Woodside to benefit from future gas demand: Morningstar

The oil and gas producer is strategically positioned to take advantage of growing Asian demand thanks to untapped gas resources and world-class infrastructure, says Morningstar's Mark Taylor.

Natural gas isn’t going anywhere. The commodity continues to benefit from strong policy support in countries like China and India. Growing energy demand is also expected as incomes rise and economies develop across Asia. Gas is also an attractive way for many countries to cut greenhouse gas emissions in the medium term, thanks to it having half the carbon intensity of coal.

While the market is supplied today, this future demand for natural gas explains Morningstar senior equity analyst Mark Taylor’s optimistic outlook for Woodside Petroleum.

Woodside (ASX: WPL) closed Tuesday at $22.85, a 43 per cent discount on the fair value estimate (FVE) of $40. The stock is trading at five-stars. Morningstar believes that a company’s intrinsic worth results from the future cash flows it can generate. The star rating identifies stocks trading at a discount or premium to their intrinsic worth - or FVE. Five-star stocks sell for the biggest risk-adjusted discount to their FVEs.

“The thing that underpins it all is our conviction that gas markets are going to continue to grow and that there'll be strong demand for Australian LNG exports,” says Taylor in a special report last week on Woodside.

“Woodside is unique among Australian energy companies in that it has successfully managed the development of LNG projects for more than 25 years - unparalleled domestic experience at a complicated and expensive task.

“Adding to Woodside's competitive advantages are the long-term 20-year agreements with the who's who of Asia's blue-chip energy utilities.”

Taylor says the energy giant is well placed to meet future demand thanks to its infrastructure and resource assets in Western Australia. Its existing facilities are also a base on which further capacity can be added relatively cheaply.

“Woodside has unparalleled infrastructure in the north west of Australia,” he says.

“The market underestimates how valuable Woodside’s resource positions are and how advantaged it is with its infrastructure because it's underutilized right now.”

“With extensive experience, it remains a stand-out energy investment at the right price,” Taylor added later.

The firm has natural gas resources in Australia, Timor Leste, Canada, Myanmar and Senegal.

