US earnings: Apple misses on earnings and revenue

Widespread sales declines to close out 2022 foreshadow a challenging 2023.

Mentioned: Apple Inc (AAPL)

Apple AAPL closed 2022 with a rare double miss on both revenue and earnings estimates following a sales decline in nearly every product category during its fiscal 2023 first quarter.

The world’s largest company results were hit by a tougher macroeconomic environment placing pressure on near-term demand. Supply chain issues also constrained the sales of the new iPhone 14 Pro, which contributed to the company’s largest quarterly revenue decline since 2016.

Earnings per share was $1.88, slightly below FactSet consensus estimates of $1.94. Revenue had a slightly worse miss, coming in at $117.15 billion compared with estimates of $121.33 billion, and was down 5.48% from a year earlier.

Apple Earnings Takeaways

- Earnings Per Share: Apple missed estimates, with EPS coming in at $1.88 versus the FactSet consensus of $1.94.

- Revenue: Apple reported revenue of $117.15 billion, below estimates of $121.33 billion. Revenue declined by 5.48%, the worst since Apple’s 2016 September quarter.

- Revenue declined for its iPhone (down 8%), Mac (down 29%), and wearables (down 8%). However, iPad sales grew about 30% and services 6%, partially offsetting losses.

- Declines in iPhone revenue was due to supply shortages, macroeconomic pressures, currency headwinds, and potentially poorer sales for the base iPhone 14 model.

