REIT all about it

The real estate investment trust sector is trading at attractive valuations, while delivering yields close to 5 per cent, says Van Eck's Arian Neiron.

Mentioned: VanEck FTSE Intl Prop (AUD Hdg) ETF (REIT)

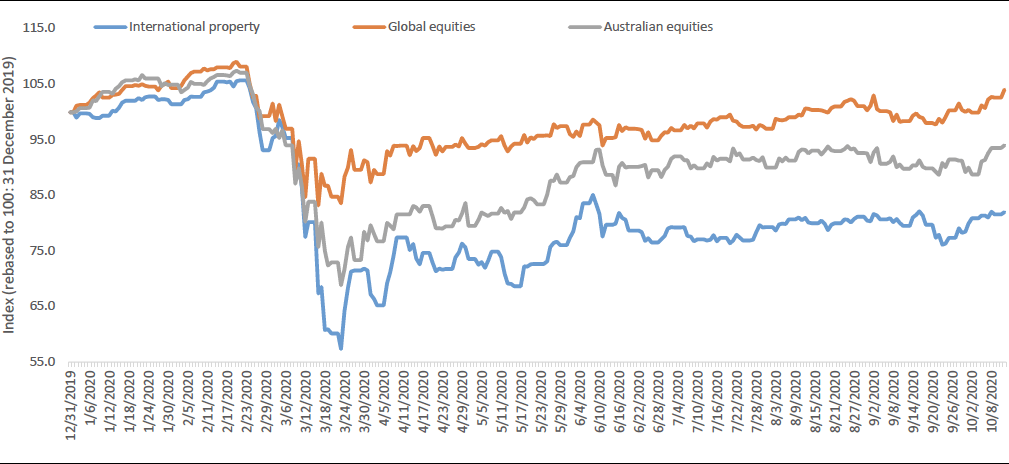

The recovery in equity markets, from the sudden and severe drop in March, has been remarkable but it has not been uniform. The international real estate investment trusts (REITs) sector, as an asset class, has been hit hard and the recovery of the market benchmark, the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged, has not yet matched international equity markets.

2020 calendary YTD index performance

Source FTSE, 31 Dec 2019 to 12 October 2020. Rebased to 100. Indices used, International Property: FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged—results assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF and taxes; Global equities: MSCI World ex Australia Index; Australian equities: S&P/ASX 200 Index. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Yet with market participants expecting continued low rates and low growth as the global economy battles the COVID-19 crisis, now could be the time to allocate a portion of your investment portfolio to listed international real estate securities. The sector is trading at attractive valuations, while delivering handsome yields close to 5%, adding to its appeal in a world characterised by negative or very low interest rates.

Global property’s green shoots

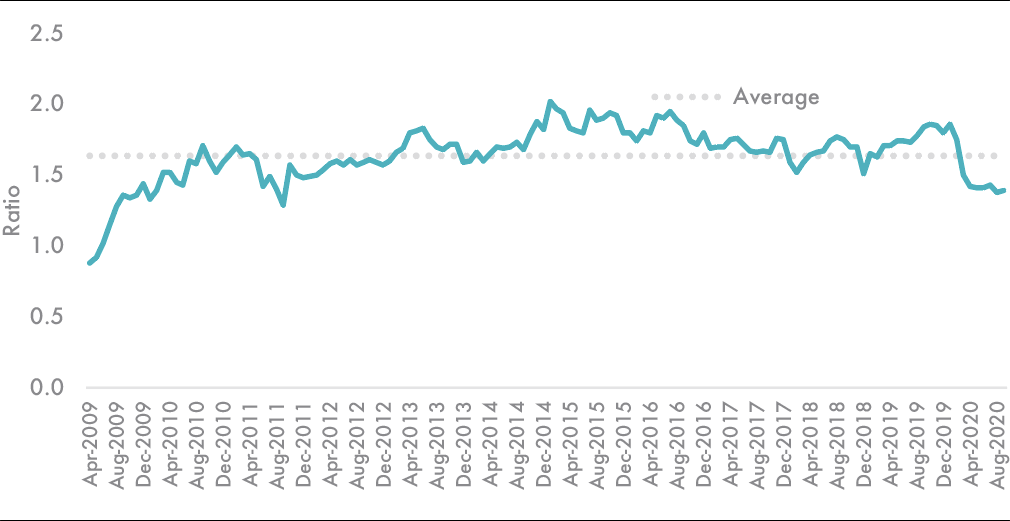

When markets retreated in March, international property was among the worst hit sectors. While equities have since led a robust market recovery, international property has lagged. Yet it’s important to remember that international REITs are a far more diverse category than Australian REITs, including sectors such as healthcare and data centres, which are likely to experience strong growth in the years ahead as more of us work from home, and healthcare experiences a surge in demand. Many global REITs’ operations have continued to hold-up well during the pandemic period and therefore represent an opportunity for portfolio diversification. With the drop in values, international property is now at its cheapest level in 11 years, as measured by the net tangible asset value relative to price.