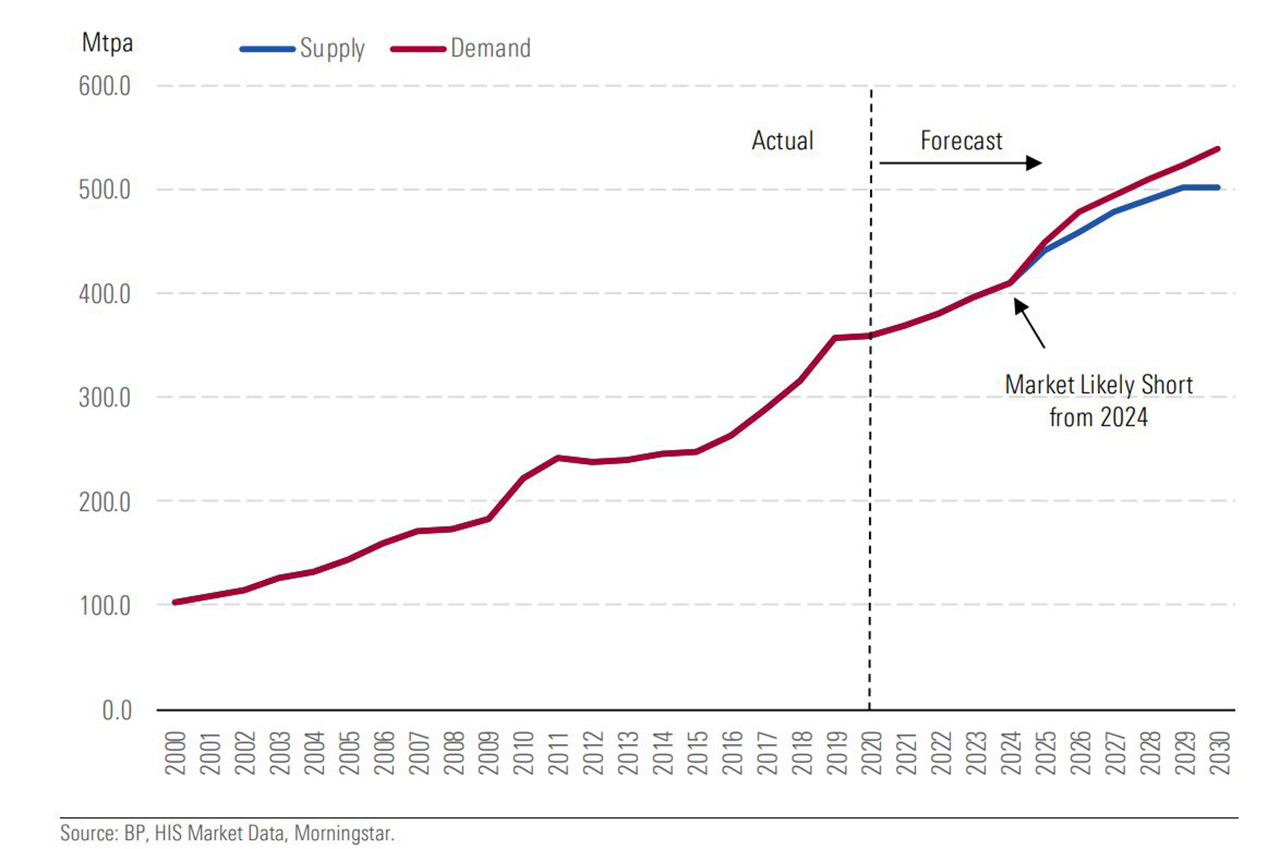

LNG demand likely to outstrip supply from 2024

Source: BP, HIS market data, Morningstar

Recent performance

Last Thursday, Woodside reported a 5 per cent decline in Q1 gas production compared to the 2020 quarter but scored a 44 per cent improvement on its LNG price versus Q4 2020. Sales revenue was up 4 per cent.

The quarterly results came just three days after long serving boss Peter Coleman stepped down from the role. He was replaced as acting CEO by development and marketing head Meg O’Neill. The firm is looking at internal and external candidates.

Coleman oversaw a 49 per cent decline in Woodside’s share price over his ten-year tenure. Aside from a minority owned project in 2017, there have been no major developments in the last eight years. Still, Taylor thinks the steady accumulation of resources like the gas field 'Scarborough' are a valuable legacy.

“There’s a perception that Coleman was there for ten years and nothing new happened,” he says.

“But maybe he did exactly the right thing for the circumstances. Where markets weren't that receptive to new supply, he conserved cash and paid a healthy dividend.

“I suspect that a new CEO will be looked upon favourably by the market, and, and may even be a better for the times.”

Wild swings in commodity and currency markets have also weighed on the share price. Crude oil prices went from near $US120 a barrel to lows around $US30 during Coleman's tenure. The Aussie dollar was at parity with the greenback between 2011 and 2013, before slumping back around the 70-cent mark.

Taylor says fluctuations in energy markets are "par for the course" and that investors need to be "in for the full cycle".

Big investment decisions loom

Coleman’s departure comes as Woodside must decide on an US$11.4 billion megaproject to develop its untapped Scarborough gas field off the coast of Western Australia. To gather the gas, 430km offshore, and pipe it to the existing ‘Pluto’ processing facility is estimated to cost US$6.1 billion. Another $5.3 billion is proposed to more than double Pluto’s processing capacity.

The investment decision has been on hold for years because of low gas prices but a final decision is expected in the second half of the year. Taylor thinks the projects are likely to go ahead.

“Nothing is ever certain but it's hard for me to see the project not going ahead,” he says

“There's too much sense in the infrastructure being utilized, and Asian customers are keen to take Aussie LNG because of the low sovereign risk and short freight distances.”

