Fixed income flows fire up

Fixed-income ETFs have this year received the largest proportion of cash flows of any asset class as recession fears mount.

This year has been good for bonds and they have been in high demand, forcing up prices. Investors have been selling out of equities and piling into fixed-income managed and exchange-traded funds as fears of a global recession mount, though experts warn the best returns could be behind us.

A growing awareness of the benefits of fixed-income exchange-traded funds has led to a jump in products launched on the Australian Securities Exchange this year, and investors have flocked to these products.

This year, fixed-income ETFs have received the largest proportion of cash flows of any asset class over the year to 31 July, totalling $2.45 billion, compared to flows of $1.52 billion into Australian equity ETFs and $2 billion into international equity ETFs.

Breaking that fixed-income allocation down, flows to Australian fixed-income ETFs totalled $1.56 billion, $284 million went to international fixed income and $601 million to cash ETFs.

Around the globe too, investors have been selling out of equity managed funds and ETFs and pouring money into both bond and cash funds. In particular, high-quality bonds such as investment-grade corporates, treasuries, and broad aggregate bond ETFs have attracted flows, according to the Vanguard Global ETF cash-flow report.

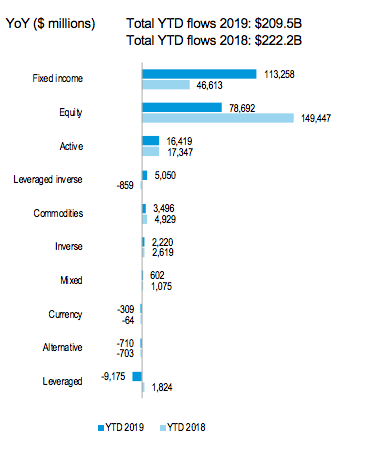

Over the year to 30 June, flows globally to fixed-income ETFs globally have easily surpassed flows into equity ETFs and are well above 2018 levels, as the chart below shows.

Global ETF/ETP net cash flow by asset class

Source: Vanguard June 2019 Global ETF cash-flow report

Jeff Johnson, head of the fixed income group at Vanguard Asia-Pacific, says there is no doubt that demand for fixed-income securities has been very strong.

“This could be attributed to a range of factors including the growing concern around the risk of a recession, thus causing investors to seek out high quality, liquid, safe havens that are likely to provide protection in the event of a market selloff in equities,” says Johnson.

“Another observation is around the chasing of returns. Both fixed-income funds and ETFs have performed very well in 2019, with calendar year-to-date returns for Australian and global bonds up about 9 per cent.

“We would caution investors on this point though, since yields have fallen and prices have rallied, and from these relatively low yields, future returns aren’t expected to be as strong as what we have recently experienced on the back of falling yields and rising bond prices,” says Johnson.

Vanguard also cautions that while including an allocation to fixed income in a portfolio can increase balance and diversification, any asset allocation decisions should be made in line with investors' long term goals, rather than a reaction to market events or cycles.

This point is backed by financial planner Scott Keeley of Wakefield Partners. He says despite the volatility of July and August, most of his clients are staying put with their portfolio allocations.

“They seem prepared to accept market movements as a trade-off for the decent dividend yields they are receiving through domestic listed investments,” says Keeley.

“Our current portfolio reviews involve ‘tidying up’ portfolios, offloading smaller holdings and rebalancing back to the client’s appropriate asset allocation. By default, this does often result in some selling down of equity positions, but not for any reason other than rebalancing.”

Keeley does say, however, that some clients are looking for suitable fixed-income options in light of lower term deposit rates and some are adding fixed-income ETFs to stabilise portfolios.

“We are gradually suggesting more and more fixed-interest/income ETFs. Fixed-interest ETFs allow a broad exposure to domestic and international fixed-interest instruments. All this said, the current dividend/distribution yields from these products is hardly compelling, making them a sometimes tough sell,” says Keeley.

Investors too are moving to cash, preferring no yields at all, but capital stability. For the month of July 2019 alone, investors poured $215,800 into cash ETFs, up from about $60,000 in June. That compares to $350,210 flowing into Australian fixed income, up from $202,231 in June, according to ASX data.

Scott Haslem, chief investment officer for Crestone Wealth Management, says the firm has adopted a more defensive stance in portfolio positioning in August, adopting a greater allocation to cash. The firm’s tactical asset allocations changes involve “moving underweight equities, reducing some of our underweight in high-grade government bonds, and increasing our defensive positioning in cash,” as the chart below shows.

“Further ahead, we are looking for signs of improving global growth, some resolution or de-escalation in the US-China trade dispute, as well as progress around Brexit to engage a more positive portfolio position,” says Haslem.