Flight Centre removed from Morningstar's best ideas list

The travel retailer has taken off since early last month as border restrictions ease and demand picks up.

Mentioned: Brambles Ltd (BXB), Flight Centre Travel Group Ltd (FLT), Southern Cross Media Group Ltd (SXL), Westpac Banking Corp (WBC)

Morningstar equity analysts have removed Flight Centre Travel Group (ASX: FLT) from their monthly best stock ideas list following its recent share price rally.

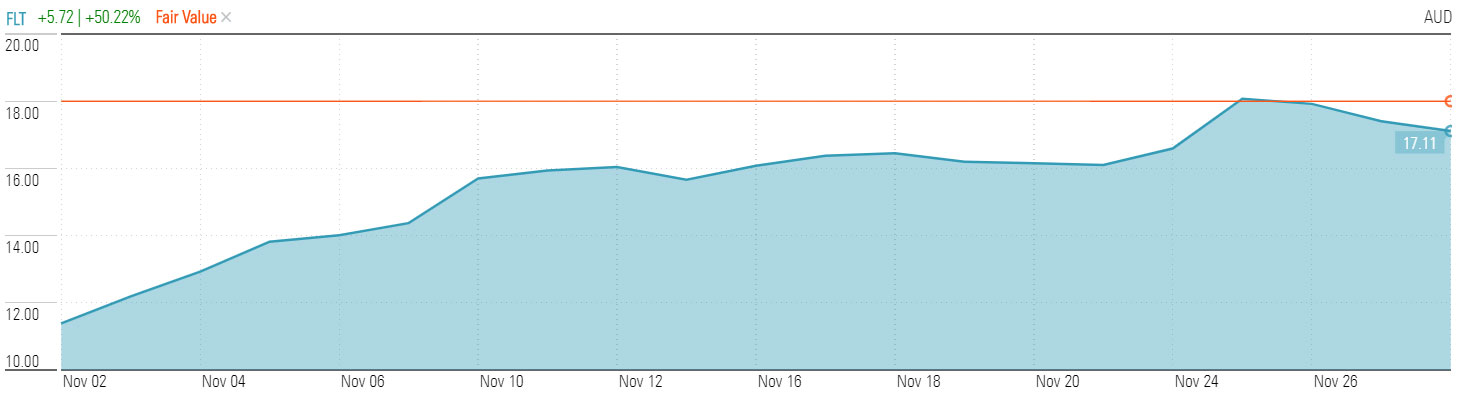

Shares in the travel retailer have rebounded by more than 50 per cent since early November, from lows of $11.28 to around $17.20 today, helped in part by positive news on the vaccine front and the global rotation into covid-market losers.

FLT is now trading just shy of Morningstar's $18 fair value estimate at three-stars.

Price to Fair Value | FLT, November 2020

Source: Morningstar

Morningstar senior equity analyst Brian Han says investors welcomed the pent-up urge to travel. His earnings expectations and fair value are intact following the rally. This is despite near-term uncertainties as the virus continues to depress corporate and leisure travel activities.

"Gradual relaxation of border restrictions and social distancing protocols are lifting consumer sentiment and encouraging investors to look to Flight Centre’s longer-term recovery potential," Han says.

"The group has an $1.3 billion liquidity buffer, and management’s swift response to the pandemic has resulted in an ultra-lean cost base–one that could ensure break-even at 40 per cent of pre pandemic total transaction volume.

"Furthermore, its fast-growing corporate travel business boasts superior profitability and resilience to the structurally challenged leisure unit and will be a key driver of earnings recovery."

Despite reporting a staggering fiscal-2020 underlying loss of $510 million in August, Flight Centre has $1.1 billion of available liquidity, thanks to $700 million injected by shareholders in April and May and a $200 million increase in debt facilities.

Going into the virus, Flight Centre had $189 million in net cash, up from $110 million at the end of January 2020.

The rotation into beaten down stocks in mid-November saw investors take profits from market-leading tech stocks, which have thrived amid the pandemic recession. The sell-off pulled the tech-heavy Nasdaq temporarily deep into red territory.

Investors were responding to the Pfizer Inc announcement that trials of its covid-19 vaccine candidate, developed with German partner BioNTech, showed a 90 per cent success rate in preventing infection. Similar positive developments flowed from Moderna and AstraZeneca/Oxford.

Morningstar assumes a full recovery in global travel demand long term, mimicking past demand shocks such as the terror attacks of 11 September 2001 and the global financial crisis of 2008.

Morningstar analysts have placed 13 stocks on December's best stock ideas list, including Southern Cross Media Group (ASX: SXL:), Brambles (ASX: BXB) and Westpac Banking Corporation (ASX: WBC).

Morningstar's monthly Best Stock Ideas highlights high-quality Australian and New Zealand companies, which are currently trading at discounts to analysts assessed fair values.

Morningstar Premium subscribers can view the full list here.