Depending on shipping rates, the cost of shipping gas from Australia to Asia are a third those from the US via Panama, or a fifth from the US via South Africa. The US is the world’s largest producer of natural gas.

Woodside’s strong balance sheet aids also capital expenditure. Net debt as a ratio of earnings before interest, tax, depreciation, and amortisation is just 0.9.

Gas in the green transition

Last week the US announced a new emissions reduction target. President Biden committed to a 50 per cent reduction of 2005 levels by 2030. The political shift highlights a general concern among investors of the risks facing hydrocarbon industries. But Taylor remains optimistic about the place of gas in any energy transition.

“We don’t think gas is a dinosaur energy product,” he says.

“Over the next few decades, there's no way that renewables are going to meet rising energy demand.

"The most carbon effective way to satisfy that demand shortfall is gas because it effectively has half the carbon intensity as coal, about two thirds the carbon intensity of oil. In the short term, the electrification of transport will also increase demand for electricity, says Taylor, which gas can generate cheaper than oil and with less emissions than coal.

Taylor’s forecasts are based on the historical rate of change observed in the growth of renewable energy usage.

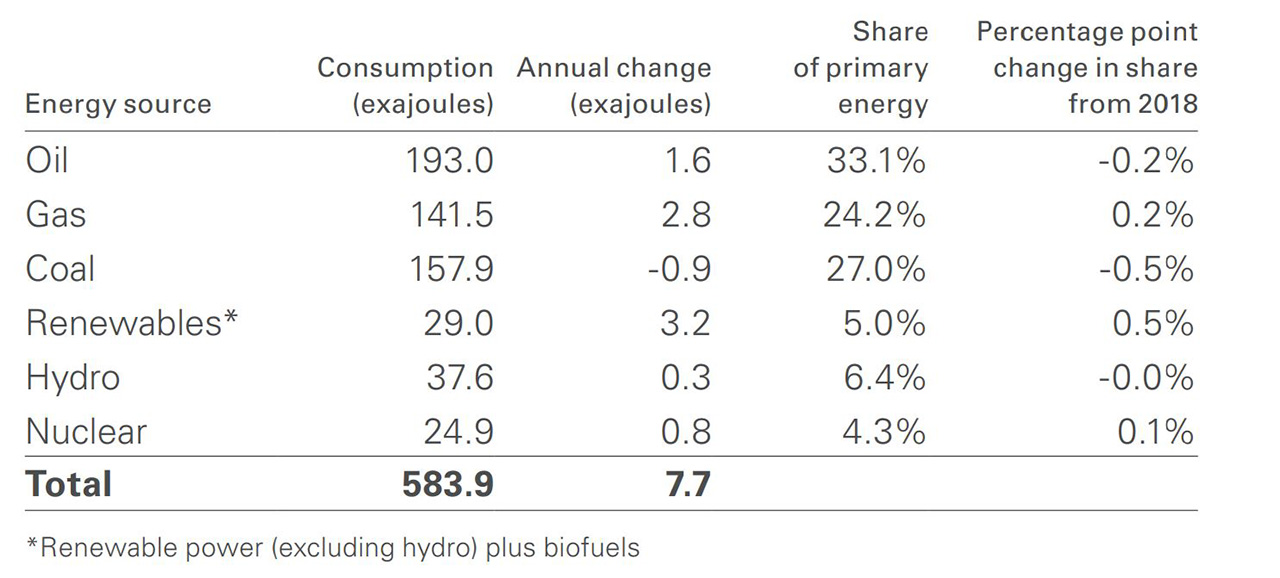

Global energy consumption 2019

Source BP – Energy Statistical Review 2020

Players like Woodside are already positioning themselves for a lower emissions future with products like hydrogen, which can be used in fuel cells. Australian hydrogen exports could be worth up to $10 billion a year, according to a 2018 report prepared for the Australian Renewable Energy Agency.

“Woodside is building a hydrogen truck stop in the Pilbara," Taylor says. "Santos (ASX: STO) is talking hydrogen production and storing Co2 in its depleted gas fields.”