What a difference three years makes: Firstlinks newsletter

5% bond yields; SMSF planning; Arian Neiron interview; Even God's portfolio falls; Volatility truths; Hybrids and credit; Longevity strategy.

Before the last Federal election, the Firstlinks pages were filled with policy discussions and articles generating hundreds of comments. Labor ran a large target agenda including negative gearing, capital gains tax, family trusts and franking credits. The Labor Shadow Treasurer, Chris Bowen, was so confident of election success that he responded to a question on ABC Radio on franking credits in a way he would live to regret:

"I say to your listeners, if they feel very strongly about this, if they feel that this is something which should impact on their vote, they are of course perfectly entitled to vote against us."

Any new policy has its losers who are easy to whip up into a frantic opposition. Labor policies were badged as 'retiree taxes' and 'death taxes' with fears they would destroy property values. Elections are more marketing that substance and messages on repeat, repeat, repeat. The days when governments worried about raising revenues to meet spending objectives are gone with structural deficits now stretching on forever.

Anthony Albanese would be in a lot better position today if one of his advisers had tucked this Reserve Bank graphic into his shirt pocket on Day One of the campaign.

Who can blame Labor for now avoiding controversy, supporting the handout Budget and keeping their heads down after nine years in opposition? We get what we deserve and voters don't reward policy bravery. This painful campaigning period until 21 May will be dominated by character assassinations and more handouts rather than meaningful policies, and it's hard to see how such politicking does not lead to more division.

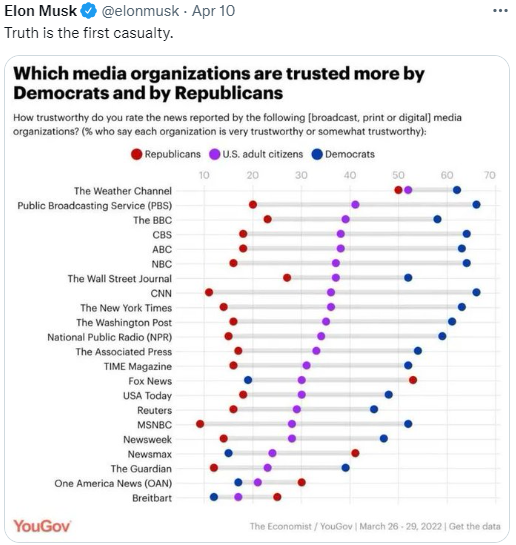

With unlimited sources of news, we all choose our favourites, and with that comes confirmation bias. We filter out information inconsistent with our beliefs. If you watch ABC current affairs, read The Guardian and Sydney Morning Herald/The Age, subscribe to Crikey or Michael West Media, then you may think Labor is certain to win the election (at least before Albo forgot a couple of key statistics). But spend a day listening Ray Hadley on Radio 2GB, watching Sky News at night or reading The Daily Telegraph and you'll see how the other half thinks. Our carefully-chosen social media feeds and friends make it worse.

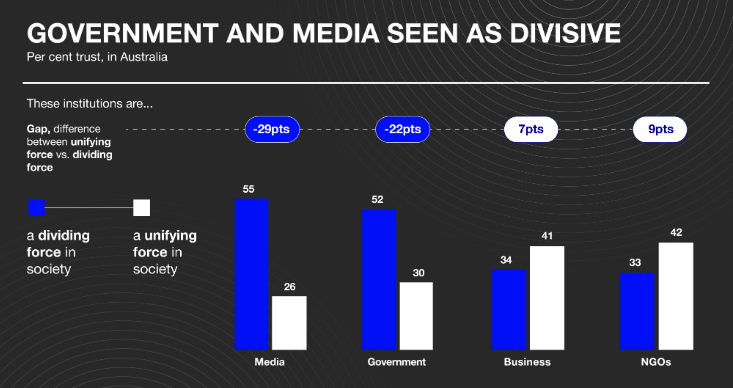

Each year for Australia, Edelman publishes a Trust Index, which this year shows most Australians see media (55%) and government (52%) as divisive rather than a unifying force. It's wishful thinking to believe there is momentum in the other direction.