International property index price to net tangible asset value (NTA): Price relative to value of equity value. Lowest point in 11 years

Source: FTSE, Bloomberg as at 30 September 2020 International property index is FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged

Rent collections too have started to improve. This is particularly evident in the retail sector.

Rental receipts improving: % of pre-covid rent collection (USA)

Source: FTSE, Nareit, from REIT Industry September 2020 Rent Collections Research.

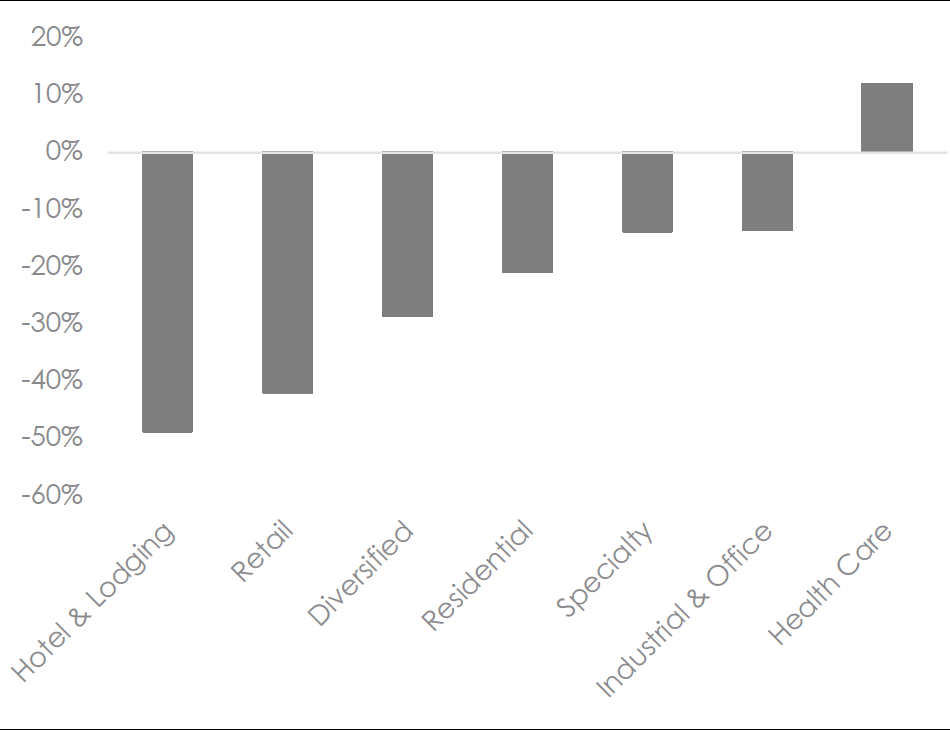

Yet in figure 4 below, you can see that the retail sector has been among the worst hit international property sub-sectors in 2020. We think the recovery in rental collections is yet to be reflected in prices.

International property sub sector year-to-date performance

Source:

Source:

Bloomberg, Facstet; 31 Dec 2019 to 30 September 2020. Past performance is not a reliable indicator of future performance.

Moreoever, global REITs are in a good position financially overall. Once a concern for investors, REIT balance sheets have been de-risked and are in strong shape. Figure 5 shows that REITs now have lower debt emerging from COVID-19 than they had during previous crises. Leverage during the GFC on the benchmark index, the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged, was over 50% as measured by debt to assets. It is now closer to 40 per cent, as shown by the figure below.

