Morningstar initiates coverage of small-cap Bega Cheese

The food processor has a stable of household brands but its shift away from dairy exposes it to retail pressure.

Morningstar has initiated coverage of $1 billion market cap Australian cheese producer Bega Cheese (ASX: BGA) with a no-moat rating and $4.60 fair value estimate.

While the company has begun steps to diversify its business beyond cheese, picking up household staples Vegemite and Peanut Butter in 2017/18, Morningstar equity analyst Angus Hewitt expects dairy to dominate earnings over the next decade.

As such, Hewitt says the producer has "not carved an economic moat required to sustainably earn economic profits".

"We forecast most of Bega's sales to come from dairy products, despite the firm's strategic efforts to develop a diversified offering of branded consumer packaged food products," he says.

"This exposes the firm to largely commoditised products, with limited product differentiation and volatile input costs.

"Competitive pressures from branded peers, niche operators, and private label products and a reliance on powerful supermarket customers will weigh on Bega's ability to increase prices."

Bega's core cheese products include Bega Tasty, Super Slices and Cheese Stringers. Its Foodservice business supplies food products to the catering industry, and it recently began producing spreads, honey, dips, butter, dressings and supplements.

At yesterday's $4.60 close, BGA shares were trading within a range Morningstar analysts consider fairly valued.

BGA is a small-cap stock with the market capitalisation of around $1 billion. A small cap stock is considered a company that sits outside the largest 100 listed companies by market cap.

Read Angus Hewitt's full BGA report here: ![]() Initiating Coverage of Bega Cheese With a AUD 4.60 Fair Value Estimate and No-Moat Rating

Initiating Coverage of Bega Cheese With a AUD 4.60 Fair Value Estimate and No-Moat Rating

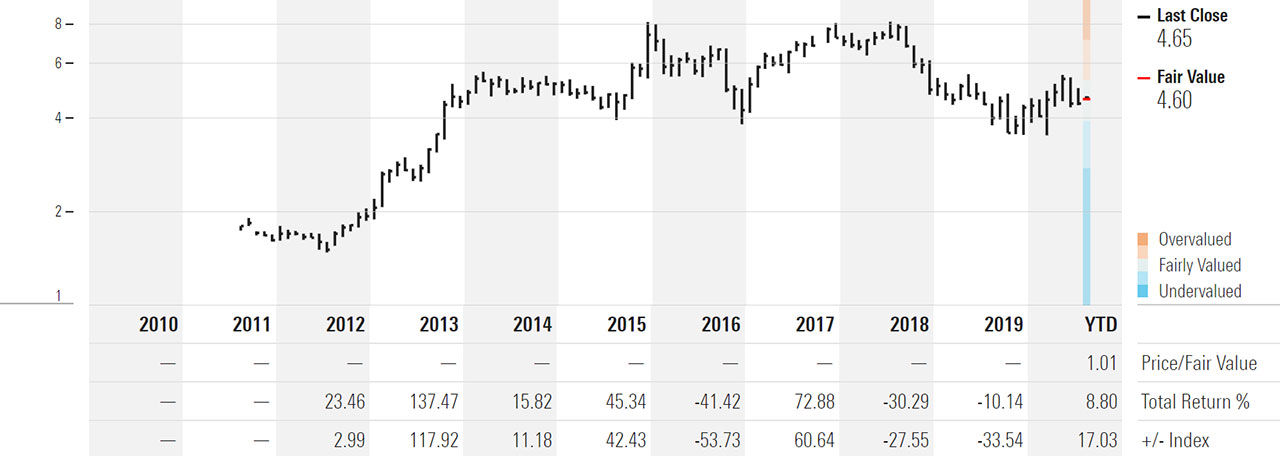

BGA | Price vs. Fair Value

Source: Morningstar Premium. Data as at 17 August 2020.

Morningstar outlook

Hewitt thinks Bega's fiscal-2020 will likely disappoint, forecasting underlying earnings to fall 33 per cent to $26 million. He says increased input costs and lower production volumes, largely stemming from drought in the Tatura region, in Victoria’s Goulburn Valley, will weigh on near-term margins.

Production volumes in Bega's Foodservice business are also expected to be weak in the second half of fiscal-2020 as customers keep their distance from cafes and restaurants. And while the company could experience a windfall from consumers stockpiling familiar brands during the pandemic, Hewitt believes this will partially be offset by lower future demand.

Hewitt anticipates Bega will return to earnings growth from fiscal-2021 with improving margins.

"We forecast group operating margins expanding over the five years to fiscal 2024 to 5.6 per cent from 4.6 per cent in fiscal 2019, underpinned by process optimisation and cost-out initiatives across the group," he says.

Consumer preferences away from dairy products to vegan and dairy free diets is a notable long-term trend for Bega, but Hewitt forecasts Australian cheese per-capita consumption to remain steady at about 13.5kg per year for the foreseeable future.

Strategic shift

Bega acquired the iconic Vegemite brand from Mondelēz International (NASDAQ: MDLZ) in 2017 marking a strategic shift for the dairy producer. The $460 million deal also included the Mondelēz's peanut butter business, ZoOsh salad dressings and sauces, Bonox spread and a 6.3ha Port of Melbourne manufacturing site.

Moving away from dairy products will lower Bega's exposure to volatile milk prices and diversify its earnings stream, Hewitt says. Spreads are also less commoditised and higher margin than dairy. Hewitt expects Bega to increase investment and focus on the non-dairy segment, ramping up marketing and innovation to expand market share.

The acquisition has had its ups and downs. Bega has been locked in a long-running labelling dispute with US food giant Kraft Heinz over the famous yellow peanut butter jar.

Kraft, which split its global business into two units in 2012—transferring its Australian operations to Mondelēz—claims that Mondelēz could not sell the packaging rights to Bega. This was rejected by the Federal Court in May 2019 which found that Bega has acquired exclusive rights to the packaging.

Kraft Heinz (NASDAQ: KHC) has applied to appeal the decision to the High Court.

Bega is scheduled to release its full-year earnings on 27 August 2020.