Best and worst performing funds in March

Alternative strategies and bond funds were the only funds that managed to eke out positive returns in the market sell-off.

Mentioned: Unibail-Rodamco-Westfield (URW), SGH Property Income (11242), AQR Wholesale Managed Futures 1P (19089), Pendal Fixed Interest (2950), SG Hiscock Property (3220), T. Rowe Price Dynamic Global Bond (40282), CC JCB Active Bond (41406), Charter Hall Retail REIT (CQR), Scentre Group (SCG), Stockland Corp Ltd (SGP), Vicinity Centres (VCX)

While March was a largely terrible month for global stock markets, some funds still managed to post positive returns.

March was “was one of the most extraordinary months ever,” says Ben Yearsley, director at Shore Financial Planning. “The Great Financial Crisis seems tame by comparison. The collapse in equity prices has brought in one of the quickest bear markets in history.”

Even government and corporate bonds with top credit ratings—the safest of fixed income assets—were caught up in March's rout of global financial markets as investors scrambled for cash.

The result was a dramatic spike in bond yields, hitting levels not seen since the global financial crisis, reflecting fears that highly indebted borrowers would not survive COVID-19.

“In a crisis, correlations go to one,” AMP Capital’s Shane Oliver told the Australian Financial Review, implying that the traditionally negative correlation between equities and bonds had disappeared.

Conventional wisdom suggests fixed income assets hold up well in a stock market sell-off—historically these assets have tended to behave conversely to equities.

MORE ON THIS TOPIC: Bonds: Still a safe port in a storm?

The 20 February sell-off saw Australia’s benchmark 10-year government bond yield spike to 1.5 per cent from its low of 0.6 per cent just weeks earlier. Similarly, US 10-year Treasuries surged to 1.25 per cent after trading at 0.54 per cent earlier the same month.

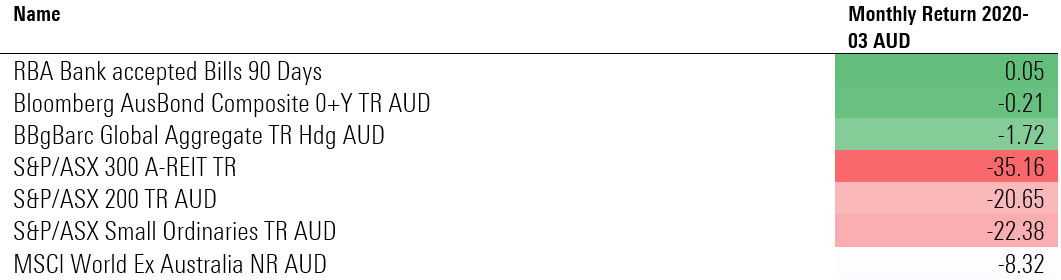

Index returns | March 2020

Source: Morningstar Direct

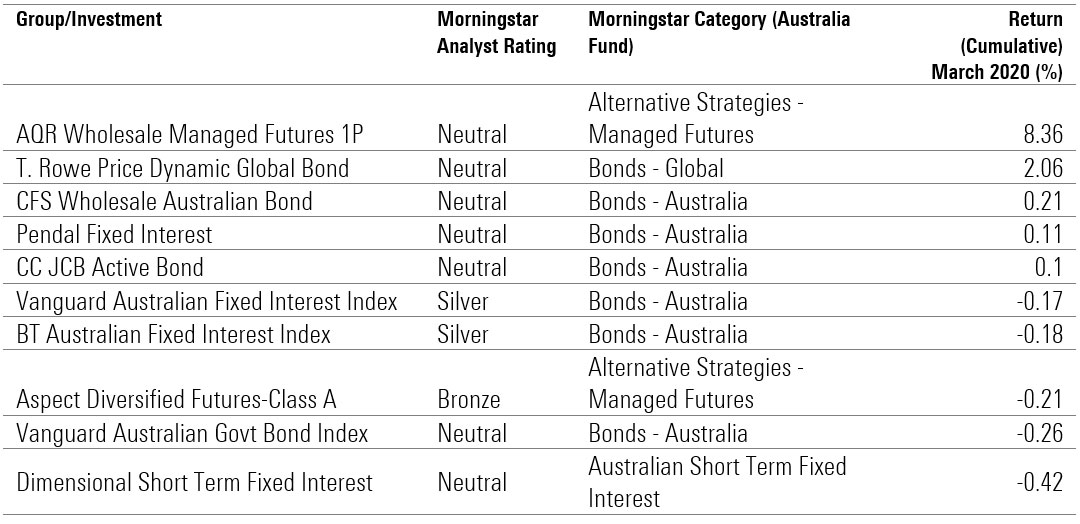

Against such a backdrop, the fact that any funds managed to stay in the black was surprising. Among the top 10 funds with a Morningstar Analyst Rating, bond funds were still the standout performers.

Central banks stepped in to boost liquidity, committing to buy billions of dollars of bonds and other financial instruments to calm markets, and here the RBA cut the official cash rate to a record low of 0.25 per cent.

Six of the top performers are focused on Australian bonds. Neutral-rated Pendal Fixed Interest led the pack with a return of 0.11 per cent, followed closely by CC JCB Active Bond, up 0.10 per cent.

