The traits of a professional stock picker - Firstlinks newsletter

+ LIC Holy Grail or not; House prices in 2023; Howard Marks on selling; Why hold cash? Stocks at 12m lows; SMSF competitive with instos; Agent secrets.

After all the media exposure on Magellan and Hamish Douglass in recent weeks, including my interview, Geraldine Doogue asked me to discuss fund managers on her Saturday Extra programme on ABC's Radio National. She did not want to talk specifically about Hamish, but I thought the subject was something like, "How do you pick a good fund manager?" In fact, in her first question, she asked me, "What type of person is attracted to stock picking at this level?", which is different.

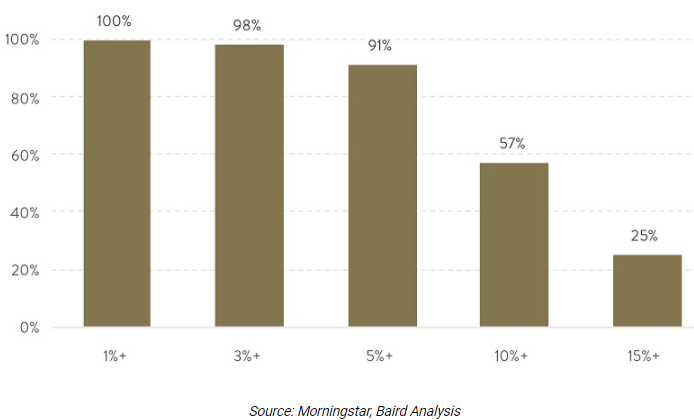

I've been rethinking the question ever since. My initial response was to quote the statistic that about 80% of large equity managers underperform their benchmarks over a long time period such as 10 years, and even the 'winners' in the 20% have a one-year period where they underperform, and 85% do so over a three-year period. My first point was that a fund manager must be resilient and consistent and able to withstand and explain long periods of failing to deliver.

An investor joining the fund at the wrong time might experience many poor years and give up before the fund manager can recover. This was explained in more detail by Andrew Mitchell of Ophir almost a year ago, and more than half of these top fund managers underperform by a remarkable 10%+ over some 12-month period in the 10 years. Selecting a fund manager is a long-term decision.

Percentage of top-performing funds over 10 years that underperformed over any 12-month period and by how much

There's another common trait in fund managers who I rate highly. They recognise a theme or trend early and back it. My first observation of this was the legendary Greg Perry when we both worked at Colonial First State when his early move into infrastructure and especially toll roads paid off handsomely. Good fund managers read widely, listen to new ideas, they are naturally curious, follow the science and find companies that will win from these trends.

According to the publication Inc., writing on Warren Buffett:

“Buffett reportedly spends as much as six hours a day reading books. It may be a daunting prospect for most busy people, but if you're up to the task, the Oracle of Omaha advises that we 'read 500 pages every day'. He says that's how knowledge works - it builds up like compound interest.”

Picking successful, long-term active managers who are worth their fees is not easy, but instead of listening for the the hot stock tips based on a short-term valuation, find the fund managers who look 10 years ahead and present a strong case why they are at the front of the curve. This is not an argument for active over passive, but rather, a core/satellite portfolio with index at the core and talented managers for extra kick and diversification.

At the same Morningstar Investor Conference, two successful funds management businesses debated the relative merits of Listed Investment Companies. Geoff Wilson of WAM reminded us how much he loves LIC discounts, but it was good to hear Chris Meyer of Pinnacle put another view based on the Antipodes experience (and Ellerston and Monash have made the same arguments). Wilson and Meyer both identified the 'Holy Grail' of LICs, but they were not the same. Can they both be right?

In the current market facing the certainty of rising interest rates, it's tempting to sell rather than tough it out. For the first time in 40 years of writing memos to clients, Howard Marks addresses the sell decision. It's not only about timing the sale but when do you get back in for the recovery?