In the US, the divide between Democrats and Republicans in trust of media organisations is staggering. It's reached the point where people need to know the politics of their countrymen and what they watch before they can have a decent conversation. Is Australia heading this way, or are we already there?

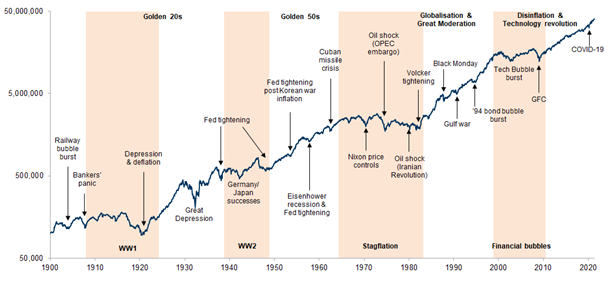

Back to investing, the impending rise in cash rates has already fed into longer-term rates, challenging portfolio construction techniques in a way we have not seen for a decade or more. The traditional 60% growth / 40% defensive portfolio has become a standard asset allocation and has paid off well since the GFC. However, as Goldman Sachs research below shows using US data, there are periods since 1900 when 60/40 in real terms delivered poor returns, shown in orange shading. The good times usually end after a strong run for equities and high valuations relative to history.

Real total returns of 60% equities/40% growth portfolio in the US 1900

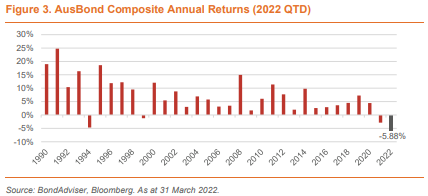

In recent years, investors who rely on the cash flow from their investments for income to live on were forced to take on more risk in equities or be satisfied with 1% on term deposits and draw down their capital. Now that's changing, and a quality bond portfolio can deliver around 5% with careful credit selection or via a bond fund. But rising rates hit fixed income portfolios that are revalued, such as bond funds, with the AusBond Composite Bond Index returning its worse loss for at least 30 years in the first quarter of 2022, and the first loss of any amount since the turn of the century.

The Roy Keenan article makes a case for floating rate exposure during rising rates, while the White Paper from IAM explains more about the 5% opportunity and shows how to judge the price risk due to a 1% rise in rates on a range of fixed rate investments.

Graham Hand

Also in this week's edition ...

Arian Neiron founded VanEck in Australia nearly 10 years ago, and has since introduced 30 ETFs to their suite, ranging from broad market indexes to themes and sectors. What makes the range different is a background forged in active management, but how does he select funds, which are his favourites and which does he expect to do well in 2022?

An investor named Wesley Gray created what he called ‘God’s portfolio’ which invested exclusively in the top decile of stocks based on their performance over five years. Over the 90-year investment horizon, God’s portfolio compounded at more than 29% per year yet endured the pain of drawdowns that exceeded 20% on ten different occasions. Chris Demasi writes that this is a reminder while sell-offs and drawdowns are difficult experiences, a long-term view is a critical component of being a successful investor.

Andrew Mitchell also explores market volatility by looking back at history and highlighting the journey investors should expect when investing in the share market through the seven laws of volatility.

Against a backdrop of economic and geopolitical uncertainty, rising inflation and expectations of a rate hike, Australian investors are searching for investments that can benefit from these evolving market conditions. Roy Keenan makes the case for floating rates and that hybrids are just such an investment.

There were many questions and comments on Meg Heffron's last article on future-proofing your SMSF, so this week she covers how to manage some trickier situations.

David Williams has been developing the concept of a National Longevity Strategy, and he shares his thoughts here.

We will be taking a break next week for Easter and the next edition will be published on 28 April. Hope everyone has a great Easter break!