Breaking $100 billion?: Editor's Views

The Australian ETF market hit $100 billion this week. Well, not really.

Mentioned: Magellan Global (Open Class) (MGOC), Hyperion Global Growth Companies ETF (HYGG), SPDR® S&P/ASX 200 ETF (STW)

Much was made this week by the ETF industry's biggest champion about a new milestone. The headline "Raise the bat! Industry blasts through the $100b mark" accompanied BetaShares' Tuesday afternoon media release. New ASX data revealed exchange-traded products (ETP) added around $8 billion in the first quarter of 2021, bringing funds under management to $102.9 billion.

We're well on our way to $125 billion by the end of this year, according to BetaShares chief executive officer Alex Vynokur.

“The ETF market experienced record growth in 2020, which has continued in the first three months of this year," he said. "We anticipate strong investor demand will be maintained through the rest of 2021 and predict the ETF industry will end the year with around $125 billion funds under management.”

Australia's ETP industry certainly deserves praise for exceptional growth. From $370 million under management at the turn of the century (2001) to $100+ billion today, Australia now has its very own thriving industry, with over 30 firms participating and 230+ products across two exchanges. Products have captured the attention of young and new investors, offering a way for first-time investors to dip their toe into the market, and filling a void created by inaccessible unlisted managed funds. Almost half (45 per cent) of Australians aged 18 to 24 told the ASX in May last year that they were aiming to invest in ETFs over the next 12 months. The industry has stared down the naysayers, and the alarmists, to secure its place as a key feature of the financial services industry.

But as the industry matures, I think it's also time we looked at who is in, and who is out. When we talk about ETPs, the average investor takes this to mean exchange-traded funds (ETFs). They're pitched as an easy way to get low-cost, index-tracking exposure to a diversified, transparent portfolio of securities. The first Australian ETF, the SPDR S&P/ASX 200 Fund (STW), is a classic example providing exposure to the largest 200 Australian shares, based on market capitalisation. But today's ETP market hosts a much more diverse cast of characters including exchange-traded managed funds (ETMF) and structured products (SP). Trading on our exchanges today we have leveraged products, inverse products, actively managed funds and synthetic products. While these products are exchange-traded (trading on the exchange), they are not ETFs, and come with their own unique features around transparency and pricing. Good luck coaxing the full portfolio holdings out of a listed active fund manager.

MORE ON THIS TOPIC: ETF or ETP: What's the difference?

