Morningstar runs the numbers

We take a numerical look through this week's Morningstar research. Plus, our most popular articles and videos for the week ended 23 July.

10 per cent

Several super funds have a ten-year annual return of 10 per cent, in a big win for everyday Australians and the super industry, writes Graham Hand: “More important, the 10-year annual return from several funds is almost 10%. Compound $100,000 upfront and $1,000 a month for 10 years at 10% gives over $450,000. These are not personal SMSF returns or the results of a few top-performing fund managers. These funds hold the savings of 'mum and dad' investors who work in nursing, retailing, construction and hospitality who don't know one end of an SMSF from another. I wish my SMSF had done so well last year.”

$80,000

That’s the average loan size in NAB’s “equity builder” program, a mortgage style loan facility for buying funds, that is popular with young investors, I write: “The four-year-old product has a cult following in retail investing forums like Reddit. Originally designed to be distributed via advisers, word of mouth among retail investors has created so much demand that applications have been replaced by a waiting list. Most interest now comes directly from retail investors, not advisers, says Craig Saunders, a regional director in NAB’s private wealth business. While its popular with retail investors of all ages, it’s “weighted” to younger investors, with an average loan size of $80,000 and a term of 11 years.”

9,900 per cent

When Ethereum (or ether) returned 9,900 per cent in 2017 and made many into millionaires. Amy Arnott examines what effect small quantities of ether have on an investment portfolio’s risk profile: “But ether has shown even more volatile price moves than bitcoin, with runups as large as 9,900% in 2017 (no, that’s not a typo), followed by an 82% loss in 2018. Like other cryptocurrencies, ether has also been subject to extreme price swings over the past few months. In the third week of May, for example, ether’s price dropped about 38%, although it has since recovered most of its losses.”

3,848 per cent

Ethereum isn’t the only asset class with astronomical returns. Once a small-cap, Afterpay is up 3,848 per cent since 2017, writes Emma Rapaport in her look at the micro-cap sector: “Obscurity is the main attraction in the micro-cap space. Micro-caps are an under-researched segment of the market. These stocks are either too small, too new, or indeed too speculative to be on the radar of many stockbrokers or institutional investors. Skilled micro-cap investors try to identify the undiscovered gems with the potential to grow earnings and migrate upwards towards the Small Ordinaries, or beyond. These companies tend to grab fewer headlines and garner less interest and research, allowing investors to “find some gems” for cheap. For example, ASX-listed buy-now pay-later provider Afterpay has grown from relative obscurity to a solid S&P/ASX 50 company. Growth on AU$10,000 invested in 2017 is an incredible AU$384, 888 – or 3,848%.”

9.4 per cent

At 9.4 per cent of the population, Australia has the second highest number of millionaires in the world, as household wealth continues to grow, writes Nicki Bourlioufas: “Australian wealth per adult gained more in Australia in 2020 than in most other countries; it rose by US$65,695 ($88,390), second only to Switzerland at US$70,729. Moreover, our nation abounds with millionaires. Australia (with 9.4 per cent of the adult population being millionaires) follows second only to Switzerland (at 14.9 per cent), compared to roughly 1 per cent of adults worldwide, according to the Credit Suisse report.”

Charts from last week - Afterpay and US house prices

Afterpay’s journey from small to large cap (here)

Source: Morningstar

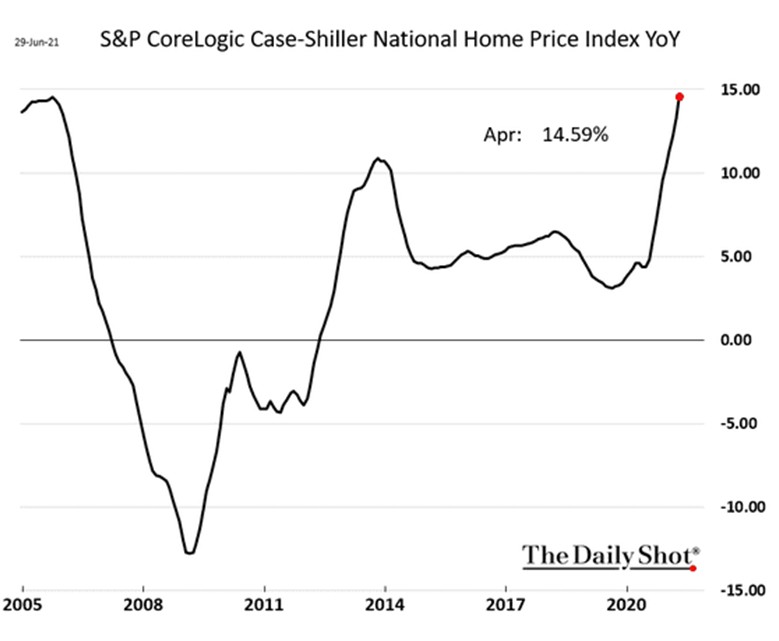

House prices in the US approach pre-GFC highs (here)

Source: The Daily Shot

Most popular articles

- ETFs and tax explained: why 2021 was a capital gains headache for investors

- What top Australian equity managers bought and sold last quarter

- Australian households the wealthiest in the world

- Some investments just aren't worth the effort

- What I learned from my faux retirement

Top videos

- Forecast 2021-2022: A correction could be around the corner

- 3 small caps with Dawn Kanelleas

- Big returns, big risks: Making money with microcaps