Keep your distance from Coles: Morningstar

The supermarket giant is trading on overly ambitious PE ratio, says Johannes Faul.

Morningstar director of equity research Johannes Faul is warning investors to keep their distance from Coles despite its booming fiscal-2020 sales.

While the supermarket giant's earnings beat Morningstar's estimates—including a boost in operating profits for the first time in four years—Faul says investors are paying through the nose to access Coles' (ASX: COL) defensive attributes.

"The stock is trading at a forward price to earnings ratio of 25 while offering only high-digit earnings compound annual growth rate over the next five years and a 3 per cent dividend yield," he says.

"Because of the stock's recent outperformance, Coles has even closed the valuation gap relative to market leader Woolworths (ASX: WOW) which had existed since Coles listed in late 2018."

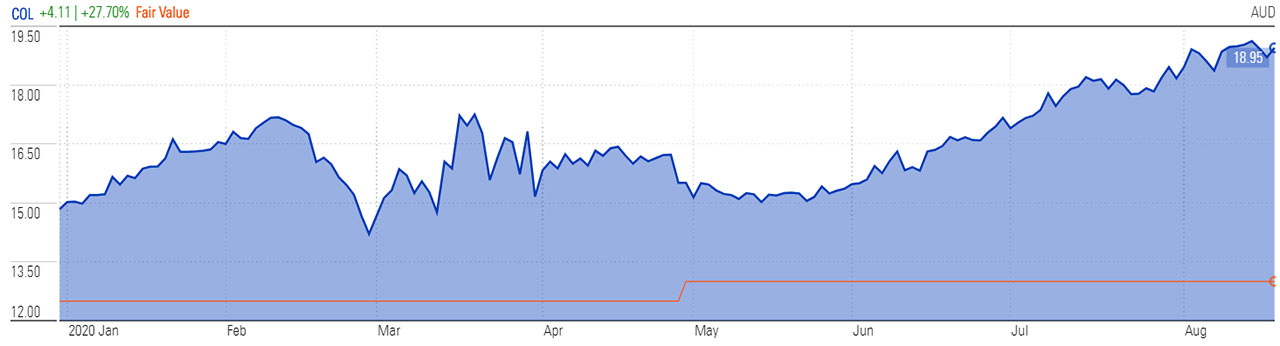

Faul has maintained his $13 fair value estimate following the result. Trading around $19, the stock is significantly overvalued at a 46 per cent premium.

"Our short-term outlook is broadly in line with company guidance and our long-term earnings estimates are virtually unchanged," Faul says.

Coles fully franked declared dividend of 57.5 cents for fiscal 2020 was in line with Morningstar's estimate.

COL | Price to Fair Value, YTD

Source: Morningstar Premium

Read Johannes Faul's full COL report: Coles’ Safe Haven Premium Is too Rich. Margin Increases Are Unlikely in the Medium Term

Resilience in a challenging environment

"It seems food retailers were in the right place at the right time during this pandemic," Faul says.

Customers flocked to its stores to stock up on essential supplies in March while increased in-home consumption benefited home-cooking categories such as meat and poultry. Customers made fewer trips to the supermarket, but they left with their trolley piled high, Coles reported.

Coles group EBIT grew for the first time in four years, rising by 4.7 per cent. Like-for-like food sales are already up around 10 per cent in the first six weeks of fiscal 2021.

Liquor sales also rose, up 20 per cent in the fourth quarter—accelerating from an already solid increase of 7 per cent in the third quarter.

Coles says the mix of sales has evolved following the initial panic-buying period as customers de-stock their pantry items. An increase in in-home entertaining has seen an uplift in categories such as gourmet cheese and flowers.

Margin expansion unlikely

Faul's estimated sales were on par with actual fiscal-2020 sales, but it was the profitability of those sales that surprised. He attributed this to the supermarket's "impressive strides" with its Smarter Selling cost-cutting programme—a four-year transformation revealed in June last year which includes increased automation, faster checkouts and distribution centre planning.

"The supermarket EBIT margin of 4 per cent was some 20 basis points ahead of our 3.8 per cent estimate," Faul says.

"Instead of the $150 million in cost savings targeted at the beginning of the year, Coles already implemented $250 million in annualised sustainable cost efficiencies of the $1 billion four-year programme—despite the volatile environment."

However, Faul expects these new savings to offset cost inflation and be passed on to consumers. His long-term food EBIT margin forecast of 4 per cent from fiscal-2021 is unchanged.

Faul is forecasting another solid year ahead for Coles’ core supermarkets segment. He also anticipates liquor sales growth to stay above the long-term trend while coronavirus restrictions limit attendance at cubs, pubs and restaurants.

"We estimate strong sales growth will continue during the first half, but the challenge of cycling comparable sales growth of 10 per cent achieved in the second half of fiscal 2020 results in our food sales growth estimate of 3 per cent for the full fiscal year 2021," he says.

This article is part of Morningstar's Reporting Season 2020 coverage. The calendar will be updated daily to connect you with our equity analysts' take on the financial results.