19 Aussie stocks for investors with lower-risk profiles

Don't think of this as a list of ‘buys’, but as a collection of names to investigate further.

Mentioned: Unibail-Rodamco-Westfield (URW), Air New Zealand Ltd (AIZ), Flight Centre Travel Group Ltd (FLT), Myer Holdings Ltd (MYR), Nine Entertainment Co. Holdings Ltd (NEC), Qantas Airways Ltd (QAN), Scentre Group (SCG), Sky Network Television Ltd (SKT), Web Travel Group Ltd (WEB), Zip Co Ltd (ZIP)

Australian media is awash with stories about the sharemarkets 'corona generation' – a cohort of new young traders traversing the wild-west of the fastest bull market in history.

But these hopeful millennials are not necessarily taking a punt on stock-standard blue-chips.

Instead they’re trying their luck on small growth stocks like buy-now, pay later player Zip Co (ASX: Z1P) and high-risk leveraged ETFs. Battered travel businesses Flight Centre (ASX: FLT), Qantas (ASX: QAN) and Webjet (ASX: WEB) are also getting a look in as investors speculate about a turn around.

An ASIC investigation reveals a sharp increase in the number of new retail investors—up by a factor of 3.4 times—as well as a spike in the number of reactivated dormant accounts.

Trading frequency has soared as has the number of different securities traded per day; conversely, the duration for holding the securities has plunged. The regulator says this indicates an increase in short-term and "day-trading” activity.

The offer of $0 commmission trading is also enticing investors to invest overseas as brokers like Stake report an uptick in new accounts and trading volumes.

Not all investors are lucky enough to have time on their side. Those closer to retirement or relying on their investments for income can't afford to risk it all on a penny stock or possess the nerves of steel required to sail through the volatility.

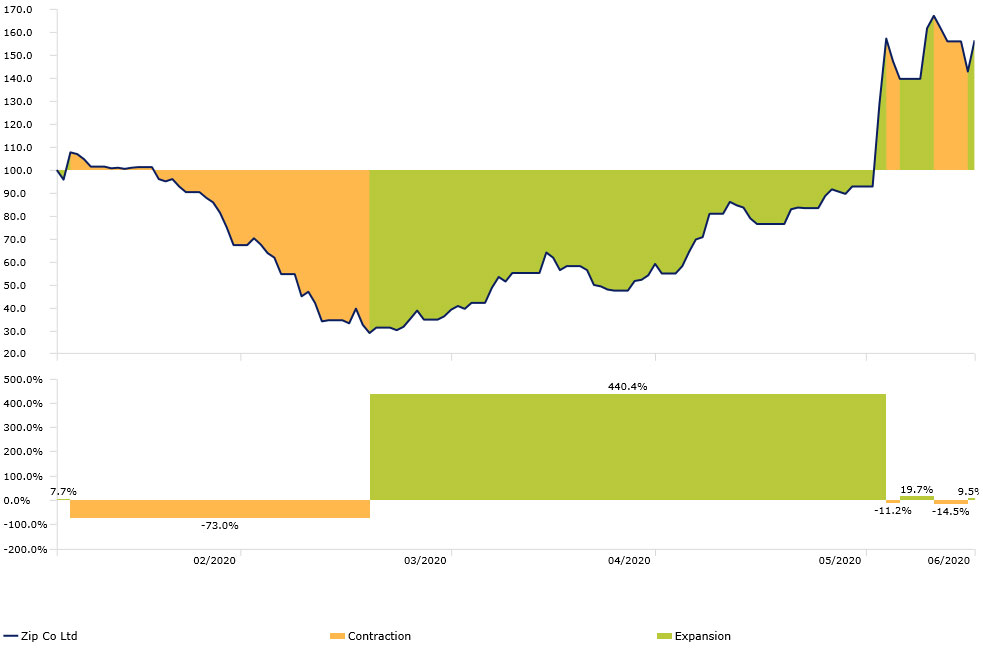

Investment growth | Zip Co (Z1P)

Time period: 03/02/3030 – 16/06/2020

Define drawdown as a decline of 10 per cent or more

Source: Morningstar Direct

With an uncertain economic outlook, and large sections of the economy still under lockdown, analysts say it's difficult to predict companies' future earnings and cash flows with any kind of certainty. Many companies are throwing their guidance out the window, slashing dividend payouts, or rushing to secure additional equity or debt to shore up their balance sheets.

