Fair value estimate for Macquarie up, CBA unchanged

Both banks are sitting on billions in excess capital and dividends are expected to rise, says Morningstar equity analyst Nathan Zaia.

Morningstar has upgraded the fair value estimate for Macquarie Group but kept Commonwealth Bank unchanged, despite double-digit profit growth at both banks.

Macquarie Group (ASX: MQG) reported a fiscal 2021 profit of $3 billion, up 10 per cent from last year. Profit at Commonwealth Bank (ASX: CBA) jumped 24 per cent to $2.4 billion, for the three months ending 31 March.

Morningstar equity analyst Nathan Zaia has upgraded narrow-moat Macquarie’s fair value 8 per cent to $135. He left wide-moat CBA unchanged at $77. Both companies closed Wednesday at a premium on their fair value estimates, at 14 per cent, and 24 per cent, respectively.

Higher expected returns in Macquarie’s asset management business led to the new fair value estimate, says Zaia.

“We continue to believe Macquarie's businesses are well placed to capitalise on growth in global infrastructure and renewable energy investment over the next five years.

“Low cash rates are likely to spur investment as investors chase income and drive up asset prices, a nice tailwind on top of the value Macquarie adds by identifying opportunities and developing assets.”

Macquarie gets a second-half boost

Macquarie’s strong end-of-year result was thanks to a jump in the second half of the year. The $2.03 billion booked in the second half of fiscal 2021 was 106 per cent up from the $985 million from half one.

Earnings volatility is to be expected given how parts of Macquarie’s business are reliant on market activity, but Zaia says it’s not indicative of structural issues that could affect long-term earning potential.

Full-year profits jumped 50 per cent in Macquarie’s commodity and global markets division thanks to hedging and trading activity from oil, gas, and precious metals.

Macquarie paid out a final dividend of $3.35, bringing the full-year distribution to $4.70 (40 per cent franked). This year’s dividend is up 9 per cent year-on-year, but Zaia expects the dividend payout ratio to rise from its current level of 56 per cent into the midpoint of a 60-80 per cent range.

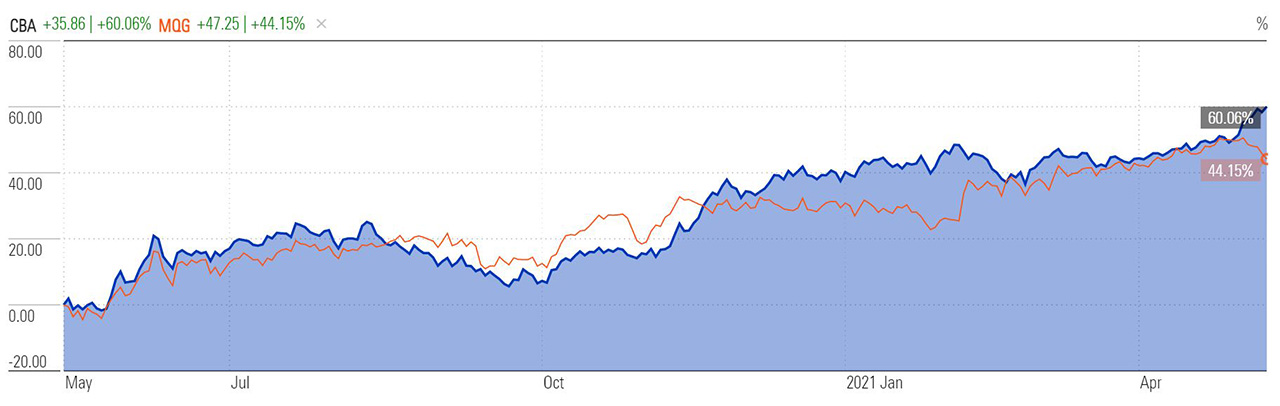

CBA and Macquarie performance (1 Yr)

Release of loan impairments boosts CBA profits

Profit growth at Commonwealth Bank was mostly thanks to the reversal of $300 million in loan impairments made during Covid. This is money the bank had set aside to deal with potential loan defaults.

A stronger than expected recovery means more provisions are likely to be released in future quarters, says Zaia.

“We expect additional releases in the fourth quarter as falling unemployment and rising house prices lower the likelihood of stress on the loan book.

“Our loan impairment/loan ratio falls to just 5 basis points for fiscal 2021, down from 20 basis points previously.”

Zaia estimates earnings before loan impairments were flat.

The flood of would-be homeowners rushing into the property market helped the bank grow its home loan book 5.3 per cent in the last twelve months. More efficient processes helped CBA turn the deluge of applications into more market share as competitors struggled to handle the volume.

Interest margins stayed steady despite competition for new home loans thanks to the growth in household deposits, which rose 13.9 per cent, says Zaia.

“Greater funding from cheap at-call deposits is offsetting competitive pressures from customers switching to fixed-rate loans and lower rates on new loans versus older loans.”

Growing market share positions the bank to take advantage of rising interest rates in the years ahead. As the cash rate rises the bank will be able to reprice its loan book upwards.

The bank’s loan book is high quality. About 80 per cent of customers were ahead with their payments by an average of 38 monthly payments (including offset balances).

CBA is sitting on $10 billion in capital above its regulatory requirements, but with the bank remaining conservative over capital management, shareholders might need to wait till fiscal 2022 for that to be returned in dividends or buybacks, says Zaia.

But even with a capital buffer 30-50 basis points above what regulators require, there could still be around $4.40 to $4.90 a share available to be returned to shareholders.

“We believe it is a matter of when, not if, special dividends or buybacks feature,” says Zaia.