'Markets aren’t pricing in mutation risk': Douglass

The veteran stock picker sees no shortage of risks including that covid-19 mutations could render current vaccines ineffective.

There was one major caveat in Peter Warnes' 2021-22 market forecast:

"…in the absence of a significant escalation in the spread of Delta or a serious outbreak of another coronavirus variant."

The spread of the Delta variant from Australia's most populous city to other states hasn't worried the equity market so far, but anyone watching the NSW chief health officer on Friday morning declare a 'national emergency' saw the economic and social impacts of this highly transmissible strain.

While the US was applauded for the pace of its vaccine rollout, new infections have more than doubled in the past month and the vaccination rate has slowed. Supply certainly isn't a problem.

Closer to home, Malaysia is an indefinite lockdown are case numbers surge. Even Vietnam and Singapore, lauded for their initial handling of the pandemic, are now seeing significant outbreaks of Delta. The Aussie dollar has sold-off, and concerns are rising in bond markets, resulting in falling yields.

One person worried is Magellan's Hamish Douglass, describing the hard lockdowns in Sydney and Melbourne as a "wake-up call". Asked whether he believes an investment day of reckoning is around the corner; Douglass said things could go either way but that the risks of a material market correction are "hiding in plain sight".

"We are not over [the virus]," he told shareholders at a digital event on Tuesday. "We were all going to the football and the pub. We all thought this was over.

"The risk is we get an escaped mutant from this virus, one that evades the vaccines. We've seen so many mutations happening this Delta one's frightening and the speed it can spread.

"The vaccines still seem to be effective against death, but that might not always be the case."

It's not just developed markets at risk but emerging, Douglass says.

"They're particularly vulnerable with what's going on in the pandemic and we could really see a market correction."

Markets aren’t pricing in mutation risk because of the recorded effectiveness of the vaccine against death, Douglass adds. But he says the risks are real and foreseeable.

"I'm not saying it's gonna happen. Actually I've no idea where it's going to happen, but the probabilities of [an escaped mutation] happening are increasing by the day."

Another risk playing on his mind - the big 'I' word: Inflation. Douglass is squarely in the transitory camp, believing that monetary policy is likely to be tightened gradually and that sky-high prices for used cars and timber are driven by blockages in supply chains. However, he acknowledged that if there was sustained inflation, there could be a 'U-turn' in monetary policy, particularly in the United States.

"If that was to happen in the next 12 months or so, all bets are off for the currencies that have high equity markets," he says. "We will see higher interest rates and a recession".

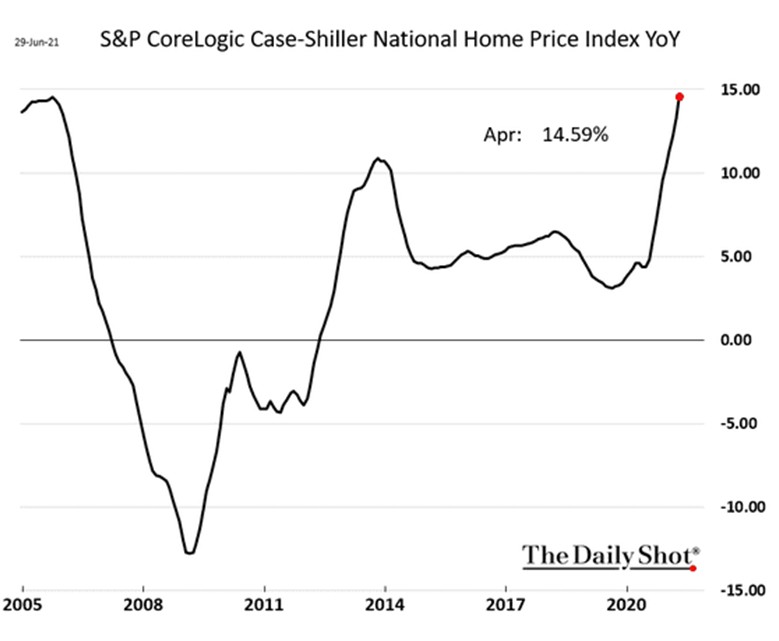

Douglass' biggest concern is the increasing cost of shelter - housing and rent - globally which he acknowledges are a material part of inflation statistics. "We're watching that component incredible closely at the moment".

Toil and trouble

The top of a market cycle brings asset bubbles and Douglass sees them all over the place, including the resurgence of speculative grade credit or junk bonds. Corporations have taken advantage of low interest rates to lever up, pulling down their credit ratings in the process. These same low rates have driven investors to this high-risk credit in search for yield.

"These assets are at an enormous scale," Douglass says. "They're across the financial system, they're very widely held and if we see inflation and the central banks force the world into a recession, there would be a lot of consequences in these asset classes."