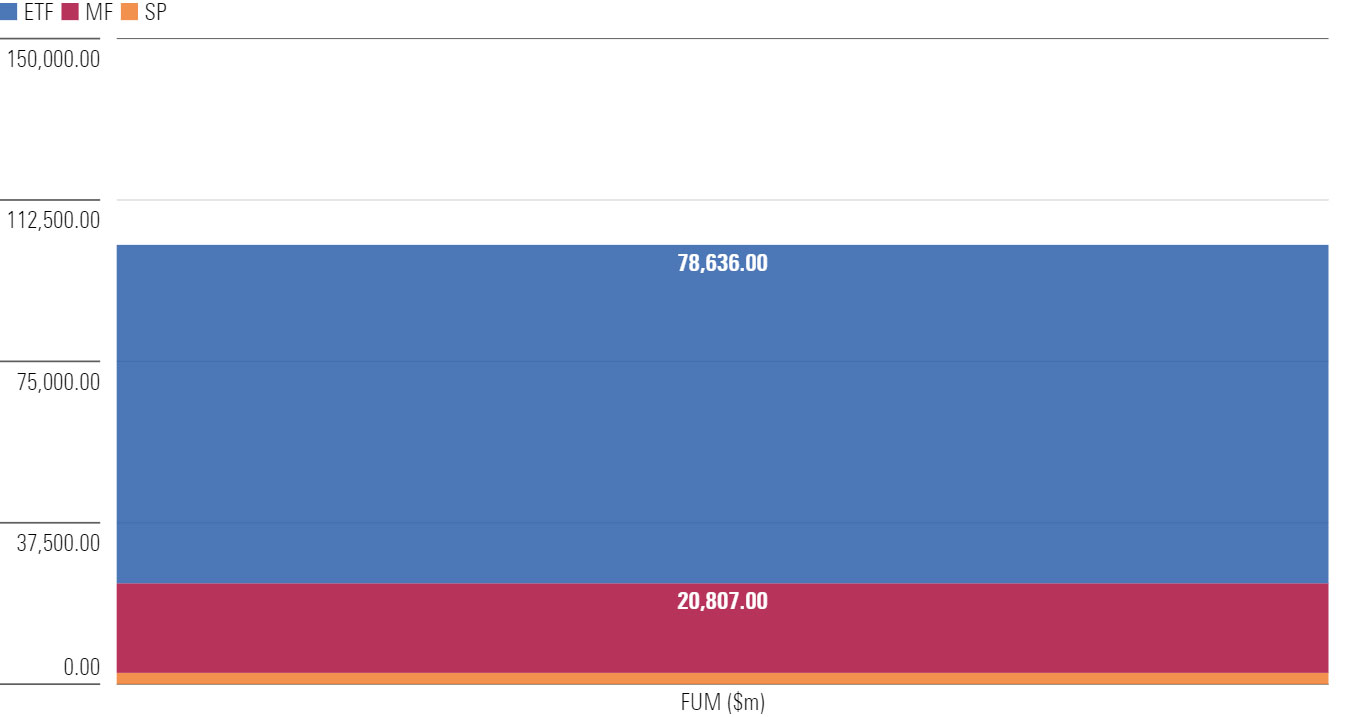

A former ETF industry leader turned to LinkedIn two weeks ago to express his frustration that the ASX doesn't strip ETFs from its monthly exchange-traded product report -- relied upon by the industry to produce the headline $100 billion figure fed to the media. Digging into the ASX data, he showed that of the $100 billion under management in exchange-traded products, around $78 billion is in ETFs, $20 billion (nearly 20 per cent) in managed funds, and $2 billion in structured products. The MF figure is complicated by the fact that $12.9 billion is attributed to a single fund -- Magellan Global Open Class (MGOC) -- which operates under a new combined structure with open-end (on and off exchange entry) and a closed-end classes. Hyperion's newly listed global equity fund (HYGG) also uses a converted unlisted structure. What this means is the inclusion of managed funds and structured products to the exchange-traded product statistics has boosted the reported headline growth of the ETF industry.

Size of the ASX's exchange traded product market, March 2021 – by type

Source: ASX, data as at 31 March 2021

Admittedly this complaint is minor and belongs among the wonks of the financial services sector. ETF industry growth is up, no matter which way you cut the data. But I think it's emblematic of an industry that is plagued with classification woes that are putting everyday investors at risk.

If 'ETF' become a catchall phrase for any fund that is listed on the exchange, we run the risk of investors not being alerted to the very real risks some of these ETPs exhibit. Last year, we saw a surge of money flow into leveraged and inverse products and single commodity products, many of which are not ETFs (despite being described by some in the media as such). The risks are real. In the US, a triple levered crude oil linked ETP was delisted following a dramatic decline in oil prices with an expected value of zero dollars per share. As ETP provider iShares noted, while the decline in value was extreme, the product performed as designed.

In an industry gathering increasing complexity, it should not be up to inexperienced investors, nor the media, to sort out these classification problems. BlackRock, alongside other heavy hitters in the global ETP industry, has thrown its considerable weight behind a petition for classification reform. In a proposal to US stock exchanges in mid-May, BlackRock, Vanguard, State Street Global Advisors, Invesco, Charles Schwab and Fidelity Investments, pushed for a new taxonomy for ETPs split into ETFs, Exchange Traded Notes (ETNs), Exchange-Traded Commodities (ETCs) and Exchange-Traded Instruments (ETIs). Local iShares head Christian Obrist told a media event last year that it was done so with "investor protection in mind". I'm interested to see what it produces. If you ask me, 'ETF brand' deserves protection so it continues to mean something to those who rely on it.

In the meantime, it's worth remembering that just because a fund is listed, doesn't mean it's broadly diversified, index-tracking, low cost, nor transparent. Look for the phrase 'ETF' at the end of the product name. Be careful around product names that include words like 'active', 'hedge fund', 'synthetic' and 'managed fund'. Do your homework, look at each fund's product disclosure statement, and do your best to understand what you're buying.

In Firstlinks this week, Graham Hand examines the appropriateness of a 60/40 growth defensive retirement savings portfolio in today's market environment. Ross Clare, director of research and resource centre at ASFA challenges the assumption that most people have no superannuation when they die.

Elsewhere, Morningstar equity strategist Gareth James looks back at the first quarter in Australian equities.

Fidelity's Kate Howitt is back again to deliver her top three stock tips for 2021.

If you weren't already sick of ETF coverage we have more. The ASX released their monthly ETP report meaning we could delve into the best and worst performing funds for the first quarter.

VanEck's MD walks us through three strategies for building all-ETF portfolios - core and satellite, strategic asset allocation and tactical asset allocation.

Lewis Jackson goes under the hood of Australia's best performing ETF of 2020, while the prolific John Rekenthaler dismantled the latest of a series of attacks against index funds.

Tough times are ahead for Australian online retailers with Amazon on the scene, writes Lewis Jackson.

Senior equity analyst Michael Field pitches two stocks to play the digital learning boom.

And finally, in Your Money Weekly, Peter Warnes writes that the current market enthusiasm needs a reality check.