Australia's best and worst equity funds in 1H20

It's been a volatile year so far and some funds fared better than others.

Mentioned: Hyperion Global Growth Companies B (42173), T. Rowe Price Global Equity I (14479), Investors Mutual WS Australian Share (5339), Airbus SE (AIR), Amazon.com Inc (AMZN), Boeing Co (BA), Brookfield Corp (BN), Chubb Ltd (CB), BetaShares Global Sstnbty Ldrs ETF (ETHI), Alphabet Inc (GOOGL), The Goldman Sachs Group Inc (GS), KKR & Co Inc (KKR), MetLife Inc (MET), Microsoft Corp (MSFT), Rolls-Royce Holdings PLC (RR.), Tesla Inc (TSLA)

Fund managers have had a half-year to forget, one marked by extreme market volatility, and varied performance.

And to top it off, flows into the industry dried up as investors kept their distance from shares.

But some funds have navigated the treacherous waters better than others.

Our round-up of the best and worst performing equity funds under Morningstar coverage in the first half of 2020 shows that some investors have enjoyed returns of up to 14 per cent. This is while the All Ords index and the MSCI World index remain in the red.

"The first quarter of 2020 will be remembered for the unprecedented sell-off in response to the COVID-19 global pandemic," Morningstar senior fund analyst Ross MacMillan says in Morningstar's latest review of the Australian equities fund market.

"History has shown us large market dislocations have been times when good active managers have proven their worth, the best of them delivering lower volatility and greater downside protection than the passive index funds.

"However, such periods also inevitably reveal some lacklustre performers. As the saying goes, when the tide goes out, we see who has been swimming naked."

