Australia remains the lucky country - for now: Firstlinks newsletter

How 'active' is your fund manager? Commodities boom-bust cycles; Aged care and pension; Budget's 'bad' debt; Taiwan's prospects; Hybrids vs bonds.

Whether it's 'The future ain't what it used to be' or 'It's tough to make predictions, especially about the future' or 'It ain't over 'til it's over', these and many other gems are attributed to Yogi Berra, a great US Hall of Fame baseball catcher. Yogi tried to explain, "I never said most of the things I said" and that the quotes were made up by 'newspapermen' (these days, we would blame the 'media') but nevertheless, we love to use them.

But there's one Yogi-ism that does not have much applicability in financial markets at the moment: 'It's like deja vu all over again.' (deja vu translation: 'already seen'). There's a lot we have not seen for a long time.

The cash rate in Australia has never been lower, but it will start to rise after the May election. Globally, negative bond rates made up 30% of global bond indexes in 2021 but it's now down to 5% as decades of falling rates are over. The US Treasury 2-year versus 10-year yields spread is at its most deeply-inverted for 15 years. Governments around the world have never bought so many securities but that is also ending. Commodity prices such as for coal are at 20-year highs, while lithium is at record levels. The war in Ukraine threatens global peace and nuclear attacks more than any time since World War 2.

Where once we saw a future of smaller governments, now we face a more intrusive and bigger public sector. Most people in the world now live in an autocracy, while Donald Trump is the bookies' favourite to win back the Presidency in 2024 and who knows how divided and aggressive the US will become. Putin in one corner, Trump in another ... oh, dear!

Not much deja vu in that lot.

Yet despite all these threats, global equity markets remain near all-time peaks, with the major market measured by the S&P500 recovering much of the early 2022 losses.

The threat of a world divided is thwarting previous moves towards closer global links and trade. Europe is struggling to replace the 40% of its gas needs which come from Russia as increasingly the 'iron curtain' is rebuilt. Closer to home, there is a threat of a Chinese military base in the Pacific which demands billions more be spent on defence than previous budgets allowed.

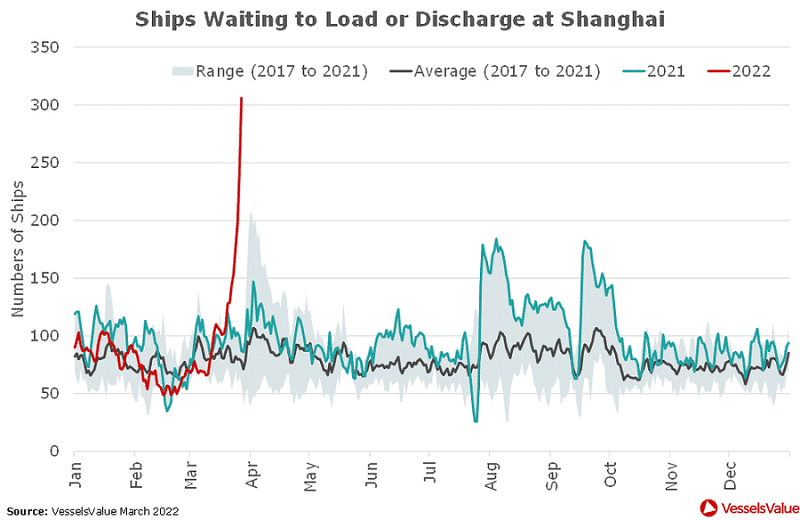

And let's not forget the ongoing impact of the pandemic. Look at how the shutdown in Shanghai is affecting the movements of goods as there are normally about 100 boats waiting to unload and it is currently over 300.

While some fund managers are on the right side of these disruptions, such as those backing resources and energy, others have misjudged the changes. For example, between the start of November 2021 and end of March 2022 (five months), the ASX200 Total Return index was up 4.5%, but the ASX200 Resources Index rising 34% was offset by the ASX All Technology Index down 19%. That's a 53% difference in two sectors of the ASX Index. Never deja vued before.

