Link’s PEXA listing a potential win for shareholders

And the decision to retain an interest in the online conveyancing platform is a shrewd move too, says Gareth James.

Mentioned: Domain Holdings Australia Ltd (DHG)

Link's decision to float online property exchange PEXA on the ASX and retain its shareholding, rather than accept a cash bid from a private equity consortium, could be a win for shareholders, says Morningstar equity strategist Gareth James.

In a research note, James notes PEXA's initial public offering enterprise value of $3.3 billion is considerably higher than Morningstar's previous $2.2 billion valuation of the company and KKR/Domain consortium's now withdrawn $3.10 billion enterprise value offer, made last week.

It's also 70 per cent above the implied $1.95 billion offered by the PEP/Carlyle Group consortium in October 2020 as part of its takeover offer for Link Group last year.

Since late 2018, Link has held a 44 per cent investment in PEXA, an electronic conveyancing platform, which handles more than 80 per cent of all property transactions in Australia.

"Link's board and executives have played their PEXA cards shrewdly to maximise value for Link shareholders which has significantly reduced the gap between Link's share price and its fair value," James says.

"The $1.52 billion valuation of Link's PEXA stake is a far better outcome than the $1.14 billion we estimated Link would receive via a trade sale to KKR."

James says questions remain about whether PEXA's $3.3 billion IPO valuation is over-priced, valuing the company at 30-times forecast EBITDA for the 2021-22 fiscal-year. The company is discussing growth options, including UK expansion and data monetisation; however, nothing is concrete. But James believes the IPO will likely succeed as managers fight to get a piece of the near-monopolistic property settlement infrastructure.

Link's (ASX: LNK) decision to list PEXA comes after it rejected a cash bid from KKR and its junior consortium partner Domain Group (ASX: DHG). The consortium had reportedly offered $3.1 billion for 100 per cent of the company, plus $126 million in cash on the balance sheet. Link has been running a strategic review over the past year, weighing up whether to offload its 44 per cent stake in PEXA in a trade sale or float the company on the ASX.

In a statement to the ASX on Monday, Link Group chief executive Vivek Bhatia said the Board unanimously concluded that retaining its interest in PEXA, while realising its value through a listing and monetising its interest over time, was in the best interest of shareholders.

Post-listing, James believes Link will distribute its PEXA holding to its shareholders via an in-specie distribution (in its actual form). This, he says, could be a favourable tax structure for shareholders.

"We expect this option will enable retail shareholders to claim the 50 per cent capital gains discount on their PEXA shares," he says.

"However, we await the tax ruling on the PEXA shareholding and recommend Link shareholders seek independent taxation advice on this issue."

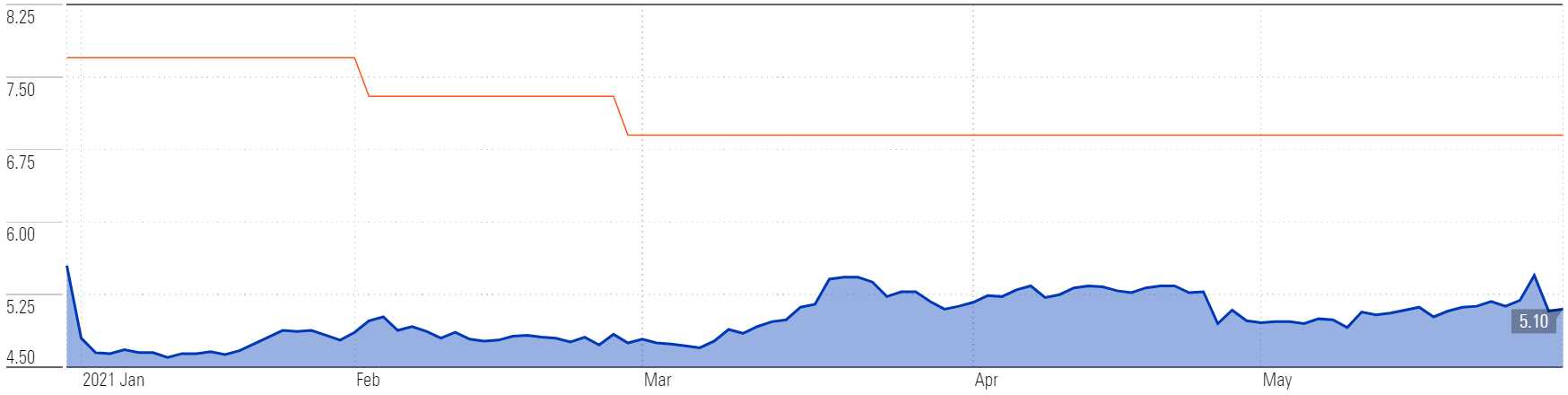

At the current market price of around $5.09 per share, Morningstar still believes Link is materially undervalued. The company is trading at a 26 per cent discount to its $6.90 fair value estimate.

Link Administration Holdings | Share Price vs Morningstar Fair Value Estimate, YTD

Source: Morningstar

Fair value upside

Link's share price fell 5.89 per cent on Monday following the announcement of its decision to list PEXA. It had risen 4.22 per cent on Friday after the announcement of the $3.10 offer from the KKR consortium. James speculates that this was because some shareholders had hoped Link would take the cash offer, at a price well above initial valuations for PEXA, and not risk an IPO.

If PEXA's $3.3 billion enterprise value is maintained following the IPO, James says this could increase Morningstar's fair value for Link by $1 per share to $7.90. However, he hesitates to incorporate its future valuation today due to the uncertainty regarding the details of the IPO.

"We intend to reassess our PEXA valuation based on the IPO prospectus and management roadshow, and particularly the potential earnings upside from exploiting its data and overseas expansion," he says.

"We are also yet to determine the extent to which PEXA's market value is incorporated into Link's carrying value of the PEXA stake."

PEXA is expected to be listed on the ASX before the end of this month.