The other asset in bubble territory is Bitcoin. Douglass described the cryptocurrency as "one of the greatest mass delusions in modern history", noting the cult-like following it had gathered around the world.

"I have to say it is one of the greatest irrationalities that I've seen in a very very long period," he says. "The scale that is behind it - there are millions and millions of people participating.

"There will be many people who disagree because people in a cult don't like someone pointing out the Emperor may have no clothes. I think it's inevitable that it’ll crash to zero."

If these bubbles do burst, Douglass is fearful of the follow-on effect to investor confidence – a "contagion effect".

NSW officials say it is unlikely Sydney's lockdown will end on July 30.

It's hard to know what to make of all this. Warnings of market corrections have been around for years, but they seem to be louder and more prominent. Investors have been getting drunk on wave after wave of government stimulus, sending markets to all-time highs and valuing loss making companies in the billions, but it's hard to deny the warning signs on the horizon. It was bizarre hearing the words "meme stocks" come out of the mouth of one of Australia's most successful investors, but a reminder of just how much the world has changed in a year.

Douglass's advice for investors: this isn't the time to get overconfident.

"Are we about to have a material market correction? The answer if I'm very honest with you is, I don't know. It's just really hard to judge what's going to happen there. You could bet in either direction," he says.

"You have to have a very balanced approach here knowing that the markets could continue to be strong, but there's major risk out there. I think you want to be somewhat conservative here if some of the downside events happen."

Magellan Global's portfolio is deliberately weighted towards defensive assets for risk management. By Douglass' own admission, this is what caused them to miss the cyclical November rally. He remains confident in his current investment approach and the companies in the global portfolio.

Big ESG

Doomsday fears aside, Douglass gave investors a clear view of where he stands on ESG - environmental, social and governance. There are several major utility companies in the Magellan Global portfolio that are the subject of some investor concern. Douglass is of the belief that investors should make changes from within the company – not employ negative screens. He argues that the companies in his portfolio have clear plans to take the coal-fired generation out of their businesses and the best thing he can do is to support those efforts.

"We could just try and pass the buck to somebody else and take it out of our portfolio and make us look like the lowest carbon portfolio you can imagine and market just how low carbon we are," he says.

"We actually think that the world will be better by investors providing the capital to the businesses that are investing in the future."

On ESG, Australia's largest company is changing in front of our eyes. First a report from Bloomberg claiming that BHP is mulling an exit from its $15 billion oil and gas assets on Tuesday. Then came the announcement of a deal with US electric car maker Tesla to supply nickel from Western Australia for batteries. While the undisclosed value of the deal was not high enough to be published to the ASX, investors did not care. The announcement helped BHP shares close higher by 3.13 per cent to $51.45 on Thursday, just shy of the record price ($51.91).

One hundred and thirty years after breaking ground in Broken Hill, BHP is reaching into Silicon Valley.

******

In this weeks' Your Money Weekly ($), Peter Warnes notes the return of volatility to global financial markets with a surge in Delta variant cases on one side and a “buy the dip” mentality on the other.

"Talk of central bank tapering has been pushed aside as fear of further lockdowns and restrictions threatens to derail the global economic recovery," he says.

"Excess liquidity and “There Is No Alternative” (TINA) are supportive of “buy the dip” but ignore the wafer-thin margin of safety being accepted in most instances. I can smell the scent of a false sense of security."

Graham Hand revisits the 'super wars' in Firstlinks. He says industry infighting disguises the great Australian success story in delivering retirement savings for the majority. "This lack of appreciation for superannuation probably contributed to three million people withdrawing $38 billion under the COVID early release scheme," he writes.

I took it upon myself this week to explore the relationship between ETFs and the Australian taxation system, and why investors were hit with mammoth distributions on June 30. It's a reminder that as investors, we never stop learning.

When I purchased my first (and only) apartment, I gained the benefit of leveraging – namely I borrowed and invested considerably more than I had in the kitty. Lewis Jackson explores how NAB's Equity Builder program is allowing equity investors to do the same, and the risks involved.

On the subject of risk, micro-caps got a lot of airtime around the MarketLit conference. In this article, I detail the allure and risk in this under-researched end of the market.

Amy Arnott has delivered part two of her deep dive into Ethereum – or Ether. She looks at the role cryptocurrency can play in an investment portfolio.

More from Morningstar:

SMSF trustees spurred into action post-covid: Charts of the week

A big thanks to everyone who has already sent in their recommendations ahead of the Morningstar Individual Investor Conference. There's still time to have your voice heard. As a watcher of the ABC's excellent Ms Represented docuseries this week, it would be fantastic to hear some suggestions from our female investor community. Who would you like to hear from, and what are the topics most important to you? Let us know.

Stay safe, stay well. Stay the F*** At Home. Get Vaxxed Baby.