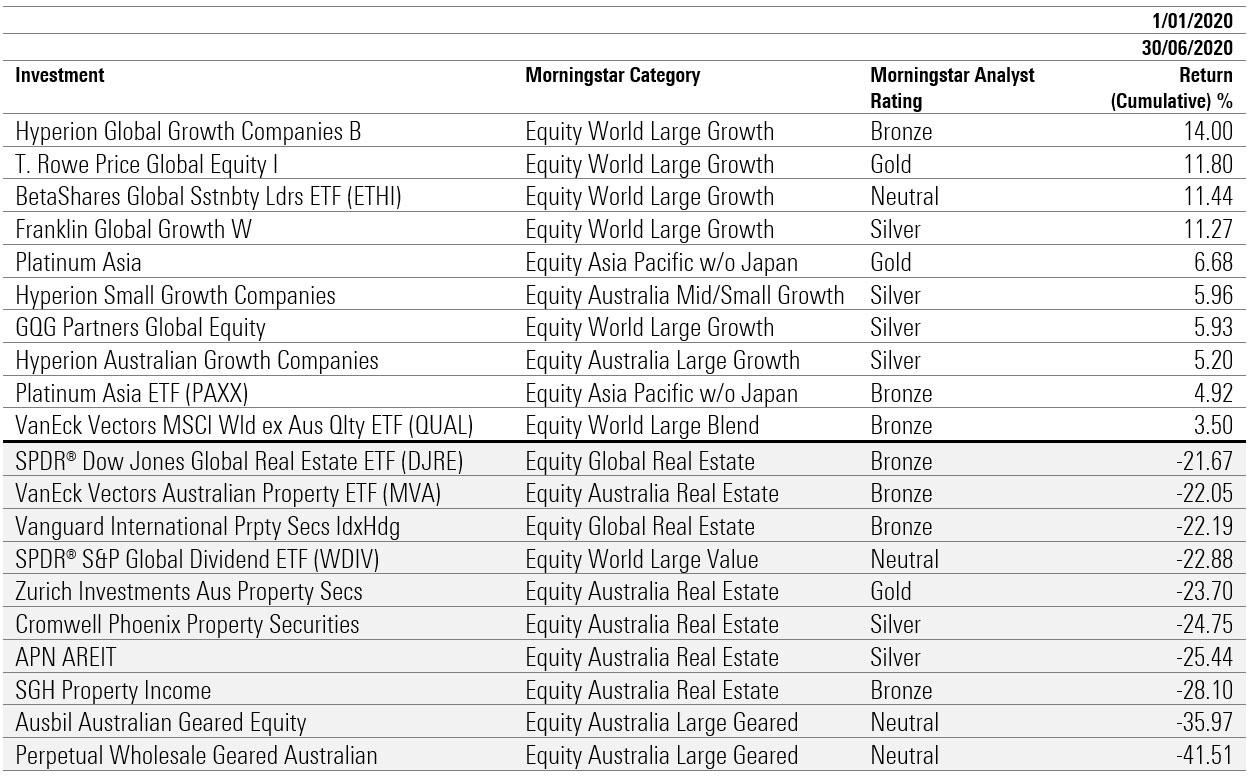

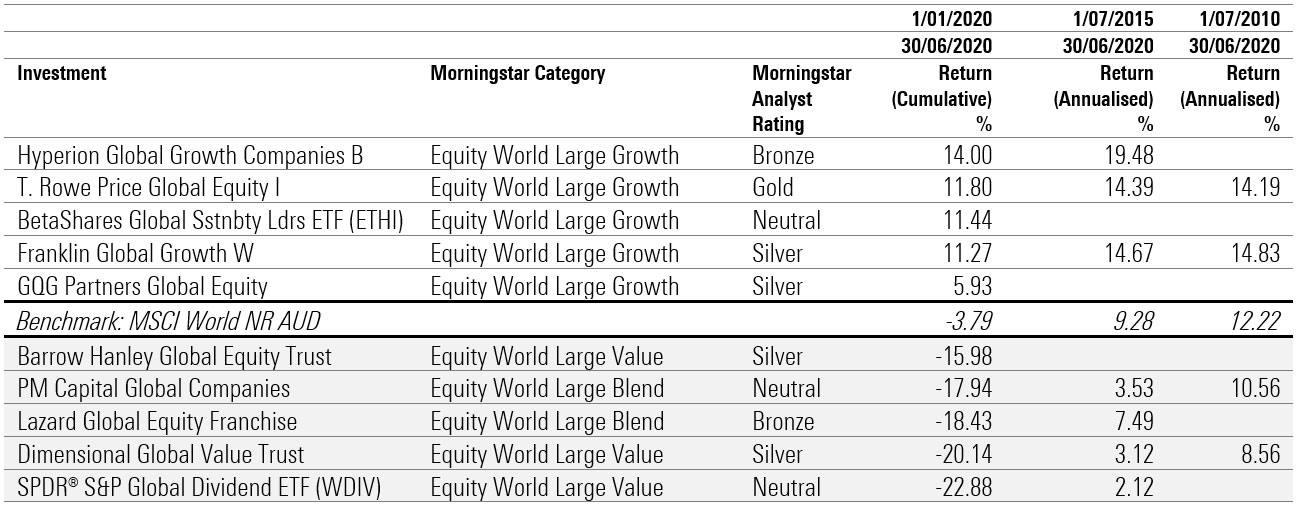

All equity categories | best and worst performing funds, YTD (Morningstar coverage)

(Click to enlarge) Source: Morningstar Direct

The Bronze-rated Hyperion Global Growth Companies fund led the way, with its portfolio weighted to large growth technology and consumer cyclical stocks such as Amazon, Microsoft and Tesla. The fund delivered an impressive return of 14 per cent to 30 June 2020, outperforming the Morningstar world large growth category by 10.21 per cent.

Also among the top performers in the category are Gold-rated T. Rowe Price Global Equity, up 11.80 per cent, and the BetaShares Global Sustainable Leaders ETF (ETHI), which gained 11.44 per cent, with its large weighting to healthcare and technology stocks and zero per cent allocation to energy.

Portfolio specialist with T. Rowe Price Sam Ruiz said the fund was fortunate to enter the late-February corona crash with a more defensive portfolio, based on concerns around the upcoming US election. Then, when the market crashed, the fund quickly sold as much risk in the portfolio as it could, including dropping aerospace names like Airbus (AIR), Boeing (BA) and Rolls-Royce (RR), as well as financials and materials.

"We were really unsure about what was going to happen," Ruiz says.

From here, the firm did an assessment of prior market sell-offs to gain a clearer understanding of how this one might play out, and added risk back to the portfolio, via higher growth firms, believing that the end of March would be the start of the next bull market.

"There's been about twelve really big sell-offs in the last century," he says. "We quickly formed the view that this wasn't a man-made recession, that it was effectively man versus nature, and we thought that the falls would be somewhere around 20 per cent to 30 per cent."

