spirits business should offer some stability, after the divestiture of lower-quality brands, allowing Constellation to place more intentionality behind its ‘high growth, high margin’ long-term strategy.”

—Jaime M. Katz, senior equity analyst

Clorox

- Fair Value Estimate: $164

- Morningstar Economic Moat Rating: Wide

“The pandemic prompted consumers to scour the shelves for Clorox’s fare, boosting sales. And even as volume growth is decelerating, we don’t think consumers are turning their backs on Clorox’s cleaning and disinfecting products, as sales remain well above where they were before the pandemic (to the tune of 5% in its fiscal first quarter). This prowess is further evidenced by its disinfecting wipes offering, which has been gaining market share.

“However, Clorox (with a host of firms in an array of industries) is facing a rampant surge in broad-based cost pressures (qualitatively referred to as unprecedented relative to the last few decades.)”

“Clorox faces a number of risks in the highly competitive consumer packaged food sector that we think merit a Medium Morningstar Uncertainty Rating. For one, consumers make frequent purchases and typically face no switching costs. In several categories, Clorox’s primary competition is private-label fare, so product innovation and marketing support are essential to ensure differentiation from these lower-priced offerings.”

“Despite reports that younger generations are more likely to accept private-label products at the expense of brands, Clorox seems to be withstanding these pressures, as it has posted low- to mid-single-digit organic sales growth over the last several years and about 200 basis points of operating margin expansion since fiscal 2012 (relative to the five-year average), to the high teens. But if its new products fail to resonate with consumers, results could falter.”

—Erin Lash, senior director

Kellogg

- Fair Value Estimate: $82

- Morningstar Economic Moat Rating: Wide

“Despite Kellogg’s intentions to spin off its North American cereal and plant-based alternative brands from its global snacking operations, our wide moat rating is unchanged. This rating reflects our confidence surrounding Kellogg’s ability to generate returns above its cost of capital (even under a more bearish set of assumptions) over the next two decades, stemming from its intangible assets and cost edge. We think its position as a leading packaged food manufacturer and its arsenal of resources have afforded Kellogg the ability to maintain valuable shelf space for its offerings, even in the cereal aisle, where category dynamics have languished from the onslaught of competition resulting from lower-priced private-label fare, other branded operators, and the encroachment of smaller foes from within the category and other breakfast alternatives.”

“We believe Kellogg also maintains a cost edge resulting from the economies of scale in production and distribution across its global network, which has afforded it the ability to invest significant resources behind research and development and advertising. We expect this competitive advantage should result in excess economic profits, with returns on invested capital (including goodwill) averaging in the midteens over the length of our explicit forecast, exceeding our 7% weighted average cost of capital for at least the next 20 years.”

“We assign Kellogg a Medium Uncertainty Rating. Kellogg intends to separate its global snacking operations from its North American cereal and plant-based alternative arms, and we forecast management attention could be monopolized by the split over the next 18 months, impeding its ability to be responsive to evolving competitive, consumer, and macro trends.”

“Further, with around 40% of sales generated outside the U.S., Kellogg is exposed to foreign exchange fluctuations, which may eat into sales and profits from time to time.”

—Erin Lash, senior director

Altria

- Fair Value Estimate: $52

- Morningstar Economic Moat Rating: Wide

“Altria is no longer a pure play on U.S. cigarettes. Over 15% of our valuation is derived from its 10.2% share of Anheuser-Busch InBev, and of the consolidated business, 14% of EBIT came from oral tobacco in 2021, while recent acquisitions in vaping and cannabis are likely to be contributors to EBIT in the near future. Nevertheless, U.S. cigarettes remain the driver of Altria’s earnings because, following the breakup of Philip Morris in 2008, Altria operates solely in the U.S., while Philip Morris International, or PMI, owns the rights to the brands elsewhere.

“Although it is in secular contraction, the U.S. cigarette market is a relatively attractive one. We forecast the volume decline rate of the U.S. cigarette to be around 4% per year, a slightly faster rate of decline than most markets. However, the ability to consistently price above the rate of volume declines should ensure that Altria can continue to increase its revenue, earnings, and dividend.

“An addictive product and almost insurmountable barriers to entry in the tobacco industry form strong intangible assets and give Altria a wide economic moat, in our opinion.

“The addictive nature of the product forms a powerful competitive advantage when combined with very tight government regulation that over the years has served to damp market share volatility and competition on price.”

—Philip Gorham, director

Estee Lauder Companies

- Fair Value Estimate: $273

- Morningstar Economic Moat Rating: Wide

“We think Estee Lauder’s strong brand equities, entrenched relationships with its retail partners, and cost edge are all durable competitive advantages that result in a wide moat for the firm.”

“Estee Lauder is the second-largest player in the global premium beauty market per Euromonitor, with 13.2% market share for calendar 2021, behind L’Oréal’s 16.4% and ahead of LVMH Moët Hennessy Louis Vuitton’s 7.2%. Premium beauty is the only market the firm participates in, unlike many of its beauty peers, which target both premium and mass markets. Estee Lauder has broad-based leadership across geographies and categories.”

“The firm maintains the number-one or number-two spot in prestige beauty in 40 countries, according to the firm, including many of the largest markets, such as the U.S., China, the U.K., Hong Kong, Brazil, and India, to name a few. The firm also has several brands that are top 10 global premium brands according to Euromonitor, such as Estee Lauder (second in skincare, fifth in makeup), Clinique (sixth in both makeup and skincare), MAC (first in makeup), Aveda (fifth in haircare), Jo Malone London (seventh in fragrance), and Bobbi Brown (10th in makeup).”

“We believe that Estee Lauder’s portfolio of strong brands possesses pricing power. Management has specifically stated that inflation has not had a significant impact on its operations over the last several years, as the firm has been able to lift prices and introduce new, higher-priced products to offset any cost increases. Even in the highly inflationary environment during fiscal 2022, inflation did not meaningfully impair the firm’s margins (although supply chain disruptions caused some inefficiencies). Furthermore, private label is essentially nonexistent in premium beauty, which we think indicates that consumers are not as price sensitive, and brands play a more important role than price for purchasing decisions.”

“Despite our reduced sales outlook for fiscal 2023, we think that the long-term secular drivers for a strong global prestige beauty market remain intact. Over the long term, we expect annual organic constant-currency revenue growth of about 7%, as a budding middle class is steadily driving higher per capita consumption of beauty products across the globe.”

—Rebecca Scheuneman, senior equity analyst