Listed infrastructure to shine amid economic uncertainty

Analysts point to a positive link between the asset class, inflation and low sensitivity to economic growth concerns.

Analysts see a supportive market environment for infrastructure assets amidst growing global economic uncertainty. Climate-change related spending on energy infrastructure, huge infrastructure spending programs in the US and Australia and ongoing global population growth will support infrastructure companies in 2022 and beyond.

Jonathan Crone, portfolio manager, Insight Investment, says against the backdrop of equity markets’ volatile start to 2022, real assets such as infrastructure have exhibited three characteristics—stable cash flows, inflation protection and lower economic sensitivity. He says this differentiates the asset class from more traditional growth assets, most notably a positive link with inflation and low sensitivity to economic growth concerns.

In an uncertain macroeconomic environment, the certainty of future earnings and growth will be key, according to Nick Langley, founder and senior portfolio manager with ClearBridge Investments: “infrastructure and utilities significantly outperform other equities on this measure.”

Inflation hedge built in

Scott Keeley, senior financial planner with Wakefield Partners, says large monopolistic infrastructure services typically have significant pricing power even during uncertain economic times, such as the present.

“Their ability to adjust pricing is often built into their contracts, meaning that the price of their services can be adjusted as required in line with the Consumer Price Index,” he says. “This ‘passing on’ of increased prices to their users ensures that mostly, profitable margins can be maintained.”

In Australia, toll roads have earnings rates indexed to inflation on a quarterly or annual basis while other transport infrastructure such as ports and airports will often have inflation-indexed retail leases and regulatory regimes for transport activities.

“Should inflation persist, as we believe it will, infrastructure portfolios will hinge mainly on what type of growth we see: amid lower growth, we would look to add utilities, with bond yields lower and utilities not sensitive to a downswing in gross domestic product (GDP),” says Clearbridge’s Langley.

“If growth surprises to the upside, transport infrastructure, in particular toll roads, will look attractive as higher GDP would result in higher economic activity and higher throughput.”

Higher bond yields have, however, hurt some infrastructure operators. Toll roads, for example, are sensitive to rises in bond yields, which has weighed on its returns. As an example, shares in Transurban Group have fallen by around 2 per cent in the year to 1 April, while the S&P/ASX 200 is up close to 1 per cent. Over the year, Transurban is up just 2.6 per cent, whereas the ASX 200 is up 10.4 per cent.

Morningstar analyst Adrian Atkins puts a fair value of $12.00 on Transurban compared to its price at around $13.50.

“Traffic volumes are still a bit soft but probably not the driver of underperformance in past year as it was already known,” he says, who blames the underperformance on higher interest rates.

On the positive side, toll roads have “high barriers to entry and benefit from rising traffic volumes and tolls, which increase in line with the consumer price index or higher". Atkins says Transurban’s traffic volumes are recovering from Covid-19 lockdowns. Distributions fell 20 per cent in fiscal 2020 and are not expected to fully recover until fiscal 2023.

4D Infrastructure’s chief investment officer Sarah Shaw says a significant jump in fuel prices could, however, hurt road traffic.

“While volumes will be impacted, historically toll roads have reported a net upside from rising fuel prices as the CPI uptick to tariffs (driven up by fuel hikes) has more than compensated for the sensitivity of traffic,” she says.

“This is, however, dependent on passenger mix (commercial versus passenger) and sensitivity to prices.”

Airport traffic may also suffer with higher fuel prices.

“Air tickets will go up as airlines look to push the jump in fuel prices through to end users,” says Shaw.

“Again, the overall impact on airports will be dependent on sensitivity to ticket pricing … Again, this can be partly offset at the airport level by any inflation pass-through to regulated tariffs and/or commercial contracts. The inflation hedge has historically more than compensated any demand squeeze from elevated fuel prices."

In terms of other infrastructure assets, ports and rails have lagged market gains as snarled supply chains have reduced utilisation and volumes, Langley says. However, he believes returns on transportation infrastructure should improve as economic growth improves and supply chain constraints ease over the course of the year.

Attractive valuations

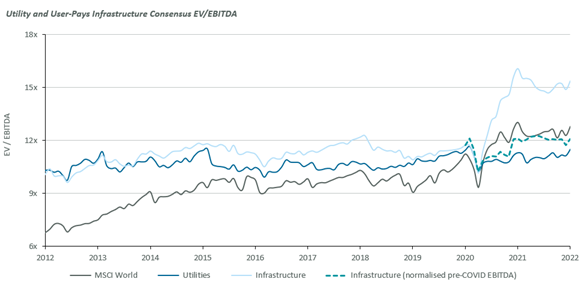

According to Langley, infrastructure looks attractive from a valuation perspective. A common earnings multiple metric for global utilities and user-pays infrastructure, enterprise value to earnings before interest, tax, depreciation and amortisation, has traded in the 10x to 12x range since 2012, adjusting the earnings of infrastructure companies, particularly airports and passenger rail networks, for the impact of the pandemic.

“We believe the market has not taken into account the cheaper cost of capital and better growth profile for these sectors. Based on this disconnect, we believe there is room to run for infrastructure in 2022,” Langley says.

Multiples adjusted for Covid-impacted earnings

Source: ClearBridge Investment. Data as at 31 December 2021. FactSet Research Systems and internal calculations

Jan de Vos, portfolio manager of the Resolution Capital Global Listed Infrastructure Fund, also sees good value in infrastructure.

“Listed valuation earnings multiples are also lower than in the unlisted market, as highlighted by recent takeover private activity in Australia, including Sydney Airport and the two utilities AusNet and Spark Infrastructure,” he says.

“Perhaps these defensive attributes of GLI are appreciated more in times of elevated geopolitical and macro-economic uncertainty … In short, we believe that many global listed infrastructure companies are well placed to benefit from strong structural tailwinds, can deliver attractive income and inflation-plus earnings over time.”

Over the longer term, de Vos says “global listed infrastructure has produced returns comparable with general equities, but with lower volatility. We attribute the lower volatility of the global listed infrastructure sector to the resilient income profile of the underlying companies, which deliver essential services to the economy and typically have contracted or regulated income streams.”