What did Morningstar subscribers buy and sell during earnings season?

And what do our analysts think of the investments?

Mentioned: Audinate Group Ltd (AD8), Apple Inc (AAPL), BHP Group Ltd (BHP), iShares S&P 500 ETF (IVV), Microsoft Corp (MSFT), NVIDIA Corp (NVDA), Woodside Energy Group Ltd (WDS)

What do our analysts think about Morningstar Investor subscriber's top trades during August?

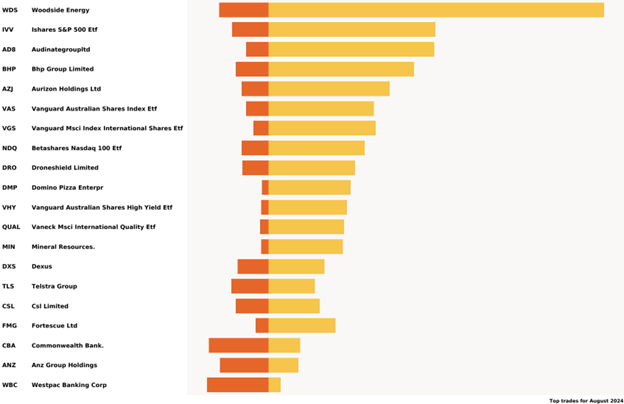

Sharesight is a portfolio tracker that is integrated into Morningstar Investor. Their data shows the top 20 trades by Morningstar users in August 2024, when we saw companies report on their earnings.

The top trades were Woodside WDS, iShares S&P 500 ETF IVV And Audinate Group LTD AD8.

Figure: Morningstar's top trades for August, 2024. Source: Morningstar Investor/Sharesight

Figure: Morningstar's top trades for August, 2024. Source: Morningstar Investor/Sharesight

Here is what our equity and manager research analysts think about our top buy trades.

Woodside Energy WDS ★★★★★

During earnings, No-moat hydrocarbon producer Woodside reported first-half 2024 underlying net profit after taxes (“NPAT”) down 13% to USD 1.63 billion, marginally ahead of our USD 1.55 billion expectations. Underlying earnings exclude a USD 305 million gain on the Sangomar oil project deferred tax asset recognition. Our $45 fair value estimate stands.

As Australia's premier oil player, Woodside Petroleum's operations encompass liquid natural gas, natural gas, condensate and crude oil. However, LNG interests in the North West Shelf Joint Venture, or NWS/JV, and Pluto offshore Western Australia are the mainstay, and the low-cost advantage of these assets form the foundation for Woodside. Future LNG development, particularly relating to the Pluto project, encompasses a large percentage of this company's intrinsic value.

Woodside is unique among Australian energy companies in that it has successfully managed the development of LNG projects for more than 25 years—unparalleled domestic experience at a complicated and expensive task. Adding to Woodside's competitive advantages are the long-term 20-year off-take agreements with the who's who of Asia's blue chip energy utilities, such as Tokyo Electric, Kansai Electric, Chubu Electric, and Osaka Gas. These help ensure sufficient project financing during development and should bring stability to Woodside's cash flows once projects are complete.

Woodside's development pipeline is deep, enabling it to leverage the tried and trusted project-delivery platform as a template for other world-class gas accumulations off the north-west coast of Australia. Woodside is well suited to the development challenge. With extensive experience, it remains a stand-out energy investment at the right price. It is currently a five star stock, trading at a meaningful 39% discount to fair value (at 2 September 2024).

Top buy trade: iShares S&P 500 ETF IVV

Morningstar Medalist rating: Gold

Many passive Australian investors are anything but. They deviate from this strategy by making active decisions to be overweight in certain sectors, themes or geographies. It is no secret that Australian investors prefer and are heavily invested in domestic markets.

However, Australian investors have started to double down on the US as well. This may be due to the US outperforming almost every other market since the GFC. It is no surprise that iShares S&P 500 ETF IVV makes the top three.

Given the breadth of coverage and the cost efficiency, iShares S&P 500 ETF IVV is a fine choice for investors seeking US-specific equity exposure. Our manager research analysts think it is the best in class option for large cap investors. The strategy is expected to outperform its peers over the long term and remains the clear choice for investors to gain US exposure. It can be paired with other ex-US products to form a balanced global equity portfolio.

