Experts warn retirees to plan for higher inflation

Countering the effects of inflation should be an important focus of retirement plans.

Financial advisers are recommending retirees adopt investments that protect against inflation as rising living costs put pressure on the budgets of Australians least able to counter the falling value of money.

Rising inflation hits retirees harder than younger investors because they lack the time and income streams to offset it. Retirees are less likely to have a wage or salary that rises with inflation. Nor do they have a long investment horizon to provide returns that could cushion the impact of inflation.

According to the Association of Superannuation Funds of Australia’s Retirement Standard (ASFA), prices rose 2.8% for those living ‘comfortably’ in a couple and by 3% for singles on a ‘budget’ over the year to September 2021. This represented the highest annual increases since 2010.

Scott Keeley, a senior financial adviser with Wakefield Partners, says this serves as a dangerous landscape for retirees. Countering the effects of inflation, whether it is transitory or remains persistent, should be an important focus of retirement plans, he says.

“While retirees and pre-retirees are not talking about inflation too much at the moment, there is no doubt we are needing to incorporate the prospects of long-term heightened inflation into our planning.

“For retirees, creating adequate income streams has always been the main priority. Eventual tightening of monetary policy should improve the income returns of defensive asset classes, but whether this will be enough to counter the rising cost of living will be topical over the short to medium term."

James Ridley, managing director of Atlas Wealth Management, says many pensioners who rely on the Age Pension have been cushioned from inflation by the government’s swift action in granting Covid-19 subsidies and supplements, so many haven’t felt the impacts of rising costs—yet.

“I expect we won’t see the impact of inflation until late next year, but it’s expected to be transitory," he says. "The natural cause and effect will result in more income drawdown out of account-based pension (ABPs) accounts to meet the rising cost in living.

“This might result in of account-based pensions depleting quicker over the coming years if inflation stays high. This would be a concern for government due to the current Age Pension system already being under significant stress by our aging population.

“Pensioners might seek to change their investment strategies within super to focus on key thematic trends, so they are on the reciprocal side of increasing inflation."

Inflation has returned after years of absence as pandemic restricted supply chains struggle to keep up with a surge in demand supported by government largesse. Economists are predicting today’s higher prices will persist for years as supply chains slowly untangle.

Inflation measures from the Australian Bureau of Statistics (ABS) show living costs for pensioners on Centrelink benefits rose 2.7% over the year to the September quarter while inflation for self-funded retirees rose 2.9%. High fuel costs pushed up inflation, along with an increase in property rates, which posted the largest rise since 2016, according to the ABS.

Assets that have historically performed well through periods of higher-than-average inflation include gold, real estate investment trusts (REITs) and stocks or exchange traded funds (ETFs) linked to commodities such as oil and iron ore, according to Ridley.

“Stocks such as utilities, telecoms, and companies with strong balance sheet and free cashflows also tend to do well,” he says.

A different mix of defensive assets is required in an inflationary environment, says Jamie Nemtsas, partner at Wattle Partners. He has been recommending clients reduce exposure to bonds as the prospect of higher interest rates erodes their value. Instead, he says investors should increase their allocation to alternatives such as property and infrastructure assets where income is indexed to the inflation rate.

Nemtsas suggests reducing exposure to growth stocks which tend to underperform when inflation is rising.

“Inflation rising to 3 per cent isn’t of a concern, even if it was to rise higher for a period of time, the problem comes when inflation is high and stays high. In the context of an economy, the more worrying inflation is when it is due to demand exceeding supply, rather than the supply chain issues were are seeing today.

“Any prudent retirement plan should have the client’s portfolio holding sufficient cash for three to five years of retirement income and have material allocations to the right inflation hedged investments."

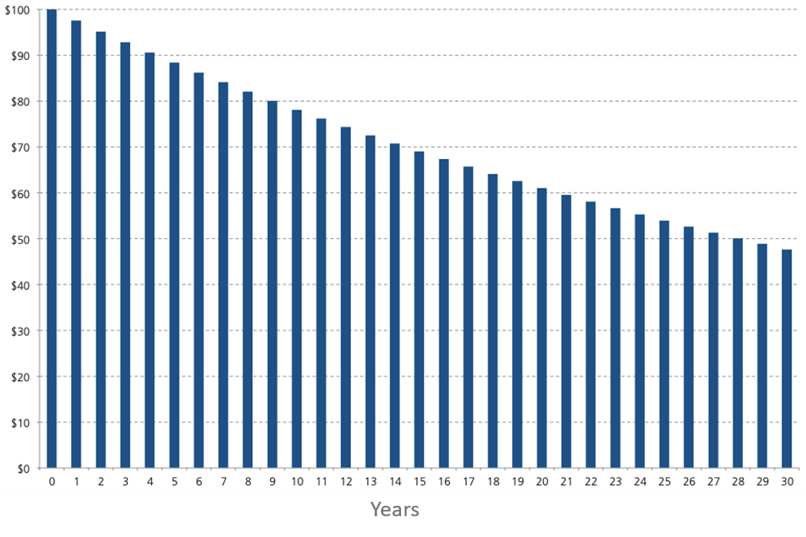

According to Challenger Investments, even low rates of inflation can have a large impact on your purchasing power. For example, if inflation averages 2.5% per annum, then after 15 years, 31 per cent of the real value of each dollar of retirement savings has been lost. After 28 years, half of the real value of their money has gone.

The falling value of $100 over a 30-year period at an inflation rate of 2.5%

Source: Challenger Investments

For future generations, ASFA’s Deputy CEO, Glen McCrea says that moving Australia to the 12 per cent Superannuation Guarantee (SG) is an important step towards ensuring savers can meet the financial challenges of retirement and rising costs.