Cost-of-living relief contradicts RBA desire to control spending: Firstlinks Newsletter

Will the next budget bring a cash splash for households?

The 2022 calendar year will include two Federal Budgets, and despite a gap of only seven months, they are framed against different backgrounds. Josh Frydenberg delivered his fourth Budget on 29 March and Jim Chalmers will deliver his first on 25 October. With an eye to the election which took place on 21 May, Frydenberg focussed on short-term cost-of-living relief rather than addressing the structural deficit. He cut the fuel excise for six months, increased the low and middle-income tax offset (LMITO) and extended the 50% reduction in super pension drawdowns.

But at the same time that the goodies helped personal bank accounts, the Reserve Bank finally and belatedly realised Australia had a serious inflation problem and started increasing the cash rate on 4 May. So here was monetary policy acting to curtail spending while fiscal policy provided more stimulus. It was a policy confusion that Jim Chalmers should not repeat as it may force Governor Philip Lowe to go even harder. Chalmers said last week that no new cost-of-living relief should be expected although previous commitments would be honoured:

“The Budget is about six or seven weeks away, but we have made it very clear to people that our priority is to implement the cost-of-living relief that we have announced. That will be in areas like childcare, medicines, TAFE fees, the cost of electric vehicles and also we want to get wages moving in this economy again. The Budget will be about a few things. It will firstly be about how do we provide some cost-of-living relief in a responsible way that doesn’t add to the pressure on the Reserve Bank.”

What is your opinion on some of the major decisions facing the new Government? At some point, Australia needs to decide how to raise the revenue necessary to pay for the services we have come to expect, and maybe repay some debt. In our Reader Survey this week, we ask for your views on the Stage 3 tax cuts, mining super profits, cost-of-living relief, the timing of child care subsidies and inflationary expectations, with a brief explanation of each issue. We will send the results to Treasury as input to their Budget (yes, we know, the impact will be minimal).

The Stage 3 tax cuts will not feature in the next Budget because they are already legislated. As Assistant Minister to the Prime Minister, Patrick Gorman, said last week:

"The decision has been made, it’s been taken to the election. Indeed, these tax cuts have been to two elections. This basically has been legislated.”

It's not likely to be so easy, politically or economically. The implementation date is still two years away, on 1 July 2024, and the Government justifies them as an election commitment rather than an economic imperative. It gives opponents a target for two years, especially when a Parliamentary Budget Office (PBO) analysis shows the richest 1% of Australians will receive as much in tax savings as the poorest 65% combined. While those earning less than $45,000 do not benefit, there are plenty of so-called working class occupations which earn far more than $45,000 a year, the lower tier of the cuts.

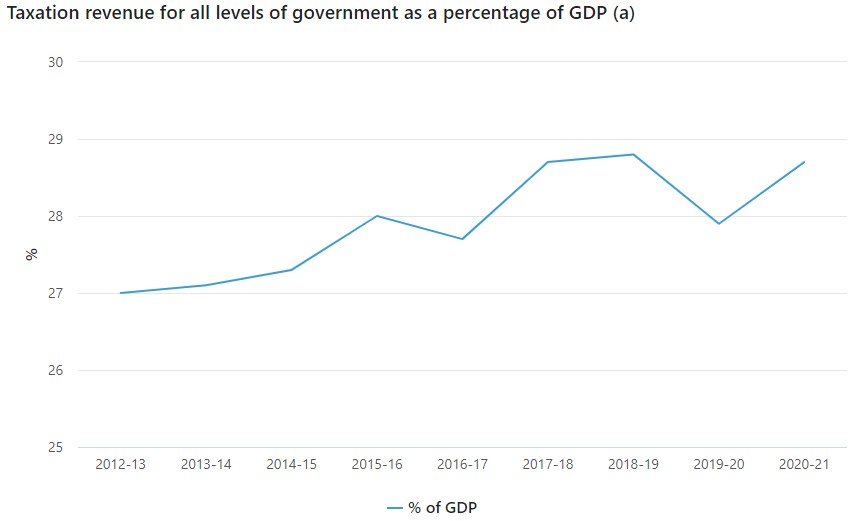

At the same time, the latest ABS data shows taxation revenue as a % of GDP continues to grow, and taxes can be disincentives to save, earn and spend. But we need to pay for increasing health costs, NDIS, education, defence, social security, all under a Labor Government. This debate has a long way to play out, so please give us your input. The PBO said:

"Studies indicate that some people would choose to work more in response to a lower marginal tax rate, while others would work less. There is considerable uncertainty regarding the direction, magnitude and timing of these effects on labour supply."