The underlying benchmark, the S&P 500, is a market-cap-weighted index of the largest 500 companies in the United States. Thus, it offers giant- to mid-cap exposure, covering about 80% of the free-float-adjusted market cap of the US equity market. This results in a well-diversified index at the stock and sector levels. As such, passive strategies that track the S&P 500 stand as above-average options in a market segment where active managers have generally struggled to outperform. Consisting of highly liquid stocks, material stock-specific valuation information is quickly incorporated into stock prices.

From an Australian perspective, IVV gives exposure to a broad portfolio of some of the world’s most noteworthy companies, including sectors that are underrepresented in Australia such as technology and healthcare. The S&P 500’s correlation to Australian equities has come down in recent years, effectively adding to diversification for Australian equities exposure. It earns a silver medalist rating.

At an annual fee of 0.04%, the fund is priced attractively compared to active and passive peers.

When we look to the index’s exposure, 34% of the index is in the top 10 holdings, 6.93% of the index is in one holding – Apple AAPL, 6.56% in NVIDIA Corp NVDA and 6.48% in Microsoft MSFT. The index is highly concentrated in tech, with over 30% of the index in this sector (at 28 August 2024).

Top buy trade: Audinate AD8 ★★★★★

Audinate is a leading provider of professional AV networking technologies globally. Investors may be bargain hunting here with the shares dropping close to 34% in the last month.

Audinate's Dante platform is the world’s most widely used protocol for digital audio networking, distributing digital audio and video signals over computer networks. The purpose of the technology is to bring the benefits of IT networking to the professional AV industry.

Audinate’s Dante protocol boasts a more-than 10 times lead over its nearest competitor, Ravenna, in terms of the number of products enabled with the protocol. Given Dante’s dominant market share, we see little remaining upside for Audinate from gaining incremental market share from direct competitors in digital audio networking. However, we do expect Audinate to use its network effect, its existing customer relationships, and its scale on research and development to accelerate the AV industry’s transition toward digital audio networking. This provides Audinate with a narrow moat – our analysts expect the company to maintain and grow its earnings for at least the next ten years. Specifically, we expect Audinate to continue creating new hardware and software solutions that unlock new device use cases and to continue developing new software solutions for AV professionals. We estimate Audinate has around 10% market share in audio devices, which leaves Audinate with a large and highly winnable market opportunity, as the industry digitizes. Additionally, we expect Audinate to gain significant pricing power, especially in its software segment, as its network effects continue to strengthen.

We maintain our $18.50 per share fair value estimate for narrow-moat Audinate following the release of its fiscal 2024 results. The company released fiscal 2024 results on Aug. 6, 2024, including its outlook for fiscal 2025, which shocked markets. The company guided for a decrease in revenue in fiscal 2025 and flat to slightly negative gross profit growth, compared with market expectations for more than 20% growth for both. The current release provides more detail and shows that the company and industry are transitioning from hardware-based to software-based sales, which come with lower per-unit revenue and gross profits. At current prices, Audinate shares screen as materially undervalued, as the market appears to believe the company’s slowdown may signal a loss of competitive position or an exhaustion of its addressable market.

Get Morningstar insights in your inbox

Terms used in this article

Star Rating: Our one- to five-star ratings are guideposts to a broad audience and individuals must consider their own specific investment goals, risk tolerance, and several other factors. A five-star rating means our analysts think the current market price likely represents an excessively pessimistic outlook and that beyond fair risk-adjusted returns are likely over a long timeframe. A one-star rating means our analysts think the market is pricing in an excessively optimistic outlook, limiting upside potential and leaving the investor exposed to capital loss.

Fair Value: Morningstar’s Fair Value estimate results from a detailed projection of a company's future cash flows, resulting from our analysts' independent primary research. Price To Fair Value measures the current market price against estimated Fair Value. If a company’s stock trades at $100 and our analysts believe it is worth $200, the price to fair value ratio would be 0.5. A Price to Fair Value over 1 suggests the share is overvalued.

Moat Rating: An economic moat is a structural feature that allows a firm to sustain excess profits over a long period. Companies with a narrow moat are those we believe are more likely than not to sustain excess returns for at least a decade. For wide-moat companies, we have high confidence that excess returns will persist for 10 years and are likely to persist at least 20 years. To learn about finding different sources of moat, read this article by Mark LaMonica.