Ruiz says the portfolio managers realised "things weren't as bad as people thought" after meeting with two distressed companies – airline manufacturer Airbus and Wynn Casinos – both of whom were able to raise finance, despite planes being grounded and shutdowns in place.

Beyond adding a series of high-growth companies to the portfolio, T. Rowe also added cyclical value names such as US asset managers Brookfield (BAM), KKR (KKR) and Goldman Sachs (GS), and insurance giants MetLife (MET) and Chubb (CB).

"This is where we really believe investors misunderstood and oversold these companies," Ruiz says.

"People said, ‘why would anyone want to hold a bank when interest rates are effectively zero?’

"But if you think of a business like Goldman, only half of its business is effectively net interest margin. The other half is transactions. Goldman actually had its best transaction month in June."

Same old story: growth beats value

Highlighting just how much growth investing has dominated stock markets in recent months, nine of the top 10 performers favour growth over value investing.

Value funds were among the worst performers in the Australia large and global large cap categories.

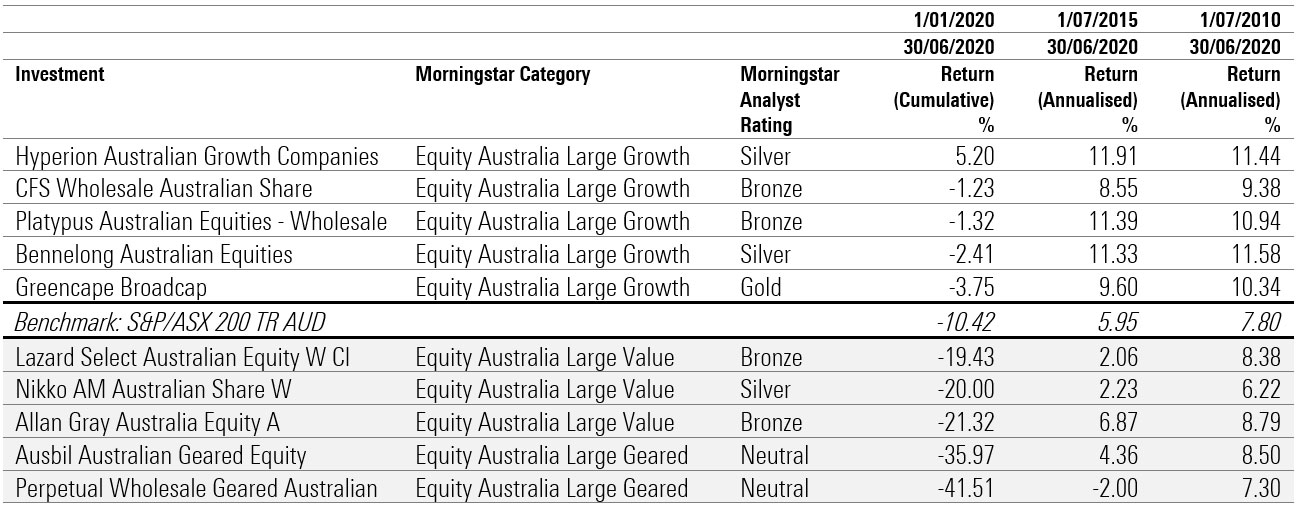

Australia equity large cap | best and worst performing funds, YTD (Morningstar coverage)

(Click to enlarge) Source: Morningstar Direct

Value stocks tend to outperform growth in the late stages of the economic cycle. But in the COVID rally, growth has handily outperformed value.

"In global equities, it's been a narrow market," Morningstar senior fund analyst Andrew Miles says.

"A small group of very large growth stocks have done well, as have the managers that have been exposed to the growthier parts of the market.

"The likes of Hyperion, T Rowe Price and Franklin Templeton have all done very well by holding large positions in big growth names like Tesla (TSLA), up 260 per cent this year, Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOG)."

Miles says these funds have also benefited by avoiding some sectors, namely cyclical exposures like banks, energy and to some extent tourism companies and airlines.

"These sorts of managers would rather own the structural growers – the Amazons and the Microsofts – that have been somewhat insulated in the economic downturn," he says.

"They believe these high-quality companies are so important and so well positioned that they can sustain strong growth despite economic headwinds and keep increasing their market share. In a low-growth world, they're willing to pay a premium for higher earnings growth."

