Avita’s share price burns will heal, says Morningstar

The corona sell-off hurt the spray-on-skin maker but it’s got an eye on the bigger picture, says Nicolette Quinn

Mentioned: AVITA Medical Inc (AVH), AVITA Medical Inc (RCEL), Polynovo Ltd (PNV), Vanguard Australian Shares ETF (VAS)

Avita Medical's share price has taken an absolute belting since the coronavirus sent markets into a tailspin. But Morningstar equity analyst Nicolette Quinn says the dual-listed spray-on skin maker's long-term prospects remain strong.

In a research note following the company's third quarter fiscal 2020 update last month, Quinn acknowledged management's warning that the ongoing rollout of the Recell system would slow amid the COVID-19 pandemic. While severe burn treatment is acute and not elective, management says there has been a pause in enrolment in some of its clinical trials.

However, Quinn says these near-term headwinds aren't enough to shake her fair value estimate. Today, Avita (ASX: AVH) is trading at about a 54 per cent discount to Quinn’s estimate.

Key to Quinn’s thesis is the eventual easing of restrictions.

"At this stage we expect the lockdown orders in the US to predominantly be lifted by fiscal 2021 and economic activity to resume,” she says.

"This will facilitate the rollout of Recell, and we continue to forecast low 20 per cent market penetration for Recell usage in fiscal 2021, up from mid- to high-teens in fiscal 2020."

Quinn has rated Avita's fair value uncertainty as "very high risk" due to the unpredictability around the pace and success of the roll-out.

Redomicile to the US

Avita's third quarter update conveyed mixed results. While the company had a healthy fiscal third quarter, including a 67 per cent jump in third quarter revenue to $8.065 million, management flagged road bumps in the rollout of Recell. Quinn also anticipates hospitals to restrict new account acquisition and training.

Among the consequences of bans of travel and movement is a drop-in wounds from burns. That's a good thing for general health but so no good if you happen to be in the business of making spray-on skin for burns victims. Management expects actual incidence of burn wounds to decrease up to 20 per cent as a result of the lower levels of manufacturing activity and travel.

During this time, Avita says it's continuing to develop the protocol and FDA Investigational Device Application for the ReCell vitiligo study. Vitiligo is a long-term skin condition characterised by patches of the skin losing their pigment.

The company is also making progress toward redomiciling to the US. Currently, Avita's primary listing is on the ASX, with a secondary listing on the NASDAQ (RCEL). However, under the new arrangement announced last month, this will be flipped.

Management says the move will better align the company's corporate structure with its U.S. business operations. Avita has had no physical business presence and only one employee in Australian since 2018.

"Our immediate commercial focus is on unlocking the US market, where we currently source virtually all of our revenue," the company said in a statement.

"The redomiciliation proposal therefore provides [us] with the opportunity to align our corporate structure with our business and beneficial ownership, and has the added benefit of providing a familiar investment offering to investors in the United States, which is the world’s largest capital market in terms of market capitalisation and trading volume."

Rocky April

Avita's share price enjoyed meteoric rise in 2019. Its stock was up almost 700 per cent, making it the top-performing stock in the S&P/ASX 200 index that year. Its star product is Recell, a “spray-on” skin product used in the treatment of burns, plastic, reconstructive and cosmetic procedures.

Quinn began coverage of the company in late January this year, at which point it was trading at a 25 per cent discount to fair value. It was added to the Morningstar Global Best Ideas list in February.

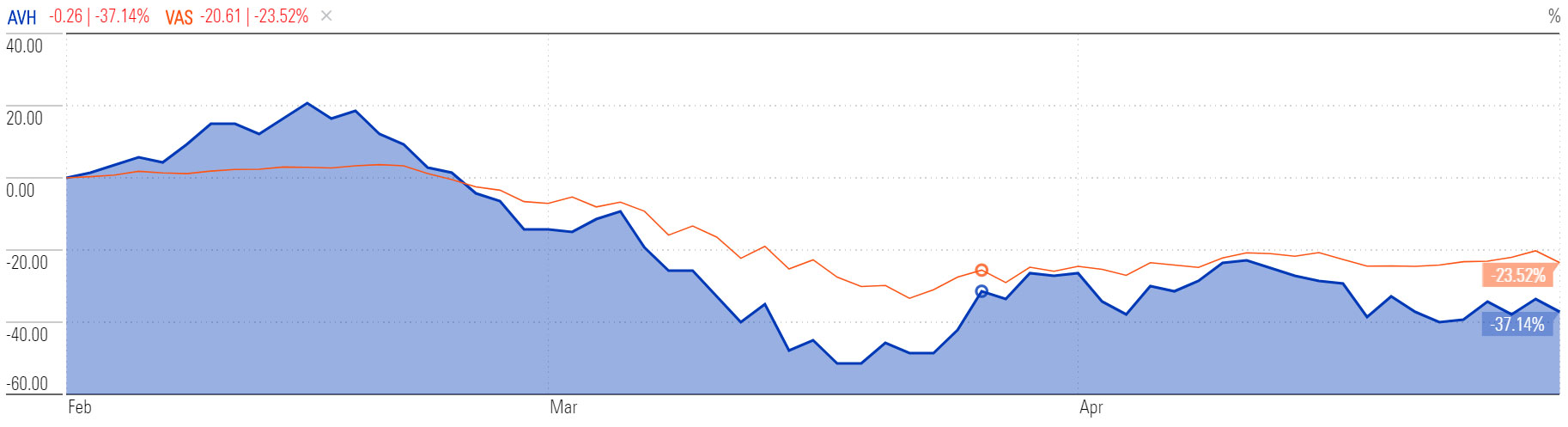

The share price has come off significantly since late-February, reaching lows of 33 cents by mid-March from a peak of 85 cents. While the index enjoyed some big improvements over April, AVH had a rocky month, down almost 10 per cent.

Price chart comparison, 3-mth | AVH, Vanguard Australian Shares Index ETF VAS

Source: Morningstar

On Avita's intention to change the company’s domicile to the US from Australia, Quinn says importantly the economic rights and share of equity held are unchanged, and the company will continue to be eligible for inclusion in Australian indexes such as the ASX 200. She believes that building the profile of the company in the US market is beneficial for closing the differential between price and valuation.

"The US market is the focus for rollout of the product and the source of almost all revenues," she says. "[We] await the detailed circular of the scheme due mid-May 2020."

The technology behind ReCell was invented by renowned plastic surgeon and Australian Living Treasure Fiona Wood, who used the product in an experimental capacity when treating burn victims of the Bali bombings in 2002.

ReCell has approval in the US for the treatment of second- and third-degree burns in adults, and Quinn sees potential for Avita to boost its market penetration in the next five years.

"Avita is early in the commercial rollout of its ReCell systems in the US, but we believe recent results show it is gaining traction and is set to take significant share in the US burn treatment market," she says.

"What sets ReCell apart from existing and new therapies is the speed at which it is able to create its Spray-On-Skin to apply to the burn site, as well as attractive pricing."