The market value weighted index Bloomberg AusBond Composite 0+Y total return index—which measures the Australian debt market and a composite of Treasury, Semi-Govt, Supra/Sov, and Credit indices—saw much smaller falls in recent weeks compared to the falls endured by the likes of the ASX 200 and the S&P 500, which both suffered some of their greatest monthly drawdowns in decades.

The Bloomberg AusBond index was down 0.21 per cent for the month, while the AU market fell by more than 20 per cent.

Alternatives on top

Morningstar fund analysts don't like to focus on short-term returns, but they say analysing the performance of different strategies at times of severe market stress can be instructive. Increased volatility will also prove the strong active managers from the weak, and a test whether active equity management can truly outperform during a downturn.

Neutral-rated AQR Wholesale Managed Futures 1P was the top performing fund for the month, returning 8.36 per cent to investors. The fund trades roughly 120 markets across four asset classes: fixed income, currencies, equity, and commodities. It uses quantitative models, which aim to benefit from price trends in equity, fixed income, currency and commodity instruments.

Morningstar analysts Simon Scott says despite a strong 2019, fund performance has been disappointing for some time.

"The fund had a good start to 2019, gaining 14.7 per cent through the end of August, but it lost almost 13 per cent in the remainder of the year to eke out a marginally positive 0.86 per cent," he says. "This came after losses of 16.7 per cent in 2018, 1.47 per cent in 2017, and 15.38 per cent in 2016.

"Since its inception in April 2011 the strategy has returned 1.2 per cent per year, less than half the level of remaining in cash. Yet given the way the performance fee structure operates with no clawback provisions, it has cost investors nearly 1.8 per cent per year."

That said, Scott says the fund does deliver on its correlation targets, providing a negative 0.1 correlation since inception to global equities as measured by the MSCI World Index and only 0.4 to the Barclays Global Bond Index, both hedged to the Australian dollar.

Neutral-rated T. Rowe Price Dynamic Global Bond was the only fund of its type to make it onto the list (Bonds – Global), returning 2.06 per cent in March.

All categories | best performing unlisted funds

Performance figures include flagship unlisted managed funds under Morningstar analyst research coverage that have provided return data for March 2020.

Source: Morningstar Direct

Real estate plunge

A prominent and early victim of the impact of covid-19 on the economy is the property sector, and this is despite help from the government. As Australia ushered in strict new social distancing rules, shopping centres traffic evaporated. Major retailers closed their doors or publicly threatened to go on a rent strike. The escalating problem now has government urging landlords and tenants to work together in return for direct assistance. Office towers are also emptying as businesses urge employees to work from home.

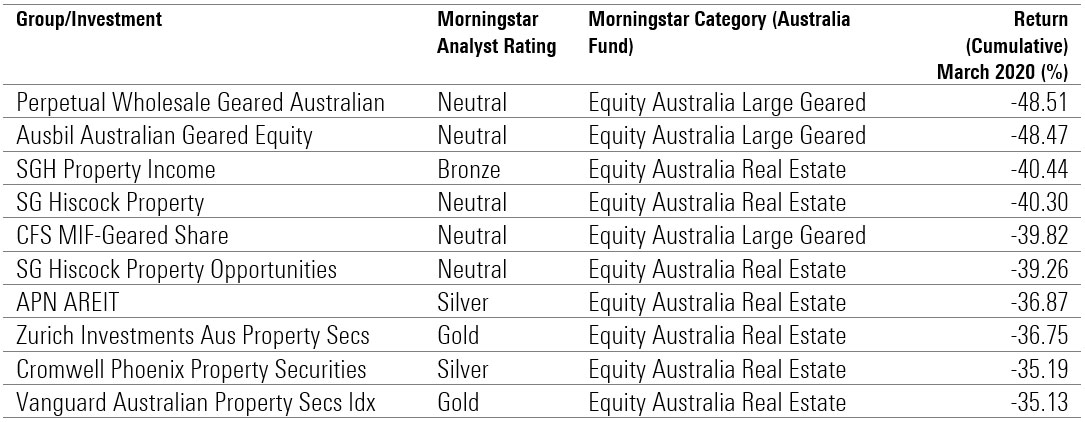

As such, the S&P/ASX 300 A-REIT total return index was among the worst performers for March, down more than 35 per cent. Digging deeper, Retail REITs were the worst affected. Industrial RIETs, which are less exposed to consumer depending, fared better.

MORE ON THIS TOPIC: Uncertainty reigns in commercial property

Bronze-rated SGH Property Income fund saw the steepest falls in the category, down 40.44 per cent. This was unsurprising with its five holdings exposed to retail rent collectors—Scentre Group (SCG), Stockland Corp (SGP), Vicinity Centres (VCX) and Unibail-Rodamco-Westfield (URW) and Charter Hall Retail REIT (CQR). Neutral-rated SG Hiscock Property followed closely behind, down 48.47 per cent.

But the falls were not limited to real estate; the two worst performing rated funds were Australia large-cap equity-focused, geared products.

All categories | worst performing unlisted funds

Performance figures include flagship unlisted managed funds under Morningstar analyst research coverage that have provided return data for March 2020.

Source: Morningstar Direct