Firstlinks Edition 492

The good and bad in my SMSF in '22; Chris Joye on '23; Ageing nonsense, LIC discounts; Pub property profit; Year for bonds; 3 new investment themes.

Back on the tools after a sabbatical, the new year feels more than usual like a time to stocktake and check the goals for an investment portfolio, especially since I turned 65 a few weeks ago. Nobody hands out a card that profiles the future, and everybody needs to plan their own investments based on their life, their resources, their desires, their objectives.

Although every financial newsletter shares the tea leaf reading of market experts at the start of the year, here's how legendary US fund manager Peter Lynch colourfully describes these efforts:

" ... they can't predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack."

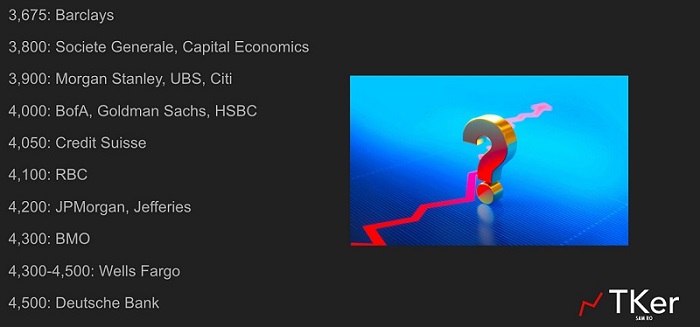

The most important risks are the ones few people anticipate, and if you could predict them accurately, they would no longer be risks as counter action would be taken. This is a time when US Fed Chairman, Jerome Powell, has made it clear that rate rises will not stop until inflation is under control. But flip a coin on where the market is going. The S&P500 is currently about 4,000, and the range of 2023 targets below varies from 3,675 to 4,500. Up, down and flat pretty much covers it.

Wall Street’s 2023 S&P 500 Targets (as of Dec. 4, 2022)

The dubious value of this pontificating was emphasised to me over the holiday during a regular quarterly lunch with four chaps I have known for decades. We call ourselves the 4Gs - Graham, Geoff, George and Gordon - and we each had long careers in different parts of the financial markets, from actuary to financial adviser to markets to legal SMSF specialist. And while three of the Gs discuss investing and markets, the actuary sits there sipping his beer and smiling at his lamb shoulder.

In the 40 years I have known Geoff, he has been admirably consistent in his investing technique. His portfolio mainly holds shares, directly and through funds, and he cares only about the rising dividends while he worries little if at all about the market value (much like the Peter Thornhill's view). So while the other three genius Gs solve the economic woes of the world to no practical effect, he collects his dividends confident he has 'enough'.

There's a word we don't hear much in financial markets: 'enough'. I read a lot during my break, including a fascinating small book by Jack Bogle, founder of indexing and Vanguard, called "Enough: True Measures of Money, Business and Life". What sets Bogle apart from dozens of the famous global wealth icons who became billionaires is that he felt the financial system subtracts value from our society and he should only take enough for his needs and goals. He quotes many examples of the 'Heads I win, tails you lose' by businesses in funds management.

"What I'm ultimately looking for is an industry that is focused on stewardship - the prudent handling of other people's money solely in the interests of investors ... and values rooted in the proven principles of long-term investing and of trusteeship that demands integrity in serving our clients."

How much is enough for Jack Bogle? He founded the second-largest fund manager in the world, and could easily have amassed billions. He says:

"Let me open up my confession about what is enough for me by saying that, in my now 57-year career [the book was published in 2009 and Bogle died in 2019], I've been lucky to earn enough - actually more than enough - to assure my wife's future wellbeing; to leave some resources behind for my six children (as it is sometimes said, 'enough so that they can do anything they want but not enough that they can do nothing'); to leave a mite to each of my 12 grandchildren; and ultimately to add a nice extra amount to the modest-sized foundation that I created years ago."

He says that for 20 years, he has given away one-half of his annual income to various philanthropic causes, but he feels he has done well because of three reasons:

1. He was born and raised to save rather than spend (his Scottish thrift genes).

2. He has been blessed with a 'fabulous' defined benefit plan into which he has invested 15% of his salary over his entire career and in retirement.

3. He has invested wisely, avoiding speculation and focussing only on (you guessed it) conservatively-invested, low cost mutual funds.

And like my mate Geoff, he tries not to watch the balance of his fund.

He says enough should be $1 more than anyone needs, and saving is the key to wealth accumulation.