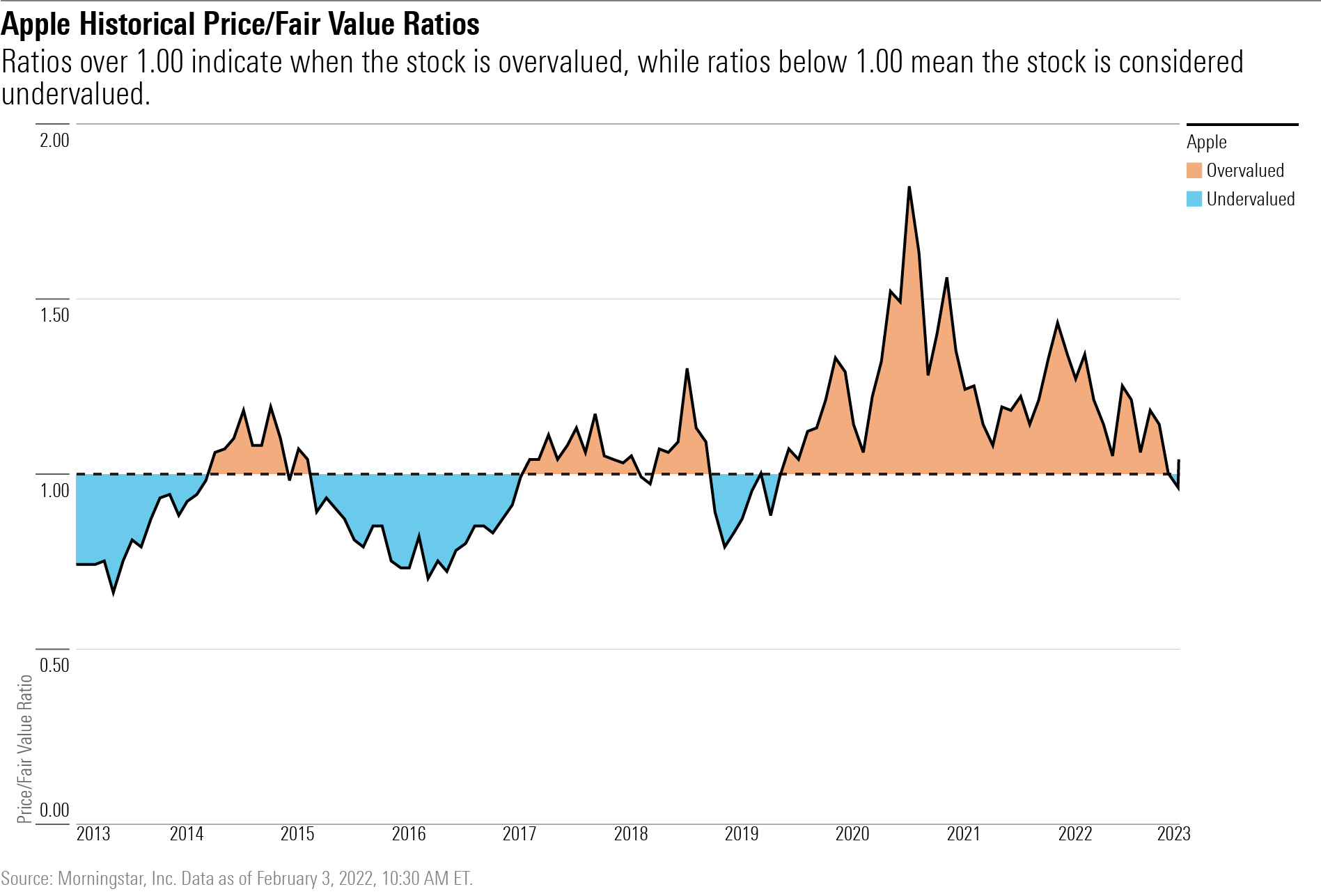

Despite Apple stock declining during afterhours trading following its earnings release, the stock jumped as much as 3.7% during early intraday trading on Feb. 3. Shares remain near Morningstar’s fair value estimate of $150, which strategist Abhinav Davuluri maintained after updating his model.

“Although we remain positive on wide-moat Apple’s iOS walled garden, we expect the upcoming quarters to be challenging and thus recommend prospective investors wait for a wider margin of safety,” he says. Davuluri recently upgraded Apple’s Morningstar Economic Moat Rating to wide from narrow.

Apple Stock Stats:

- Sector: Technology

- Industry: Consumer Electronics

- Fair Value Estimate: $150

- Morningstar Rating: 3 Stars

- Economic Moat Rating: Wide

- Moat Trend: Stable

Apple’s Sales Decline Largest Since 2016

Apple’s 5.48% decline in sales was its largest year-over-year fall since its quarter ended September 2016, when it fell 8.12%. Net income also fell by 13.4%, the worst drop since March 2019.

While revenue came as a surprise for the market, Davuluri says it was not completely unexpected. “We have been anticipating a slowdown in the firm’s hardware products following several years of strong growth related to COVID-19-induced work- and learning-from-home trends as well as the initial rollout of 5G.”

Sales fell in nearly every product category, with iPhone sales falling 8%, Mac down 29%, and wearables down 9%.

Apple’s crown jewel, the iPhone, saw sales decline largely because of supply chain issues as well as unfavorable currency rates, which the company claims to have been an 800-basis-point headwind to revenue. “On a constant currency basis, iPhone revenue was roughly flat,” says Tim Cook, chief executive officer.

Only iPad and the services segments saw revenue increase during the quarter. Sales for iPads rose 30% from a year ago, though Davuluri notes this was an easy comparison due to supply chain constraints a year prior as well as a new iPad model launch during the quarter. Revenue from services, which includes offerings such as AppleCare, rose 6%.

Apple Seen Facing Continued Revenue Pressures

Looking ahead, Apple refrained from giving concrete guidance for its fiscal 2023 second quarter ending in March because of macroeconomic uncertainty. However, “we expect our March quarter year-over-year revenue performance to be similar to the December quarter,” says Cook. In iPad and Mac sales, the company expects to see double-digit declines because of tougher year-over-year comparisons.

The company also expects to see an acceleration in iPhone sales, which has been held back by supply chain issues. “From a supply chain point of view, we’re now at a point where production is what we need it to be. And so, the problem is behind us,” says Cook.

Morningstar’s Davuluri disagrees, however, “We believe iPhone revenue will be down another 9%, as improved supply conditions in China for the iPhone 14 Pro models won’t be enough to combat overall weaker smartphone demand, in our view.” He expects that sales for the base iPhone 14 model have been disappointing and foresees that being the main drag on iPhone sales.

Still, Davuluri expects revenue to grow modestly in the March quarter. While hardware sales are likely to be weak in his view, services revenue should be resilient.

According to data from FactSet, the market also appears to expect modest revenue growth for the March quarter. Revenue is estimated to be around $93.41 billion as of Feb. 3, which was cut from estimates of $96.95 billion prior to results. Should Apple meet those expectations, it would mark about a 3.6% year-over-year growth.