Telstra gives off some comforting signals

Telstra’s update this week had some comforting news for investors, says Morningstar senior equity analyst Brian Han.

Mentioned: Telstra Group Ltd (TLS)

Telstra’s update this week had some comforting news for investors: earnings are on track; its market share is intact; and it has the edge on the rollout of 5G.

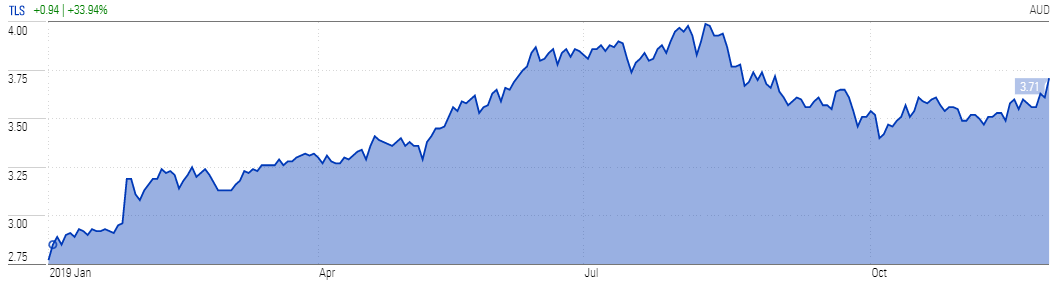

And then there’s the share price: it’s returned 37 per cent for the past year.

Morningstar senior equity analyst Brian Han says investors should be feeling good after Wednesday's investor day, describing the management's presentation "reassuring" and "welcome news" amid fluid developments in the industry.

First, he says Telstra's (ASX: TLS) reiteration of guidance for fiscal 2020 is "comforting". The company continues to expect underlying EBITDA to grow up to $500 million. Telstra is also making good progress on the $2.5 billion cost-out program, expected by fiscal 2022, with underlying fixed costs on track to be cut by $1.8 billion by fiscal 2020.

Han says this engenders confidence in Telstra's grip on industry dynamics and the impact of its simplified product suite.

"There has been no negative surprise to management's projections since the dark days of mid-2018, apart from minor tweaks due to changes in the NBN corporate plan," he says.

Stock Chart YTD | Telstra TLS

Second, Han is encouraged by management's commitment to simplification and the easing of competition among mobile players.

"Optus' aggressive discounting has eased, as has competitive intensity previously rampant in the prepaid market," he says.

"Telstra is maintaining its market share with its simplified plans, no excess data charges, more generous data allowances and the low-cost Belong brand having impact."

Third, Hans says good progress in the rollout of their 5G network will give Telstra a first-mover advantage in next-generation mobile, especially with Vodaphone hamstrung by its "legal wrangle over the proposed TPG Telcom merger".

It’s been a transformative year for the telecom industry. It has transitioned to a new fifth-generation network (5G) and navigated fierce competition, especially in mobile. The NBN also continues to reshape the industry, and regulatory risks remain a real threat.

Shares undervalued

Han has reiterated his $4.40 fair value estimate for Telstra. Late on Wednesday, Telstra was up 3.50 per cent, trading at a 13 per cent discount at $3.84, placing it squarely in the four-star (or Accumulate) range.

He says despite all positive signals stemming from Telstra, investors continue to baulk at the potential margin-crushing effect of the NBN.

This is why management is embarking on the T22 transformation project. Telstra2022, or T22, is a strategy aimed at simplifying customer experience and cutting costs.

"It is a painful and costly project, but it is designed to free Telstra from its legacy shackles in terms of technology platforms, cost structure and skillets/culture."

Morningstar's Han says Telstra is making good progress in the rollout of their 5G network.

Han also believes the easing of competitive pressures in mobile and potential cost benefits as the industry transitions to 5G are under appreciated relative to the risks posed by the NBN.

Telstra’s InfraCo subsidiary a little too fancy

Management again sought to justify the creation of InfraCo – Telstra's standalone infrastructure unit - saying it would give investors a clearer picture of its infrastructure plans. Telstra also insists the separation will also allow InfraCo to maximise the value of the assets.

InfraCo, first flagged by the company in June 2018, will oversee Telstra's fixed network infrastructure including data centres, non-mobile related domestic fibre, copper HFC, international subsea cables, exchanges, poles, ducts and pipes.

Han says while this all sounds "positive" and "sophisticated", that he sees things differently.

"We see the optionality that InfraCo brings, when the NBN is finally rolled out and looking to be privatised, as the key reason," he says.

"Until then, it appears to be creating complexity, ironically at a time when Telstra is trying to become simpler."

Dividend stable

Han is forecasting EBITDA of $9.4 billion, in line with management's projected range of $8.7 billion to 9.6 billion.

He believes Telstra's 16c dividend is sustainable, with the company's capital intensity reducing from 17 per cent in fiscal 2019 to less than 14 per cent in fiscal 2020 – or savings of about $1 billion.

"Telstra's 16c dividend per share is at least one investor concern we believe is easing," he says.