Banks, energy and resources - what’s next for Q1’s outperformers? Charts of the week

The commodity half of the value rally looks set to slowly ease even as interest rate forecasts grow.

Resources, energy and bank stocks boomed in the first quarter as commodity prices surged upwards and interest rates started to creep up around the world. Woodside Petroleum paid its second-highest dividend on record as the US Federal Reserve raised rates for the first time since 2018. How long will the boom last? As we move into the next quarter, there are signs some of the driving forces could be easing.

In this Charts of the week, we walk through the performance highlights so far this year and look at what forecasters think is in store for commodities and interest rates in the coming months.

Down under outperforms

Australia was the only developed market index to post a positive return in the March quarter owing to heavy exposure to the raw materials, energy and financial sectors.

The Morningstar Australia Index returned 2.7% in the three months to 31 March, outpacing the 5.6% decline posted by the Morningstar US Large-Mid cap index.

Resources, financial services, energy and utilities led the advance while the remainder of the benchmark declined in line with overseas markets. Energy heavyweights such as Woodside Petroleum, Whitehaven Coal and New Hope topped the ASX league tables as technology and payments stocks like Zip or EML Payments fell to earth nursing double-digit losses.

Historic moves in commodity and interest rate markets helped drive outperformance for value-oriented sectors as traders repositioned portfolios in response to rising inflation and Russia’s invasion of Ukraine. Crude oil is up 32% this year, Asian natural gas up 46%. Meanwhile, markets are now pricing in a 90% chance US rates rise above 2% this year. A month ago, odds were at 5%.

Will it last?

The old saying goes that the cure for high prices is high prices, as super profits encourage new supply. But new data from government forecasters suggest the resources leg of today’s rally should ease in the coming months—albeit slowly.

Iron ore and coal prices will decline from the middle quarter of this year, according to forecasts from the Department of Industry, Science, Energy and Resources. By 2023, the average price for iron ore is set to halve relative to 2021. Natural gas and oil prices are set to remain above the 2021 average through to next year.

A decline is already underway. Oil, natural gas and coal prices are off their March peaks by between 18% and 41%.

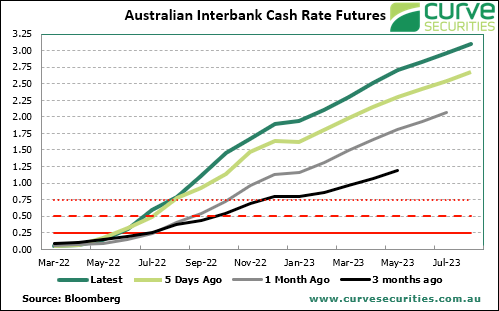

Forecasts remain more bullish for the banking leg of today’s rally. Bond market traders are now betting the cash rate will hit 1.76% by December before rising to 3% by August next year. That would require 12 cash rate hikes of 0.25% between now and then. Economists are a little less gung-ho, Analysts from UBS and AMP Capital expect the cash rate to hit 0.75% by end of year. When the cash rate rises, the amount banks charge borrowers tends to increase faster than the cost of their own funding. That helps expand margins, growing profits and dividends.

Growth managers caught out

For now, the shift to value has left managers long rewarded for top picks in technology and healthcare sectors confronting underperformance.

Silver-rated Hyperion Australian Growth Companies slumped 14% this year, almost erasing all its gains for 2021. Meanwhile, the value-oriented Lazard Australian Equity’s Equity was its mirror image with a 14% gain. It owns outsized stakes in banking and energy stocks.

The S&P/ASX 200 Value index climbed 7.3% in the March quarter while its growth equivalent fell 2.45%.

However, it may be too soon to dismiss growth stocks. Volatile commodity prices and cheap valuations helped growth indexes in Australia and the US outperform their value equivalents in the month of March. The S&P/ASX All Technology Index rose 8.9% in March, almost dead-even with the 9.2% advance by the resources index.