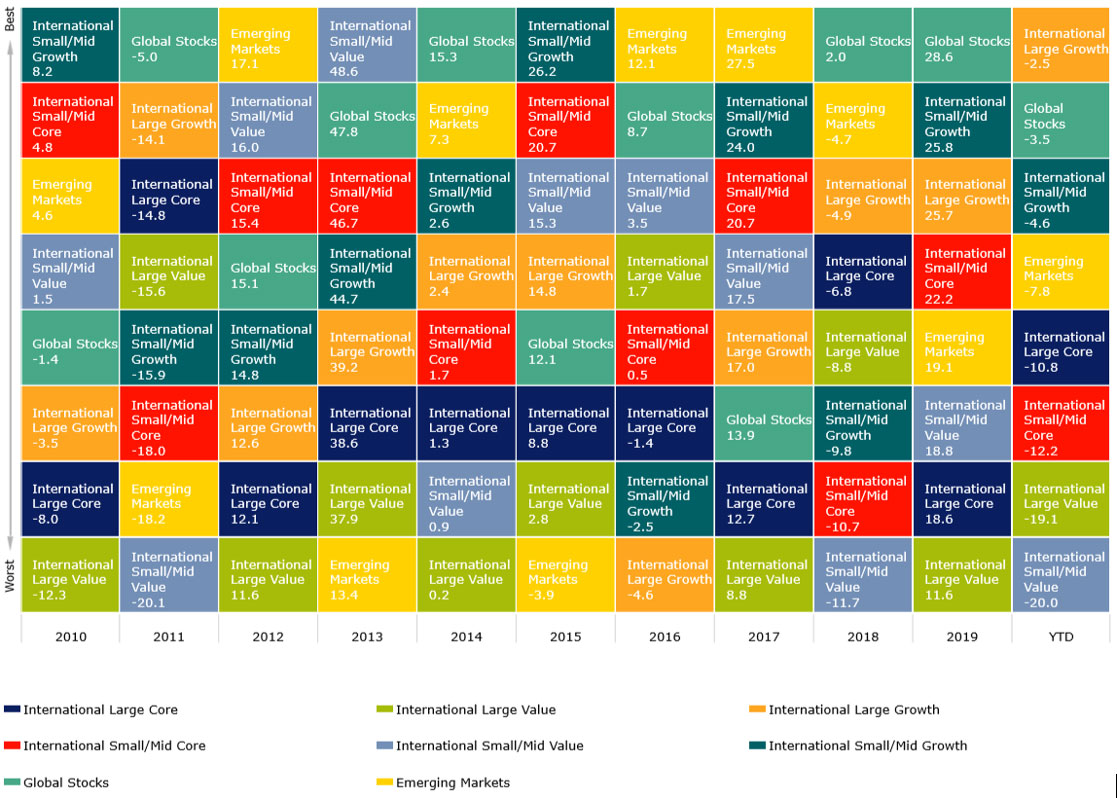

International markets | markets periodic table

(Click to enlarge)

Source: Morningstar Direct

Not all managers were fortunate enough to hitch their wagon to the best performing stocks in the first half. Value funds had a terrible run, as did their investors, underperforming growth over the past decade and indeed during the pandemic.

"The approach of value funds has been ‘no, we can't buy Tesla at any price, it's way too expensive. We're going to own the cheaper, average companies that we believe are going to going to recover’," Miles says.

"Generally, they also have more cyclical exposures, relying on sectors like banks, oil and gas and materials.”

