The evolution of investing for income

With yields at historic lows, older investors are being forced to look beyond traditional sources of income.

As a financial journalist, I love a good time series chart, but stories can serve as a window into the past. And this week, my trip into the archives to re-watch of classic TV mob drama 'The Sopranos' helped me reflect on just how much investing has changed.

In an episode set in the early-2000s, Carmela Soprano, the bejewelled wife of New Jersey-based Italian-American mobster Tony Soprano, begs her husband to think about their family's financial future. It's not an unreasonable request for someone married to an overweight 43-year-old who is permanently in danger of getting “whacked”. Most of his cash is hidden in sacks of birdseed (not recommend in an inflationary environment).

And how is Carm going to set her family up? Stocks? No, they're for those "high up in the corporate structure" with "Enron-type connections", Tony says. She wants bonds—US Treasury bonds.

"I want it in something safe, something old-economy, maybe Treasuries," she tells an adviser.

Putting aside the fact that their assets were ill-gotten gains, liable to be seized by the government, Carmella's plan wasn't bad. At the time, a 10-year US government note was yielding around 5%. Yes, she would have been better off in an S&P 500 index fund, which has returned 6.8% annualised since 2001, but if her primary concern was safety, bonds were a perfectly good option.

Fast forward 20 years and mob wives are in a different position. Since 2008, the Reserve Bank of Australia's (RBA) cash rate has primarily gone in one direction—down. And as rates fall, bond yields compress, dropping below 1% for the first time in 2019. The cash rate is today at 0.1% and the RBA has indicated that an increase is unlikely until 2024 in an effort to stoke the economy.

Traditional sources of income are in decline

Source: www.spglobal.com, Morningstar

What does this mean for Australian income investors? It has led many to claim that 'there is no alternative' to equities as a source of yields, Morningstar senior equity strategist Gareth James wrote in a special income investing report this week. And why equities? Australian dividend payout ratios are relatively high thanks to our dividend imputation system.

"The dividend imputation system encourages Australian companies to return capital to shareholders via dividends and leads to relatively high payout ratios," he says. "It also reduces the appeal of directing capital to other potential uses, such as reinvestments in the business, growth by acquisitions, or on-market share buybacks."

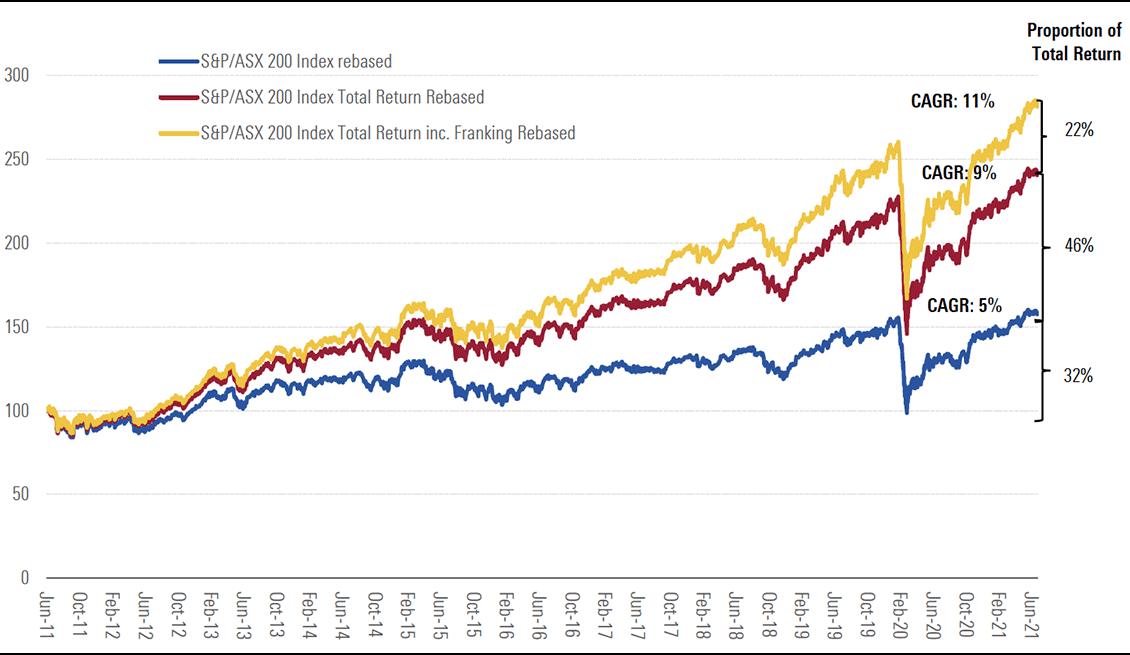

For Australian taxpayers, franking credits have increased the income received from shares. Not only have they allowed investors to reduce their personal tax liability but, since 2002, excess franking credits are also refundable, meaning taxpayers with a low or zero marginal tax rate can generate additional gross income. This effectively boosts the dividend cash flows to those shareholders, and in turn the intrinsic value of those shares. James shows how dividends and franking credits comprised around 70% of the total return of the S&P/ASX 200 Index over the past decade.

