Responsible investment funds notch up decade of outperformance

Beating their mainstream peers on a one, three, five and 10-year basis, a new report reveals.

Responsible investing has long been dogged by suggestions that investors must sacrifice returns to invest in live with their beliefs. However, a new report from the Responsible Investment Association Australasia (RIAA) shows that Australian and multi-sector responsible funds outperformed mainstream funds over every time horizon – one, three, five and 10 years.

This held true even during a global pandemic and subsequent market disruption. Responsible investment funds outperformed their mainstream peers thanks to overweight positions in technology and healthcare stocks relative to the index, and a shunning of energy stocks, which tumbled in March.

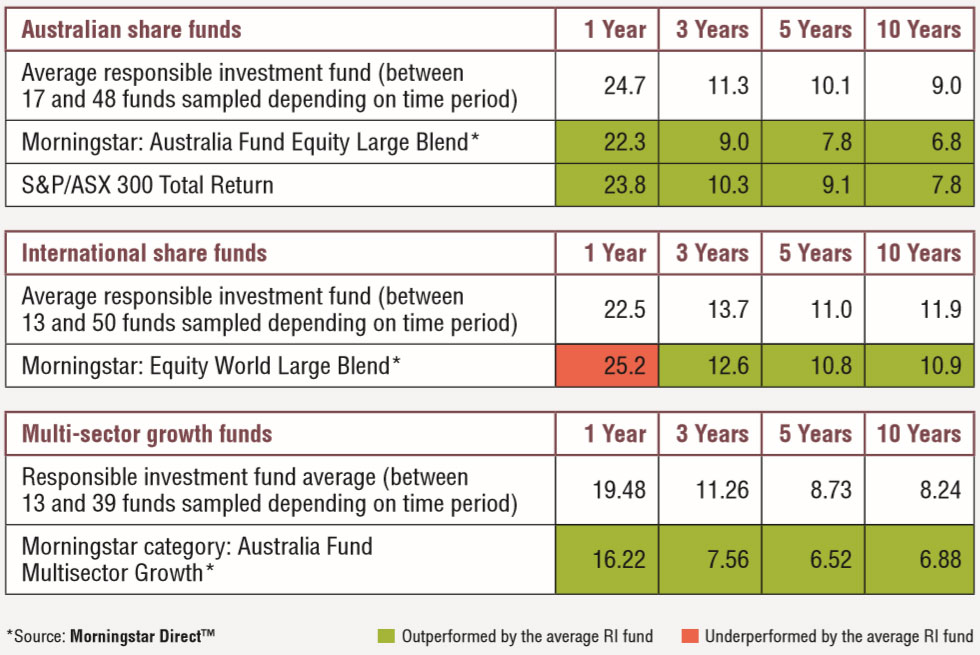

Within Australian share category, the average responsible investment fund delivered a return of 9 per cent over ten years to December 2019. The Morningstar Australia Fund Equity Large Blend category returned 6.8 per cent over the same period, while the S&P/ASX 300 Total Return index returned 7.8 per cent.

The same goes for the multi-sector growth category. The average responsible investment fund returned 8.24 per cent over 10 years versus the average Morningstar Australia Fund Multisector Growth category return of 6.88 per cent.

Performance of responsible investment against mainstream funds (weighted average performance net of fees over 10 years)

The RIAA has more than 300 members, including super funds, fund managers and trusts, that manage more than $9 trillion in assets globally.

RIAA chief executive Simon O'Connor says the results show that companies who are committed to ESG principles, namely "taking care of their employees", "minimising their impact on the environment" and "protecting human rights across their supply chains", among other things, are more likely to deliver superior financial returns.

“The COVID-19 pandemic has resulted in significant economic turmoil, severely impacting many people’s livelihoods and financial markets globally," O’Connor says.

"However, it’s become clear that responsible investors are ahead of the game. They are identifying the key themes influencing markets and returns, which helps them to better navigate turbulent times, avoid the biggest risks and capture more opportunities."

O'Connor adds that companies are "unlikely to thrive" if they ignore issues such as climate change, health and safety, labour rights, corruption, and lack of diversity.

"Investors are fast realising that consideration of these issues provides more informed investment decisions, such as valuation and asset allocation," he says.

Growing popularity

The responsible investment market is continuing to grow in leaps and bounds. Assets under management were up 17 per cent in 2019 and have steadily grown since 2015.

RIAA says industry growth has developed alongside consumer preference for responsible investing. A study released by the association last year found 87 per cent of Australians expect their savings to be invested responsibly and ethically.

ASX's 2020 Investor Study shows the "next generation" of investors, those aged 18 to 25, are the most likely to consider ethical and environment, social and governance (ESG) factors when making investment decisions.

“ESG integration” is the most popular responsible investing approach employed by managers (44 per cent) according to the survey, followed by “corporate engagement and shareholder action” (36.5 per cent) and “negative screening” (12.6 per cent).

ESG integration is defined by the Responsible Investment Association of Australasia as "the systematic and explicit inclusion of environmental, social and governance factors into traditional financial analysis and investment decision making". This, the RIAA says, is based on an acceptance that these factors represent a core driver of both value and risk in companies and assets.

Transparency issues persist

Disclosure of portfolio holdings continues to be an issue for the responsible investing market. Over a third of managers don't disclose their holdings, while 28 per cent disclose only some holdings. This can be particularly troubling for investors who are striving to align their money with their values, and who may be shocked to discover that their sustainable fund invests in a coal miner.

Several media articles have warned investors to check their ethical funds carefully before jumping in. "There are times when a provider’s idea of “ethical” may be unrecognisable from their own," writes Financial Times correspondent Kate Beioley in 2018.

MORE ON THIS TOPIC: 7 questions for assessing ESG expertise

Morningstar director, manager research, Grant Kennaway say the lack of industry disclosure is "an ongoing frustration for Morningstar", pointing out that the it lags global best practice.

"Investors are entitled to know how their money is being invested," he says. "If investors want to avoid exposure to fossil fuels for example, we need portfolio holdings data to provide the transparency they deserve.

"There is an old saying that sunlight is the best disinfectant and Morningstar believes that applies to appropriate portfolio holdings disclosure as well as fee and other disclosures."

Morningstar's bi-annual Global Fund Investor Experience study benchmarks the performance of 26 global markets. On portfolio disclosure holdings, Australia received a "below average" grade in 2017 and was called out as the "only country that does not have any requirement to disclose portfolio holdings". Ninety per cent of countries report portfolios quarterly or semi-annually, generally with a 60 to 90-day lag. India mandates monthly portfolio holdings disclosure.