Active ETFs poised to make a move in 2020

2020 could be the year in which Australia's active managers intensify their efforts to get a piece of Australia's $60bn ETF pie.

Mentioned: BetaShares Australia 200 ETF (A200), iShares Core S&P/ASX 200 ETF (IOZ), SPDR® S&P/ASX 200 ETF (STW), Vanguard Australian Shares ETF (VAS)

Will 2020 be the year Australia's active managers try to grab a bigger piece of the $60 billion ETF pie?

It's certainly heading that way if you believe Alex Vynokur, chief executive of exchange-traded fund player BetaShares.

Vynokur said he wouldn't be surprised to see more than 50 per cent of new launches in 2020 to be active ETFs, as part of the provider’s Australian ETF Year in Review.

Vynokur attributes this in part to the financial regulator lifting its six-month suspension of opaque exchange-traded funds, effectively clearing the way for new products to come to market.

“Although still relatively modest, we expect active ETFs’ share of flows to rise in the next few years”, Vynokur said in BetaShares’ annual Australian ETF Review.

“Almost half the new products launched in 2019 were active ETFs, and we think this proportion is likely to increase in 2020, particularly now that ASIC has lifted its pause on the launch of non-transparent active ETFs.”

11 new active ETFs were launched in 2019 – or almost half of all new products across both exchanges. However new product launches were down in 2019. Twenty-four funds were launched across both exchanges – compared to an average of 37 new products launched/year in the four years prior.

Today, there are over 30 active ETFs listed on the exchanges from a range of managers including Fidelity, Platinum, Montgomery, Antipodes Partners, Legg Mason, K2, AMP Capital and Schroders.

ASIC conducted the review after a surge in the number of non-transparent active ETFs that decline to disclose daily portfolio holdings and make their own markets, and concerns that this lack of transparency could allow conflicts of interest.

The regulator also flagged "international developments", including regulatory approval in the US and Hong Kong of alternative frameworks for non-transparent active ETFs, as a reason for the pause.

Active ETFs gain in popularity

Active ETFs combine the benefits of active fund management with the convenience of share trading. They are managed by a team of portfolio managers who make decisions on the underlying portfolio allocation and aim to outperform an index or benchmark.

Active ETFs still make up a small part of the $60 billion Australian ETF market, but funds are growing in popularity, with around $5 billion under management, Morningstar estimates. BetaShares says active ETFs accounted for 11 per cent of net inflows 2019.

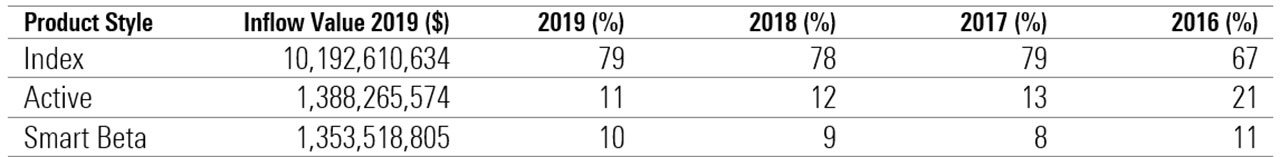

The breakdown of inflows between passive and active products in 2019 remained in line with the last few years. Passive products accounted for 89 per cent of inflows (about $11.5 billion), with vanilla index-tracking products remaining the dominant category at 79 per cent (about $10.2 billion) of total net flows, and “smart-beta” products (essentially a blend of active and passive investing) receiving 10 per cent ( about $1.4 billion) during the year.

Inflows by Product Style (by $) – Year to date

Source: BetaShares

2019 a watershed for ETFs

The Australian ETF industry added $21 billion during 2019 to reach an all-time high of $61.8 billion in funds under management.

BetaShares attributed the 52 per cent jump in funds under management to net inflows of $12.9 billion, representing the highest annual inflows on record. The remaining came from asset appreciation.

The ETF industry has solidified its lead over the Listed Investment Company (LIC) market – now about $9 billion smaller in terms of funds under management.

“This has been a tremendous year for the Australian ETF industry," Vynokur said. "At the beginning of 2019, we predicted we would reach $50-55 billion in funds under management by the end of 2019 – so to have surpassed the $60 billion milestone is a remarkable performance.”

BetaShares expects the industry to grow in 2020 but says that another year of over 509 per cent growth is unlikely.

"As such, we forecast total industry funds under management at end 2020 to be in the range of $72-$78 billion."

Vanguard surpasses State Street

Until this year, State Street's S&P/ASX 200 ETF (STW) was the largest ETF trading on the ASX. However, in August it slipped to second place behind the Vanguard Australian Shares ETF (ASX: VAS).

One reason for the shift could be fierce competition in the market, driven by fee compression. In May 2018, BetaShares rocked the market with the launch of its Solactive Australia 200 Index tracking ETF—the BetaShares Australia 200 ETF (ASX: A200). A200 charges an annual fee of 0.07 per cent, half the cost of its nearest Australian equity index rival at the time of launch.

Net inflows for the year saw three issuers - Vanguard, BetaShares & iShares – take the lion’s share of new money (80 per cent collectively).

The year of fixed income ETFs

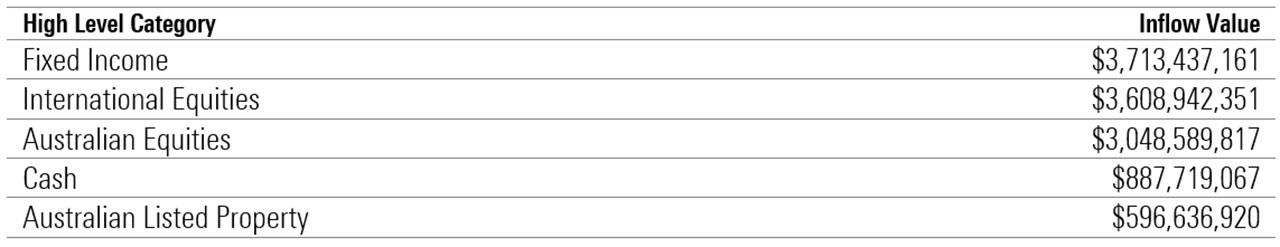

2019 was a year for fixed income ETFs, BetaShares says, with the category ranking first for inflows. Up to $3.7 billion flowed to fixed income products, followed by international equities products at about $3.6 billion. Australian Equities also had strong flows, with about $3.0 billion received.

Top 5 Category Inflows (by $) – Year to date

Source: BetaShares

In 2020, BetaShares expects "international equities to return to the top of the table, given the current yield environment and investor expectations of decent overall equity market returns this year".