When I sat down in recent weeks to review my SMSF's investments for 2022 and position the portfolio for the future, there is a focus on 'enough' and protecting the capital in the fund rather than swinging for the fence. I describe some of my investment decisions in the hope there may be ideas there for you.

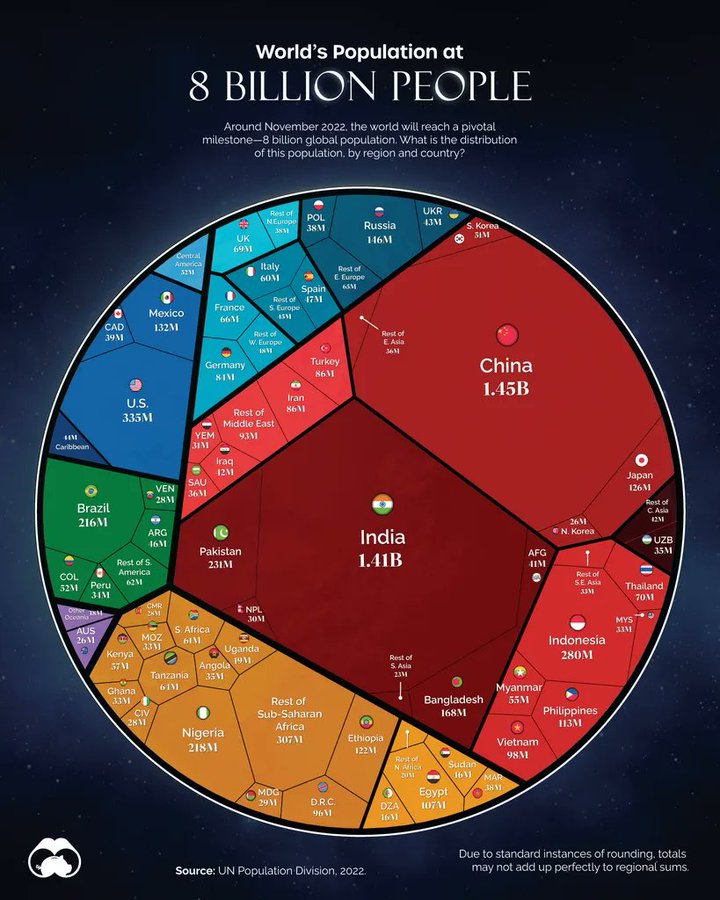

Finally, the best chart I saw in the last few months acknowledged the major milestone of global population passing 8 billion, with Australia represented by that tiny purple triangle on the left. We love to think we punch above our weight.

Many thanks to James and Leisa for producing such good newsletters in my absence. James will continue to edit Firstlinks content and write for both Morningstar and Firstlinks, while Leisa holds the whole show together.

Graham Hand

Also in this week's edition ...

Chris Joye of Coolabah Capital Investments is the bearer of bad news for those who think stocks and residential property will bounce back this year. He says both have further to drop and even when interest rates start to fall, they're only likely to deliver returns in line with wage growth in the medium term. He is bullish on one asset class though: fixed income.

And he's not alone as Tim Larkworthy is also positive on bonds. He makes the interesting case that central bank efforts to tame inflation will depend on their ability to rein in the behaviour of consumers, who've been happy to spend despite rapid rate rises. Until this behaviour changes, the central banks are unlikely to cut rates.

Cameron Murray is frustrated by fearmongering from politicians and the media about Australia’s ageing population. He says it's fine for them to make the argument for more immigration, but they shouldn't pretend that the age structure of the population is the reason why.

When investors think about commercial property, they often focus on office, industrial and retail, but specialised sub-segments are starting to get more attention. Student housing, healthcare, life sciences and the like. And Stuart Cartledge takes a look at another potentially lucrative, niche segment: pubs.

Meanwhile, Magellan addresses the elephant in the room when it comes to LICs: their tendency to trade at discounts to asset values. Magellan explains what it's trying to do about it, as well as addressing the underperformance of its Global Fund last year.

Richard Bernstein notes the sectors that led the last bull market are unlikely to lead the next one. He says investors looking at US tech and meme stocks to bounce back will be disappointed. Instead, they should be eyeing new sectors emerging as market leaders, such as energy and infrastructure.

The sponsor white paper featured this week is VanEck's Portfolio Compass on Australian Equities in 2023. As in Graham's article, it recognises that Australian equity investors had a reasonable year and not the setback many analysts describe.

Curated by James Gruber and Leisa Bell