Today, there are just over 65 companies under Morningstar coverage currently trading below their intrinsic fair value. However, only a dozen of those have carved out solid (and in some cases growing) competitive advantages that will allow them to thrive for years to come; and that same dozen have low or medium fair value uncertainty ratings—meaning companies analysts feel they can estimate future cash flows with a higher degree of confidence.

Higher uncertainty rated, undervalued companies in Morningstar’s network include Sky Network Television (ASX: SKT), Virgin Money UK (ASX: VUK), Nine Entertainment Co (ASX: NEC), Unibail-Rodamco-Westfield (ASX: URW), Myer Holdings (ASX: MYR) and Air New Zealand (ASX: AIZ). The range of outcomes for these stocks is high due to the unpredictability around their future earnings.

For example, shopping centre owner and operator Scentre Group (ASX: SCG) is currently trading below its Morningstar fair value at 4 stars. Morningstar analyst Johannes Faul says the group faces tough times as consumers avoid public places and curb spending. Faul believes Scentre will eventually recover to pre-pandemic conditions but much depends on how long the shutdown lasts. He has consequently moved the uncertainty rating to very high from medium.

To find stocks to fit the “lower-risk” bill, we screened for the following:

Discounted: the stocks of these companies must be trading at a decent discount to our fair value estimates—selling at Morningstar Ratings of 4 or 5 stars.

Fair value certainty: analysts need to have a high degree of certainty in their fair value estimates for the stocks of these companies, limiting our search to stocks with fair value uncertainties of medium or low. This rating represents the predictability of a company's future cash flows.

Top notch steward: we tossed out companies with Poor stewardship ratings, preferring to ride along with management teams that have a proven record of being good stewards of investor capital.

