The global wave of bank dividends to hit Australian shores soon

Morningstar expects the major banks could start handing back capital as soon as August.

Mentioned: ANZ Group Holdings Ltd (ANZ), Commonwealth Bank of Australia (CBA), The Goldman Sachs Group Inc (GS), Morgan Stanley (MS), National Australia Bank Ltd (NAB), Westpac Banking Corp (WBC)

US$2 billion. That’s how much big US banks such as Morgan Stanley (MS) and Goldman Sachs (GS) announced in extra dividends on Monday after getting a tick of approval from the regulator.

Similar payouts are on the cards for Australian banks, according to Morningstar analyst Nathan Zaia in a recent special report.

He estimates the Australian banking sector is sitting on $34 billion in capital excess of regulatory requirements, up from just $3 billion in March 2020.

That could mean up to $5.90 per share for Commonwealth Bank (ASX: CBA).

The hoard was accumulated through 2020 as the banks prepared for a long recession and set aside money for loan losses.

But with the ASX 200 Financials up 15 times its 5-year average this financial year and regulators keen to see banks focus on their core business, Zaia thinks “most of it” should be returned to shareholders.

That means dividends and buybacks.

“If the excess is used to boost the dividend payout ratio to 100%, and the remainder goes toward buybacks, the majors would trade on fully franked dividend yields of around 6%,” says Zaia.

He expects CBA could kick things off as soon as August 2021 depending on how conservative the bank is with loan loss provisioning.

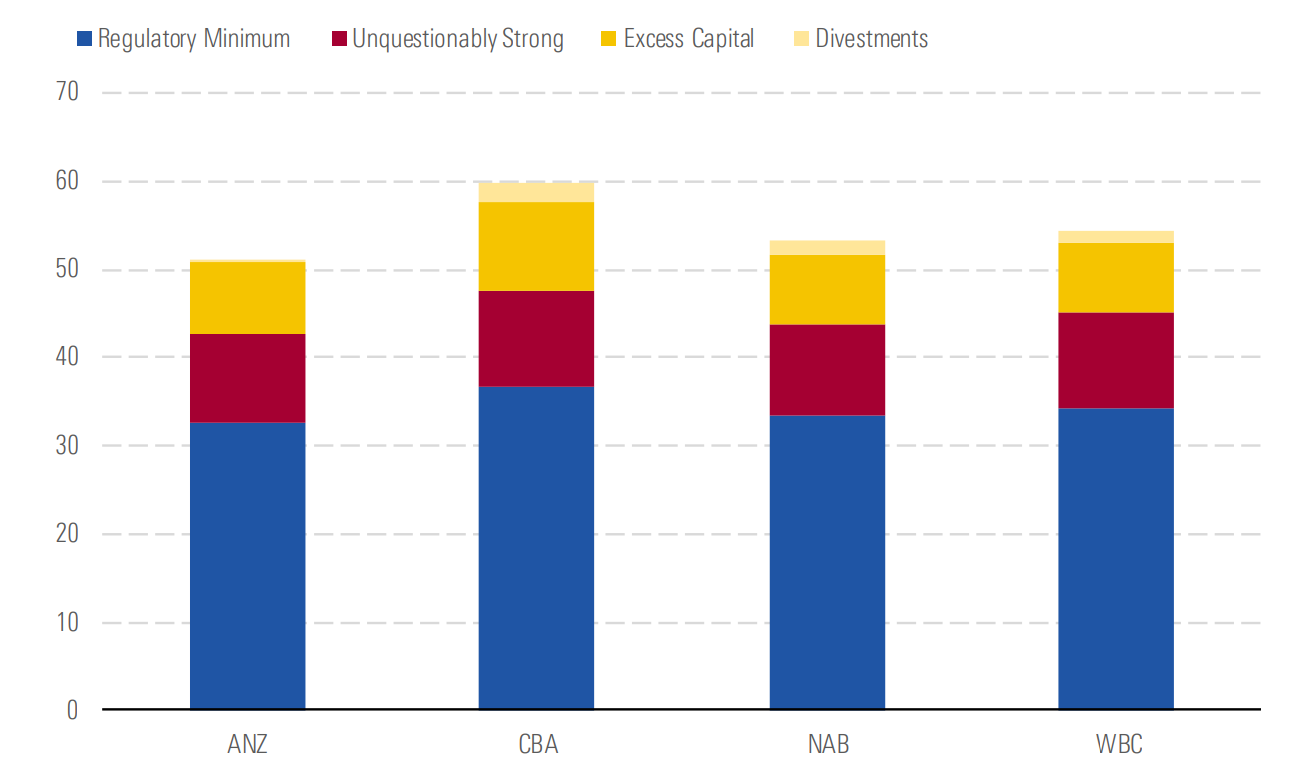

Big banks with big buffers

Source: Company Reports, Morningstar Analyst. Data as of 31 March 2021.

Zaia prefers capital be returned in a steady stream of dividend top ups but he expects banks to opt for a combination of on and off-market buybacks and dividends.

Off-market buybacks are conducted via a tender process directly with shareholders as opposed to buying via the exchange.

They give local shareholders the option to use franking credits because some of the share repurchase is treated as a dividend.

“Given a large component of the buyback is treated as a dividend, and franked, the total return to the shareholder can be 20% higher than selling on market,” says Zaia.

Shareholders who do not participate can still benefit from a small increase in earnings and dividends per share.

How banks eventually decide to return capital will be in part dictated by the availability of franking credits.

Only Westpac (ASX: WBC) has enough franking credit to fully frank an off-market buyback large enough to return all surplus capital.

CBA could return about 60 per cent of excess capital that way, falling to 37 per cent for the National Australia Bank (ASX: NAB) and 16 per cent for ANZ (ASX: ANZ).

Investors will cheer the windfall but Zaia cautions against expecting a new normal.

The accumulation of capital was a temporary response to a shock. Capital returns will be no different.

Zaia expects capital to be fully returned by 2025.

Banks don’t need the money

Investors have reason to thank Commissioner Kenneth Hayne for the windfall.

Australia’s banks are strong but “mature” firms and don’t need so much capital for day-to-day business, says Zaia.

He forecasts a modest 3 per cent in annual credit growth over the next five years, which banks should have no issue funding out of earnings.

The capital heavy acquisitions and expansions that once saw the banks diversify into wealth management and insurance have fallen out of favour in the post-Royal Commission “simplify the banks” era.

With all but CBA trading in a range that Morningstar considers fairly valued, the big banks remain a solid option for investors, says Zaia.

“We think the strong wide-moat franchises and prospects for material capital management initiatives still make the banks attractive holdings in a fairly overvalued Australian market.”