Leverage—debt/assets: Leverage still well below GFC levels

Source: Bloomberg, Indices used: MSCI World Index is MSCI World ex Australia Index, REIT Index is FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

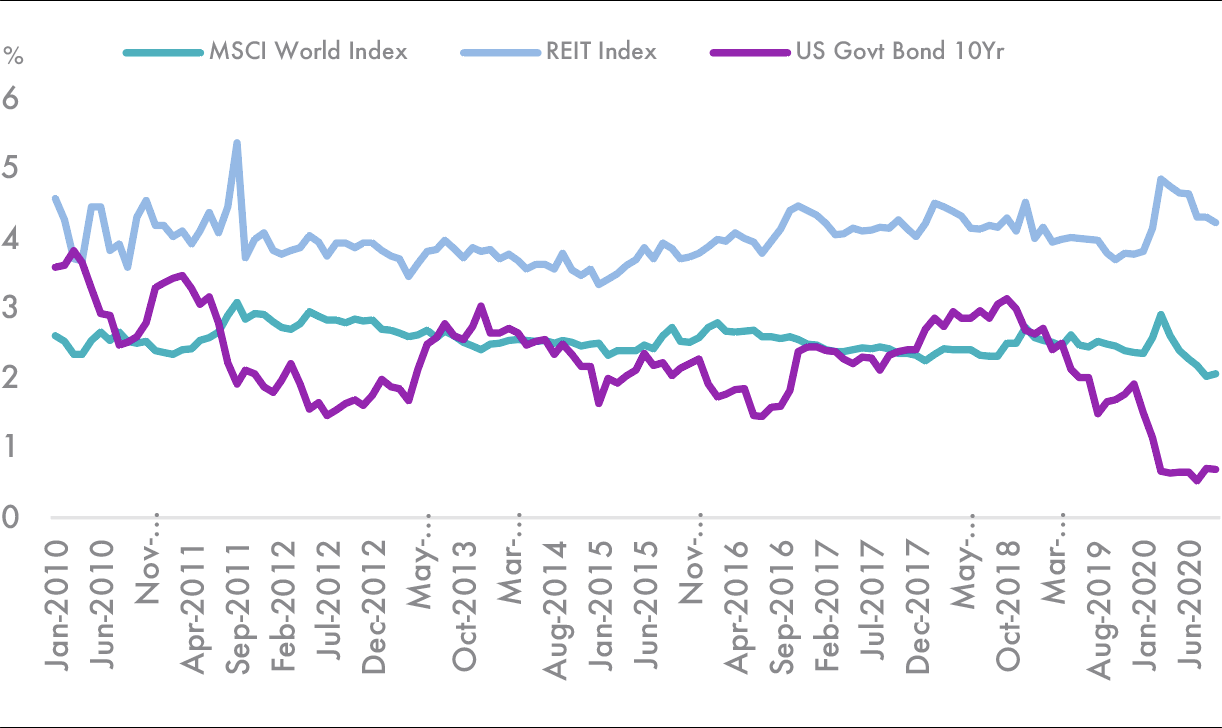

An income opportunity

Investors needing income from their portfolios are experiencing a very difficult time given the downward trajectory of interest rates over many years. In 2020, this has been dramatically exacerbated, with most economies experiencing low or negative real rates with central banks using unconventional programs in order to stimulate their economies in response to COVID-19. Investors are having a near impossible time reaping income from traditional fixed income assets. Against this backdrop, international property can provide both a value and income opportunity.

The chart below shows that the international property benchmark index has maintained a steady dividend yield this year despite falling government bond yields. You can see in figure 5, the dividend yield on the REIT Index is relatively high at 4.54 per cent as at 30 September 2020 and had remained generally steady, as bond yields have plunged. The 12-month trailing yield rose significantly in March 2020 due to the fall in asset prices and while there has been some REITs that have reduced dividends, we believe many global REITs will remain dividend payouts.

12-month trailing dividend yield

Source: Bloomberg as at 30 September 2020. Indices used: MSCI World Index is MSCI World ex Australia Index, REIT Index is FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged, US Govt Bond 10 Yr yield is US Gerneric Govt 10 Yr (USGG10YR Index). You cannot invest directly in an index. Past performance of the REIT Index is not a reliable indicator of future performance of REIT. Trailing dividend yield is not an indication of past income paid by REIT or a guarantee of future dividends payable from REIT.

Diversification is key

It important to understand that US, Europe and Asia offer real estate investment opportunities not readily available in Australia, including healthcare, data centres and self-storage. Australian REITs account for just 3 per cent of the world’s REIT opportunity. While the US remains the largest listed real estate market, the opportunity is increasingly becoming global. Today, nearly 40 countries offer REITs, according to Nareit, many offering investment opportunities not readily available in Australia.