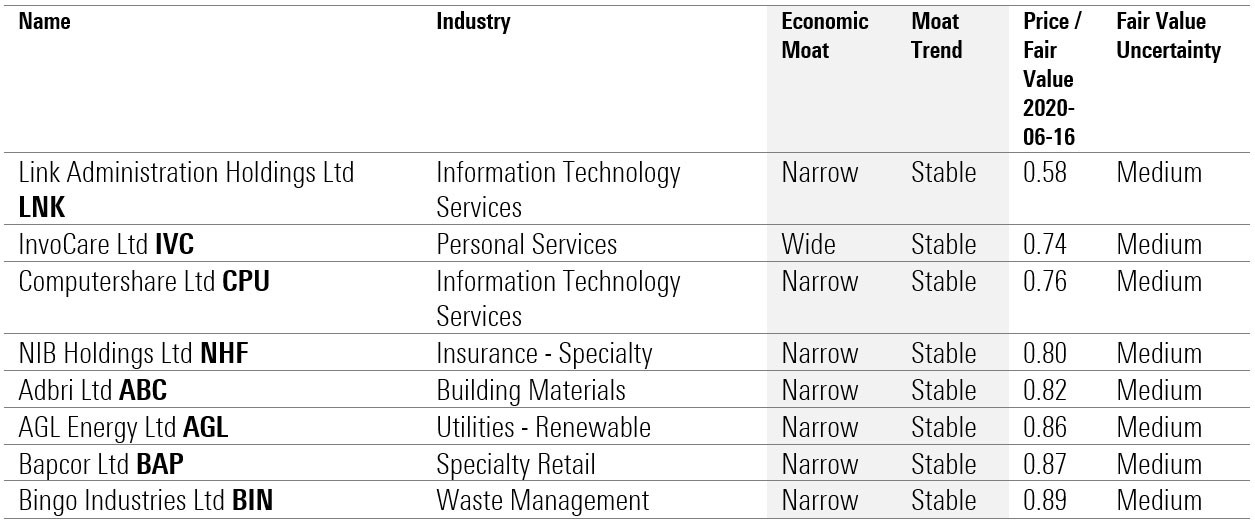

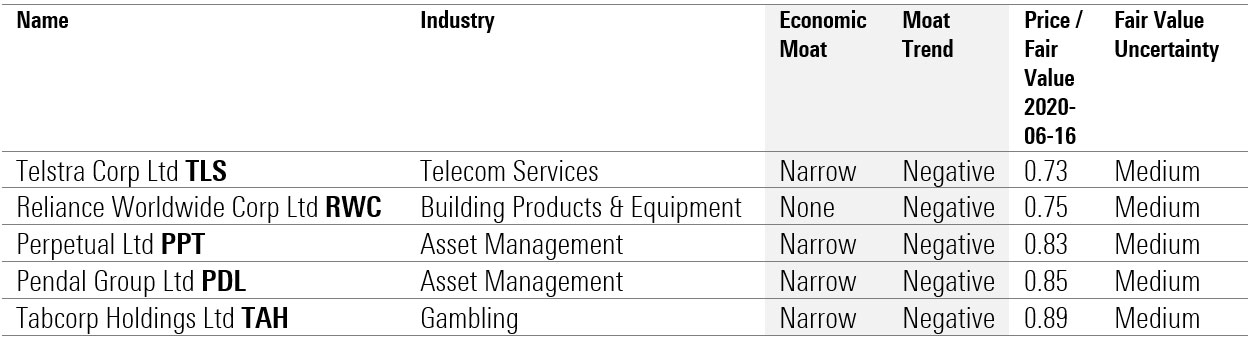

Several stocks on the list also boast Morningstar Economic Moat Ratings (wide or narrow)—and Morningstar Moat Trend Ratings of stable or positive. In other words, these companies have competitive positions that are steady or even improving.

Don't think of this as a list of "buys," though. Instead, think of it as a collection of names to investigate further. See the individual stock pages for full analysis.

"A 5-star rating does not suggest that the stocks won't drop further," says Faul. "Our aim is not to pick the bottom, but to highlight to investors that they can pick names up at a discount."

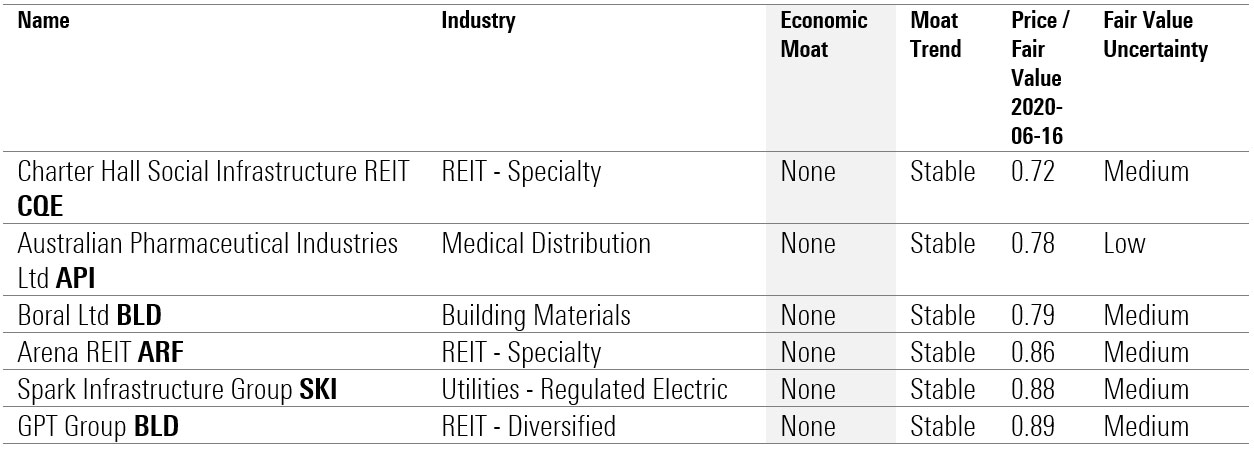

Stocks trading at a discount

This is a snapshot of how these stocks stand at the time of writing: 16 June 2020. Given the current market volatility, the valuations could jump around.

Companies with stable economic moats

Source: Morningstar Direct

Companies with eroding economic moats

Source: Morningstar Direct

Companies without moats

Source: Morningstar Direct