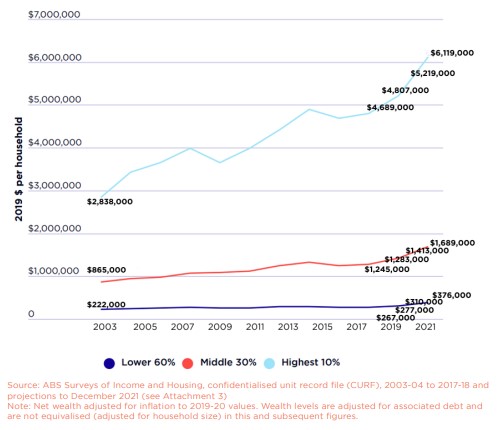

Australia is following the wealth trends that we often associate with the US, with research by the University of NSW and ACOSS released in July 2022 shows that Australians are now the fourth richest people in the world on average but with increasingly unequal distribution. About 69% of the increase in household wealth during the pandemic was in residential property.

“Once again, this report reminds us that wealth in Australia is distributed very unevenly. We have over 130 billionaires in this country and last year their wealth grew, on average, by $395 million or 12%. It means they now hold almost as much wealth as the 2.8 million households in the lowest 30 per cent of the population.”

Average wealth by wealth groupings in Australia

On Tuesday night in the US, the higher-than-expected inflation rate hit stock markets hard, sweeping away the optimism that inflation may have peaked. Large falls of 10% in the price of gasoline gave the market hope for a lower CPI but 'core inflation' rose 0.6% over the month, twice the rate expected, increasing the annual rate to 6.3% from 5.9% last month. The US Fed will have little choice but to cool the market further with at least 0.75% next week with the market giving a 30% chance of 1%. On Tuesday in the US, the S&P500 lost 4.3% and NASDAQ 5.2%.

This tweet from the Financial Times shows once again the perils of predicting in this market. The FT quickly went from its morning news that "Economists expect consumer prices to have moderated again in August" to "US stocks drop after hotter than expected inflation reading." Thanks for the advice.

In this week's edition ...

At a time of rapid change and policy challenges, please take our Reader Survey, and add any other national policy issues which are at the forefront of your mind. Following some further questions from readers on whether inflation will eat away at the value of household debt and is therefore good for home borrowers, we reached out to more economists for an opinion.

In her continuing series on SMSFs, Meg Heffron responds to a previous article on why a young person is waiting for higher balances before establishing her SMSF. Meg moved earlier (before she started working in the SMSF industry) to establish hers and she explains the reasons.

Last financial year threw up a wide range of performance results from our large superannuation funds, amid a controversy in the way some unlisted assets were revalued. David Carruthers at Frontier dissects the numbers to find whether fund size, type of assets or level of risk drove the results.

As more investors are tempted by the better yields on offer from bonds, it's important to check the default rates at various levels of borrower quality. Matthew Macreadie of IAM Capital Markets takes us through the latest Standard and Poor's default data.

Dan Kemp of Morningstar says he is often asked to justify his decisions as Chief Investment Officer, but facing the most important question ever put to him, he explains his priorities.

Professor Kevin Davis has been involved in much of the debate about superannuation policies, including as a member of the Financial Systems Inquiry. He looks into the funding mismatches in banking and super funds and makes the case for long-term investing with retirement savings.

Finally, next Wednesday is the 21st night of September. So what? Well, apropos of nothing to do with investing, 'September' by Earth Wind & Fire is one of the greatest dance songs of all time, released in 1978. Next Wednesday, just before dinner goes on the table, turn up the sound system and sing along. This official video has been viewed over 600 million times so you won't be alone.

Do you remember

The 21st night of September?

Love was changin' the minds of pretenders

While chasin' the clouds away

Our hearts were ringin'

In the key that our souls were singin'

As we danced in the night, remember

How the stars stole the night away, oh, yeah ...