Traditional defensive assets are looking risky for retirees

A broader defensive portfolio could include infrastructure, safe-haven currencies, and bank stocks.

Mentioned: Janus Henderson Tactical Income Actv ETF (TACT), Betashares Global Banks Currency Hdg ETF (BNKS), SPDR® S&P/ASX Australian Govt Bd ETF (GOVT)

In an inflationary environment, classic defensive assets like cash and bonds could turn into liabilities for retirees, says AMP Capital Core Retirement portfolio manager Darren Beesley.

Equities and bonds are traditionally used to offset each other in portfolios. In an economic downturn, equity prices tend to fall but bond prices increase as investors move to safety. But with rising inflation, equities and bonds could sell off together.

“We need to think about how we lower risk going into retirement,” said Beesley at an AMP webinar on Wednesday.

"While investors hold bonds for the negative correlation, the correlation of bonds to equities is only negative when the risk is a deflationary shock.

"In an inflationary environment, where inflation break out is the risk, bonds no longer go up when equities go down. They actually become correlated.

"The whole premise to hold bonds as a defensive asset class over the medium term is challenged."

Beesley, who manages the neutral-rated fund, has redesigned the defensive side of the portfolio to include asset classes like safe haven currencies, options and in some cases, assets that directly hedge against inflation like US bank stocks, alongside bonds for tactical purposes. On the growth side, he has a large allocation to direct and listed infrastructure, assets that deliver a stable income.

"There still is a role [for bonds], if we feel like there may be a deflationary shock risk, or a reset in economic activity, bonds will help, but that is tactical," Beesley says. "We don't believe there is a structural place for bonds in the medium term."

The strong economic recovery and the prospect of rising inflation triggered a sell-off in bonds earlier this year. Yields on the Australian 10-year Government Bond more than doubled to above 1.60 per cent at the end of February. This has led to recent underperformance among funds which hold lots of long-dated bonds, a strategy popular with passive funds, says Morningstar senior fund analyst Matthew Wilkinson. But, if long-bond yields continue to rise, says Wilkinson, there’s a chance central banks could step in and reduce yields with bond-buying programs.

Retirees have options if inflation rises

Morningstar’s director of personal finance Christine Benz suggests retirees consider inflation hedges and inflation beaters in an environment of rising prices. The former could include inflation-linked bonds, commodity-tracking investments—be careful timing this volatile sector—and real estate. The latter, companies with a history of increasing their dividends, which can provide a measure of inflation protection.

Long-bond focused SPDR S&P/ASX Australian Govt Bd ETF (GOVT) fell -4 per cent last quarter. Henderson Tactical Income Actv ETF (TACT) was the best performing bond ETF, with a loss of -0.65 per cent. Elsewhere, Global bank ETF BetaShares Glb Banks ETF-Ccy Hdg (BNKS) returned 17.22 per cent for the quarter.

The AMP Capital Core Retirement fund has recently undergone a series of people changes, contributing to Morningstar's neutral rating. Twelve people have left the fund's investment team including internal moves over the two years to July 2020. Senior analyst Simon Scott says this has left a "gulf in market experience between many asset-class specialists and the portfolio managers".

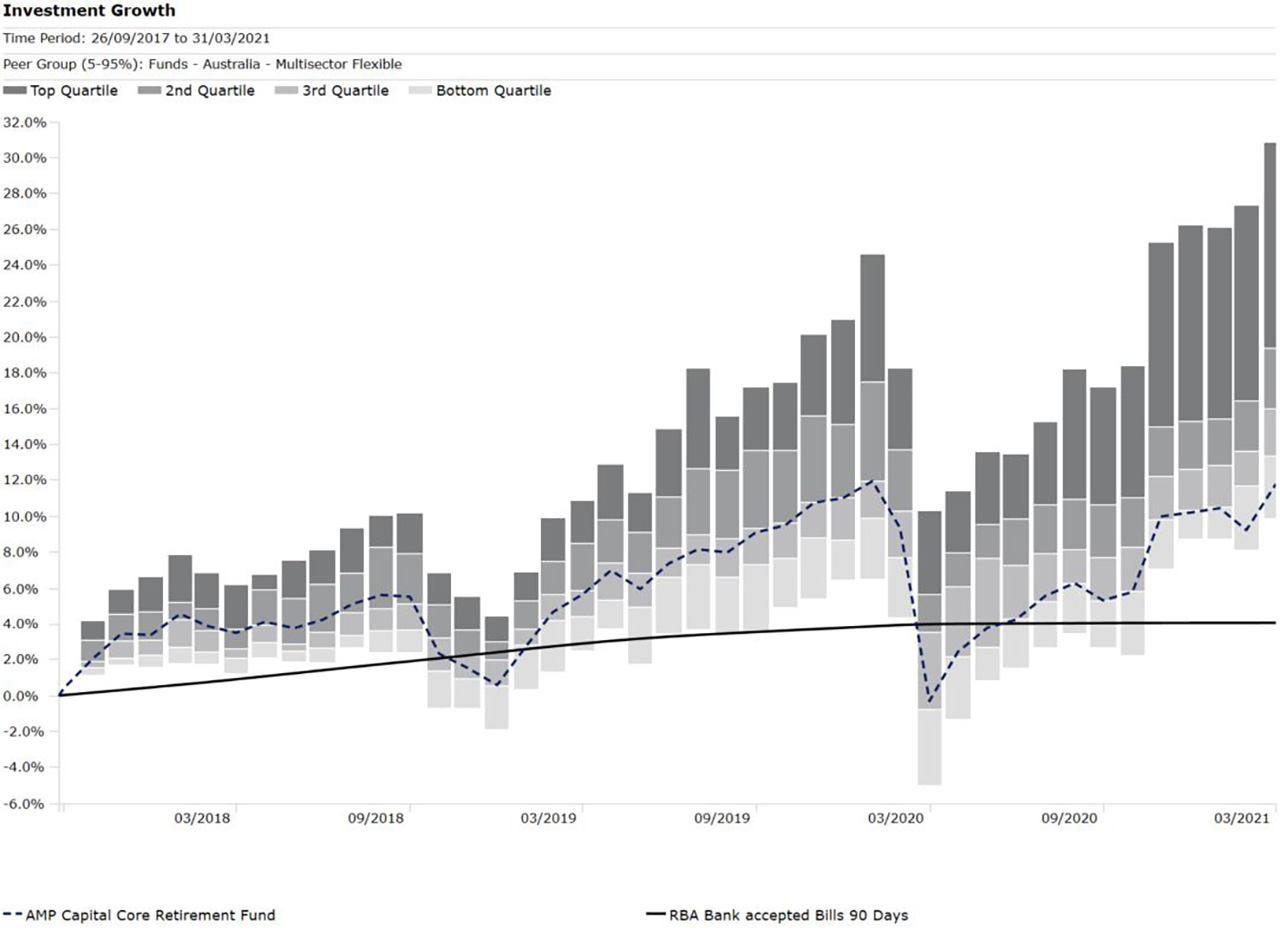

Performance of AMP Capital Core Retirement Fund 26.08.2017 - 31.03.2021

Quartiles represent peer group performance. Darker colours represent better performing peers

Source: Morningstar Direct

Fund performance struggled in 2018 and 2019 with the success of growth strategies. Hopkins acknowledges they held a little too much value in the portfolio but thinks a turn to value is underway. Year to date the fund has returned 1.44 per cent, besting the RBA Bank accepted Bills 90 index by 1.43 per cent.