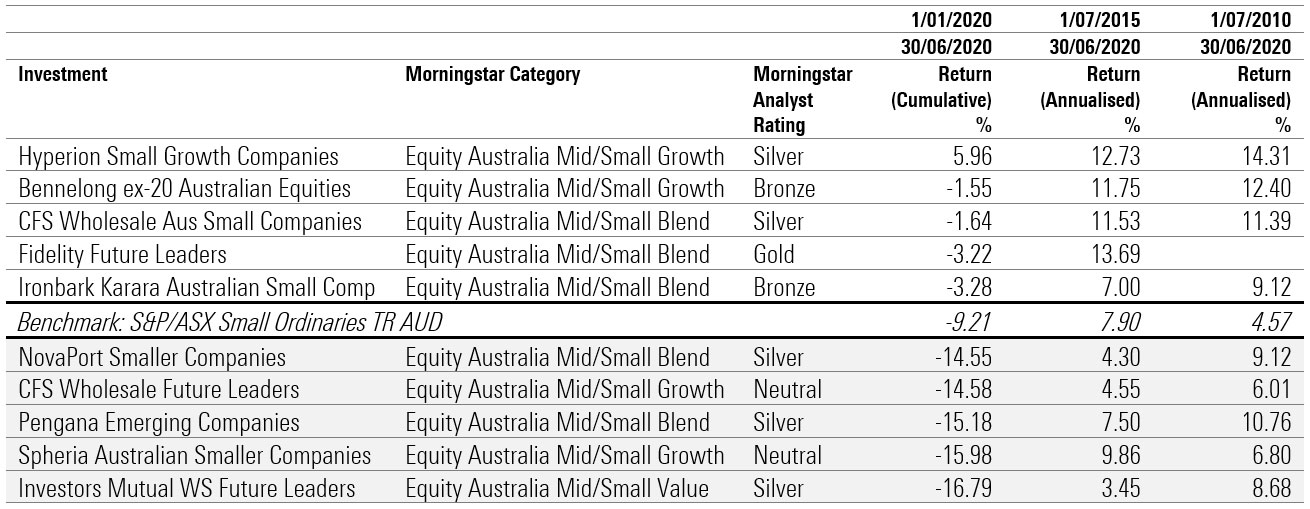

Australia equity small cap | best and worst performing funds, YTD (Morningstar coverage)

(Click to enlarge) Source: Morningstar Direct

Poised for a comeback?

Why is value underperforming? It's an open question, according to Miles. One school of thought is that growth companies have outperformed because of a decade of low interest rates.

"Interest rates globally are at depressed levels," he says. "This environment favours the discounting of future cash flows for growth companies whose valuations depend on longer dated cash flows than traditional value businesses."

Another theory, he says, is that broad economic growth across industries will disappoint in the near term. Therefore, investors are seeking out high quality, innovative companies with good management teams that can grow in the current environment.

Value-oriented indexes also tend to overweight sectors like energy and financial services, and those have been particularly challenged areas of the market over the past decade due to the decline in oil prices and the challenging interest-rate environment, Morningstar's director of passive strategies, North America, Alex Bryan says.

World equity small cap | best and worst performing funds, YTD (Morningstar coverage)

(Click to enlarge) Source: Morningstar Direct

This is not to say investors should write off value investing. Styles go in and out of favour and explaining the past is of course no indication of what will happen in the future.

"The reality is that over short time periods, the relative performance of the two styles is cyclical," Morningstar Investment Management EMEA chief investment officer Dan Kemp says.

"Equity markets are prone to trends in the short- to medium-term but not over longer horizons."

MORE ON THIS TOPIC: Are value stocks due for a comeback?

MORE ON THIS TOPIC: Value managers on why the strategy has underperformed

MORE ON THIS TOPIC: Value investing: A deep dive into performance

Anton Tagliaferro, co-manager of the Silver-rated Investors Mutual Australian Share Fund, says the case for value investing is strong as Australia heads into an economic slowdown.

"As we begin the new financial year, we have entered a period in which although the sharemarket recovered strongly in the June quarter, the overriding issue is that much of the economy in many parts of the world is still in something resembling a rather unreal state of ‘suspended animation’," he says.

"We believe that the recovery period will be a lot more prolonged than many may be expecting. Household income growth is likely to remain tepid. Corporate earnings growth is likely to be more modest, with dividends likely to assume a greater significance in the appeal of listed companies.

"This environment is consequently likely to be much more favourable to the kinds of stocks value managers favour, and in particular to businesses with real earnings, rather than companies which may (or may not) become profitable at some point down the track."

Investors Mutual's Australian shares fund has delivered periods of extreme outperformance and underperformance over the past two years. However, its 10-year trailing returns remain well ahead of rivals.

Morningstar prefers to place greater significance on long-term performance. However, evaluating the returns strategies at times of severe market stress can be enlightening.

Growth funds have had their moment to shine during the corona recovery. Will the same strategies continue to outperform as companies give us a peak into their worst quarter since the global financial crisis?