Amid all this, there is reason for optimism in Australia. One big hope for our economy and Federal Budgets, as well as many companies and fund managers, is that the resources boom continues. The global gas crisis is a boon for local producers such as Woodside. Mark Taylor, Senior Equity Analyst at Morningstar, says:

“We anticipate Woodside’s near-term earnings to soar due to higher prices for hydrocarbons but in particular to uncontracted LNG.”

The massive upside has already fed into the Budget deficit improvement announced by Josh Frydenberg last week. Exports of resources including energy are expected to reach $425 billion in FY22, or 50% more than forecast, feeding a $100 billion improvement into the Budget coffers.

Australia is a major beneficiary of the growth of EVs, and lithium carbonate prices in China have risen from US$10,000 a tonne in July 2021 to US$75,000 now. The share prices of companies such as Pilbara Metals have increased 10-fold in two years. While carmakers are scrambling, Australian miners are developing new mines and raising fresh capital to fund future growth. In a sign of the times, GM and Honda have just announced a technology-sharing partnership aimed at producing millions of EVs priced at around US$30,000 by 2027.

Resources have a boom/bust reputation but these are reasons to expect success to run for many years, although see Ashley Owen's article on this. Imagine the Budget impact if Australia had introduced the proposed Minerals Resource Rent Tax with a 22.5% tax on super profits. Norway now has the largest sovereign wealth fund in the world with US$1.4 trillion in assets based on its 78% tax on income from North Sea oil. In the US, the Senate Budget Committee is considering proposals to tax the windfall profits of major oil companies at a rate of half the difference between their current profits and their average profits between 2015 and 2019. There is no hint of a resources tax in Australia by either major party going into an election.

Meanwhile, back on the good news, this from the Australian Actuaries Institute:

"During 2021, with COVID-19 public health measures, there were only 2 deaths from influenza compared to 840 expected; pneumonia deaths were 31% lower than expected, and across all respiratory diseases deaths were 17% lower than expected."

Graham Hand

In this week's edition ...

What do you expect from your active fund manager? They must select stocks away from index weighting to achieve outperformance, but there is a business temptation to play it safe and hug the index. If you are paying for active management, you want a manager with the skill and risk appetite to back strong convictions, but do you know if your fund manager is really having a decent go?

While the war rages in Ukraine, many pundits have turned their attention to China and Taiwan. Jason Hsu was born in Taiwan and his parents still live there. He argues that much of the commentary on the parallels lacks a deep understanding of the political reality in China and Taiwan.

Many investors have soured on bonds and instead seek their fixed interest exposure through hybrids. Matthew Macreadie outlines some unique risks to hybrids and urges investors to take a more pragmatic approach when assessing the risk-return trade-off.

The history of commodities prices is riddled with price rises followed by surplus supply causing price falls when new supply or alternatives catch up to and then overtake demand. Ashley Owen takes a look at the history of commodity prices and explores how investors can get the timing right on commodities pricing cycles.

When will the election be called? With the Federal Budget done and dusted, and the May deadline looming, we have two pieces focused on politics. One thing's for sure: Noel Whittaker was no fan of last weeks' cash splash in the dash for the polls. And with tens of billions being spent on the age care sector and more to come, Louise Biti says neither political party has addressed the election killer issue of consumer contributions. She believes individuals need to start the hard conversation about frailty planning.

Finally, Australia’s age pension rose in March reflecting inflation and the growing cost of living pressures. This represents the biggest increase in the payment in almost a decade and Rachael Lane walks us through the changes to the rules.

This week's White Paper highlights the investing behaviours of Vanguard's clients in 2021, the differences between men and women and generations as well as Covid-related investment trends.

We received many comments on last week's article on the return of conflicted selling fees, where we explained that some financial advisers and brokers are switching their business models towards 'wholesale' clients and reducing investor protections. Among the responses was Judith Fox of the Stockbrokers and Investment Advisers Association (SIAA) with a link to their recently published white paper, 'Does the wholesale investor test need to change? It is included in the comments on the article.