Franking credits increase the long-term total return of Australian taxpayers

Source: www.spglobal.com, Morningstar

Ditching bonds, term deposits and cash for higher-yielding stocks is understandable in this context but it comes with risks. As James points out, the Australian equity market is highly concentrated across financial and resources stocks. An Australian equity income investor's portfolio may be highly correlated and less diversified than a global portfolio, loaded up with resources companies and arguably exposed to increasing ESG-risks and volatile earnings. The price of iron ore has fallen about 30% since its May peak, although our major miners are still in good shape.

Pursuing income also forces investors to not just consider payouts but also price. "Income investing is about more than simply buying companies with high short-term dividend yields, which could signal future earnings and dividend weakness rather than relatively high returns -- a situation known as a yield trap," James says.

And as we saw in 2019, income investors are exposed to regulatory risk. While a repeat of Labor’s franking credit debacle is unlikely for now, it can’t be discounted forever.

Income investors must also accept that dividends are not ‘guaranteed’ like on a bond or bank deposit interest. Amid the covid-crash, many companies suspended or cut their dividends to protect their balance sheets—there was no promise of a coupon payment (as there is on bonds). And if an income investor panic-sold at the first signs of the global equities cash in March-2020, they missed out on one of the fastest stock market rallies in history. In this scenario, I'd have advised a 60-year-old Carmella to "buy the dip" (and I'm not talking about pesto).

Where do income investors turn to in this environment without taking on unacceptable levels of risk? There is nowhere to hide, nor easy answers, but in his report, James outlines 10 franked income stock ideas. The shortlist is based not only on the short-term dividend yield, but also on the gross yield including franking credits and other indicators of dividend sustainability, such as Morningstar's Economic Moat rating.

A difficult path is ahead. As Morningstar's Peter Warnes wrote in his FY2021 forecast, the surge in equity markets has more to do with accommodative monetary and fiscal policies than earnings growth. Carmela’s Treasuries were more dangerous because the Feds might raid them. Today’s income investors are riding high but a bear market is always lurking.

******

In Your Money Weekly, Peter Warnes asks: With the three eastern states locked down recently, could Australia experience a double-dip recession? " The Reserve Bank (RBA) expects a contraction in the September quarter and has cut its 2021 GDP growth forecast from 4.75% to 4%, but the knife may have to be sharpened," he writes. He also notes the strong start to August reporting season with results from CBA, Suncorp and ResMed, and advises that next will deliver a greater cross-section of companies, providing the market and investors with a better reading.

In Firstlinks, Graham Hand gawks at the valuations placed on several Australian tech-startups including Afterpay—valued at $39 billion—and Canva—worth $15 billion. " When future cash flow potential is discounted by tiny interest rates, numbers head to infinity," he writes. "There is so much money sloshing around that investors park US$1 trillion in spare cash in the US Federal Reserve every night earning zero."

Hand has also released the results from Firstlinks' Retirement Income Survey. Thank you to the 1,200 of you that heeded the call. The results are now on their way to the Treasury Department.

On the topic of retirement, researcher Amy Arnott walks us through how to manage sequencing risk in retirement—an underappreciated danger of investing. It pays to mitigate the risk with flexible withdrawal rates and keeping some cash on the side, she writes.

Amid the dire news on climate change, some green shoots—new research from Morningstar shows Australia's sustainable funds industry is growing at a "blistering pace". Analyst Christopher Franz estimates that retail assets invested in sustainable funds topped $33.420 billion at the end of the second quarter of 2021, an 18% increase compared with 31 March 2021 and a 66% increase compared with 30 June 2020. And investors have been rewarded with just over half of funds outperforming their peers.

A good yarn from our Hong Kong reporter Kate Lin—Chinese "citizens of the net" (netizens), looking for someone to blame for national team losses at the 2020 Tokyo Olympics, pointed to the Adidas (ADS) logo on the uniform of the women's volleyball. They claimed the logo was the cause of the team's losing stream and that most medallists wore Chinese brands. Subsequently, sales volumes at domestic brand ANTA Sports Products have doubled.

And finally, catch up on the biggest earnings announcements this week with Prashant Mehra.

More from Morningstar