Investments you had your eye on in 2019

Here are the 10 most popular investments on Morningstar for 2019.

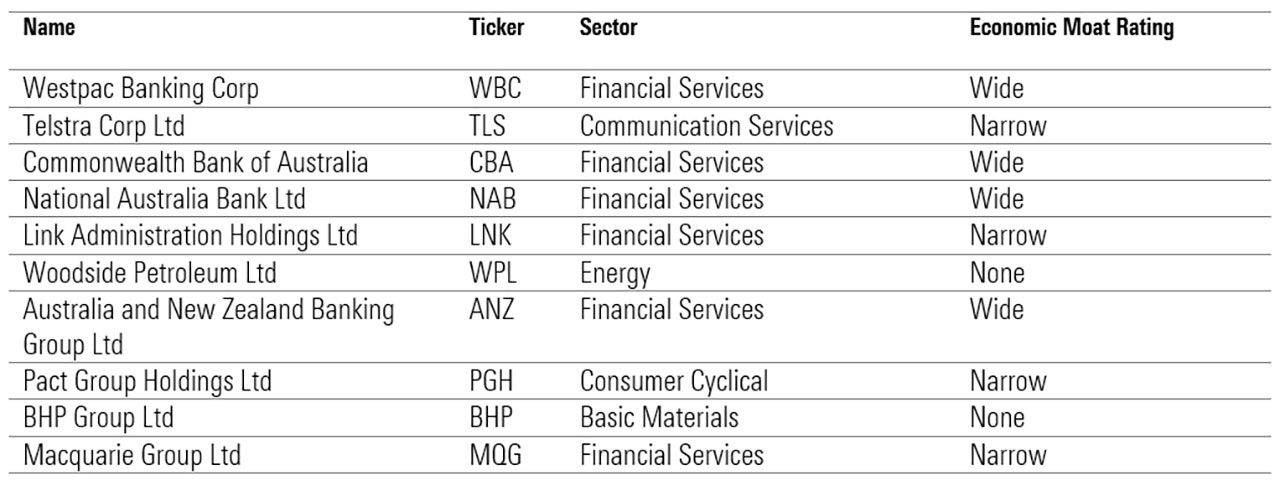

Mentioned: ANZ Group Holdings Ltd (ANZ), BHP Group Ltd (BHP), Commonwealth Bank of Australia (CBA), Macquarie Group Ltd (MQG), National Australia Bank Ltd (NAB), Pact Group Holdings Ltd (PGH), Telstra Group Ltd (TLS), Westpac Banking Corp (WBC), Woodside Energy Group Ltd (WDS)

Last week, Google released its Year in Search report. The most popular Google search item in Australia in 2019 was sadly “Fires near me”, which has trended upwards since November, followed by the Rugby and Cricket World Cups, the 2019 Election results and Disney star Cameron Boyce.

In this spirit, we’re also sharing “most popular” content. Yesterday, we covered the 10 most popular articles on the site in 2019. Today, we’re looking at the most frequently viewed securities – stocks, funds, listed investment companies and exchange-traded funds – on the site for the year.

Not surprisingly, the list of most-often-viewed stock reports consists primarily of high-quality, large companies (meaning the companies have carved out economic moats). Most also pay regular dividends. Some of our top picks for the year also made the list including Link Administration Holdings, Pact Group Holdings and Woodside Petroleum.

CommSec's SMSF Trading Trends Report (September 2019) shows similar results, with CBA, Westpac, NAB, and ANZ shown as the top shares held by SMSFs at 30 June 2019 (by value), followed by Telstra, CSL, Wesfarmers and Macquarie Group.

Of the list, Macquarie Group and Telstra were the top returning stocks – delivering 34.18 per cent and 34.93 per cent respectively, year to date. And more than half of the stocks are today trading in a range Morningstar analysts say are undervalued.

Financials continued to be the dominant sector, representing more than half of the companies listed. Companies Ramsay Health Care, CSL and G8 Education have dropped off the list since last year.

10 most popular stocks

Source: Morningstar Direct, at 24 December 2019

Pivoting to funds, the most popular unlisted funds list is, as one would expect, dominated by global fund managers Magellan and Platinum. Although a few Vanguard passive strategies make the list, the majority delivered active strategies. Funds from other top-notch families including Fidelity, MFS and Walter Scott are also among the most popular.

Bennelong Concentrated Australian Eq, Platinum Asia, Atlantic Absolute Return, and Macquarie Australian Shares dropped off the top 10 list this year.

10 most popular funds

Source: Morningstar Direct, at 24 December 2019

On the exchange-traded front, Vanguard dominated. And it seems no matter what type of structure Magellan launches, be it an unlisted fund, an ETF or an LIC, people are interested. The new BetaShares Australian ETF A200 also made an appearance for the first time after storming on to the market with a rock bottom fee in 2018.

Funds iShares Asia 50 ETF, BetaShares NASDAQ 100 ETF, BetaShares Global Cybersecurity ETF fell from this years' list after being featured in 2018.

10 most popular ETFs

Source: Morningstar Direct, at 24 December 2019

For listed investment companies, Australia's largest closed-end fund – Australian Foundation Investment Company – featured as the most popular, followed by the Magellan Global Trust, Argo Ord and WAM Capital Ord.