Cochlear fair value increased after upbeat result

The wide-moat hearing implant maker was less affected by coronavirus elective surgery restrictions than analysts expected.

Mentioned: Cochlear Ltd (COH)

Australian hearing implant maker Cochlear has topped analyst earnings expectations, delivering a better than expected fiscal-2020-unit sales amid the global pandemic.

While analysts anticipated the widespread curtailment of elective surgery in response to covid-19 would dampen Cochlear sales, implant numbers held strong.

This is largely due to elective surgeries resuming ahead of expectations and patients choosing not to defer.

Morningstar director of equity research Mathew Hodge has forecast a reduced impact from coronavirus in fiscal-2021 and marginally increased Cochlear's (ASX: COH) fair value from $134 to $138.

"We estimate the company achieved implant unit sales of 65 per cent of normal levels in the second half versus our forecast 50 per cent," Hodge says.

Shares in Cochlear surged 8.6 per cent in the hours following to announcement to $215.37.

At Tuesday's close, shares were significantly overvalued to Morningstar's fair value estimate, trading at a 62 per cent premium.

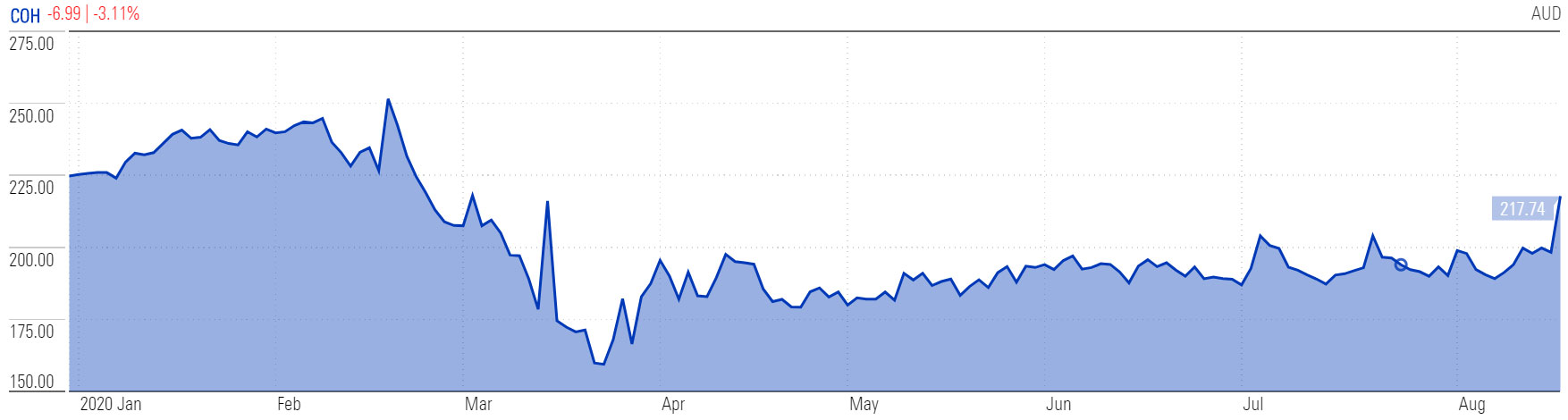

COH | Share Price, YTD

Source: Morningstar Premium

Non-urgent elective surgeries in Australia and around the world were suspended from mid-March in response to covid-19 to preserve resources, protect non-covid-19 patients and help the system prepare for an influx of patients.

Cochlear reported implant unit sales across developed market countries declined around 80 per cent in April—compared to April 2019—with most elective surgeries postponed. To the extent that there were surgeries, they were predominantly among children.

But by the end of June, Cochlear says over 80 per cent of implant surgical centres in developed market customers had recommenced surgeries.

Read Mathew Hodge's full COH report: Coronavirus Impacts on Cochlear’s Implants Less Than Anticipated; Increase FVE to AUD 138

Loss on virus

Expectations aside, covid-19 sent Cochlear into the red. The company reported a net loss of $238.3 million, down 186 per cent, which was blamed on patent litigation costs of $416.3 million and covid-19 surgery deferrals.

Sales revenue declined 6 per cent to $1.4 billion—up 9 per cent in the first half but down 22 per cent in the second.

Excluding the litigation settlement and revaluation of investments from the fiscal 2020 result, Hodge calculates underlying profit of $154 million.

Cochlear management declined to provide net profit guidance "given the uncertainty in forecasting revenue for fiscal-2021".

Cochlear has operations in more than 20 countries and distributes its products in America, Asia Pacific, Europe, Middle East and Africa. Its other products include its Baha bone conduction hearing aid and wireless accessories.

Near-term outlook subdued

Ahead, Hodge warns that Cochlear's pipeline has been disrupted by the virus, and that his new forecast "represents a change in timing rather than quantum of sales".

A key constraint to Cochlear's rebound is hearing clinics functioning at lower capacities. Referrals and assessments for adults in developed markets takes nine to 12 months.

Cochlear agrees, advising that covid-19 risks are still front and centre.

"While the resumption of elective surgeries is positive, we caution that there is still a risk, noting that second waves of covid-19 cases are likely to remain a reality for some time and may result in new restriction to elective survey, complicating recovery plans and timing," the company said in an ASX statement.

"We also recognise that the surgeries current occurring, particularly for adults and seniors, include a catch up of delayed surgeries from March to May.

"We will get a clearer picture of the impact of clinic closures in April and May on the new candidate pipeline over the next few months."

Cochlear adds that while most clinics have re-opened, many are running below capacity and the company expects there to be some impact on the number of patient assessments.

Hodge believes Cochlear's path to recovery will vary between geography and market segment.

In developed markets, he forecasts Cochlear to achieve 85 per cent of normal pre-covid-19-unit sales in fiscal 2021 versus an estimated 80 per cent in fiscal 2020. This reduced figure accounts for countries, like the UK, where elective surgeries have not resumed.

For emerging markets, Hodge says sales will vary according to macroeconomic conditions as implants are often supplied under government healthcare tenders. Consequently, he expects sales to remain depressed in fiscal 2021 at 65 per cent of normal levels.

As sales in China are predominantly paid for privately, he expects this market to be "the most resilient".

Overall, Hodge forecasts implant unit sales to fall 5 per cent to 29,900 units in fiscal 2021, with an improvement in developed markets offset by a decline in emerging markets.

"As developed market prices are higher than those achieved in emerging markets, the impact on cochlear implant revenue is a muted 1 per cent decline."

This article is part of Morningstar's Reporting Season 2020 coverage. The calendar will be updated daily to connect you with our equity analysts' take on the financial results.