Geoff Warren continues this theme by asking about the role of cash. It's amazing how good cash looks when the market falls 10%, and it's plausible in 2022 that returns from other assets will be poor.

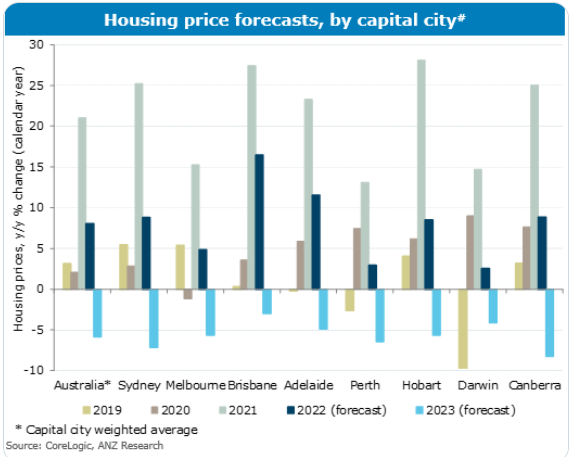

Now that our leading economists are moving their forecasts for the next cash rate increase to as early as June, only a few months away, the Reserve Bank's view that rate rises would not come until 2024 looks like poor judgement. Chris Bedingfield examines house prices from another perspective, the supply and demand.

ANZ Bank released its forecasts yesterday and they expect a soft landing for house prices despite higher rates. The forecast is for up 8% in 2022 and down a modest 6% in 2023.

Still on property, I admit I can be a pain when it comes to friends and family asking my advice on investments. A mate told me last week that he was looking to buy an apartment in a holiday resort. One of the attractions is the ability to stay in the apartment when it is not rented out for short-term holidays. He said there was no point leaving money in the bank earning nothing and shares are too risky. This sounds like a scenario being considered by many readers looking for income in new places.

I'm sure he thought I would smile pleasantly and he would drive off to buy his dream with a view. Instead, I sent him this article from 2015. I have not changed the numbers so please read it knowing it is seven years old, but the arguments remain valid. These resorts are a crap shoot.

Adding to the potential headwinds for property, here is what Gareth Aird of CBA Economics said this week:

"We shift our central scenario for the first hike in the cash rate target to June 2022 (from August 2022). Our forecast profile now has the cash rate at 1.0% by end-2022 (a 15bp increase in June, followed by two 25bp increases in Q3 22 and a further 25bp in Q4 22). We expect one further 25bp rate hike in Q1 23 that takes the cash rate to 1.25% - our estimate of the neutral cash rate."

Market volatility throws up opportunities, and Gemma Dale has looked at stocks which were at or near their 52-week lows at the time of writing. These stocks ran hard as the market recovered from COVID but then gave back a lot of their gains, and Gemma asks if they are now worth another look.

New research from the University of Adelaide, sponsored by the SMSF Association, sheds light on the appropriate size of SMSFs to be competitive with larger funds, and why diversification again proves its merit. Researchers believe the ATO data on SMSFs is increasingly unreliable for comparisons.

This week's White Paper from Western Asset looks at global inflation and highlights differences in recent inflationary impulses, expectations for inflation trajectories over the coming months and the potential implications for bond yields.

Finally, here's a quick summary of the changes in superannuation rules passed into legislation on 10 February 2022, all effective from 1 July 2022.

* Removal of the monthly salary minimum of $450 before an employee qualifies for the superannuation guarantee.

* Increase in amount of voluntary contributions that can be released from super under the First Home Super Saver Scheme from $30,000 to $50,000.

* Eligibility age for downsizer contributions allowing a contribution to super from the proceeds of selling a home decreased from 65 to 60.

* Increase in the cut-off age for the bring-forward rule applying to non-concessional contributions from 67 to 75.

There are also changes to the work test and exempt current pension income (ECPI) which are too complex to summarise here but will be covered in the near future.