Fortescue’s fortunes tied to iron ore – for now

Iron ore has plummeted thanks to a slowdown in Chinese steel production, taking Fortescue Metals with it. Could green hydrogen be the mining giant's future?

Mentioned: Fortescue Ltd (FMG)

After two years in overvalued territory, mining giant Fortescue Metals is now fairly valued according to Morningstar after a significant drop in the price of iron ore. But analysts are pricing in more downside saying prices for the commodity could fall below US$50 by 2025.

"We don't see Fortescue making great returns in the long run," says Morningstar mining analyst Mathew Hodge.

"People think oh well, the iron ore price has halved from its peak of US$230, there must be decent value here. But US$100 plus is still a very favourable price and the returns the industry is making at those prices are still huge.

"Based on the cost curve and the incredibly high industry returns, we think there's further for the iron price to fall."

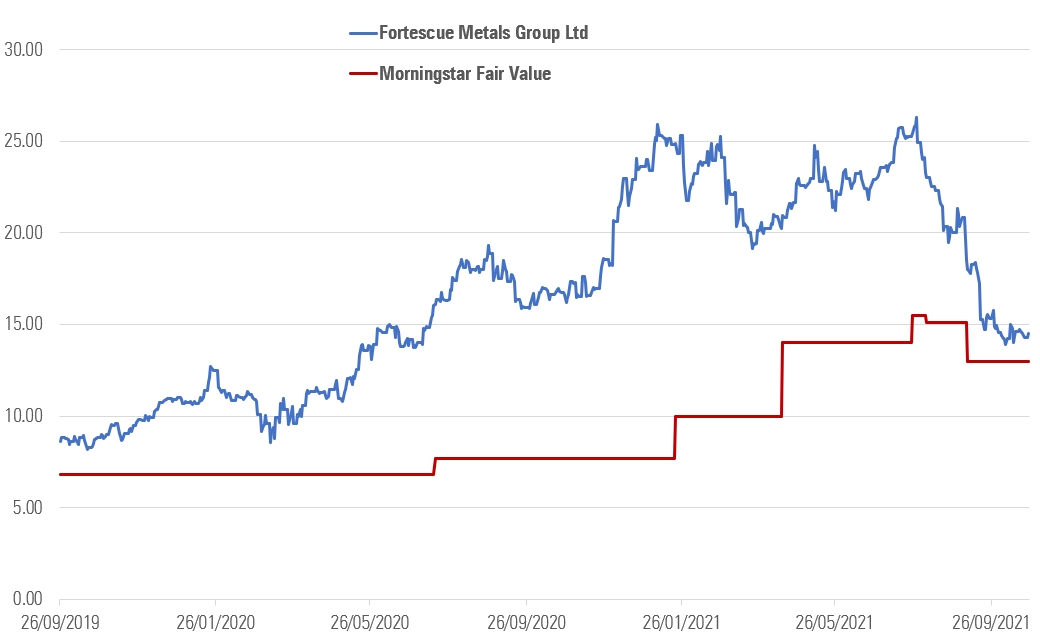

Fortescue Metals' (ASX: FMG) stock price has dropped over 45% since its peak of $26 in August to around $14 today, placing the stock in the three-star range. Hodge anticipates his fair value of $13 could fall if iron ore prices remain depressed.

FMG Price vs Fair Value

Source: Morningstar

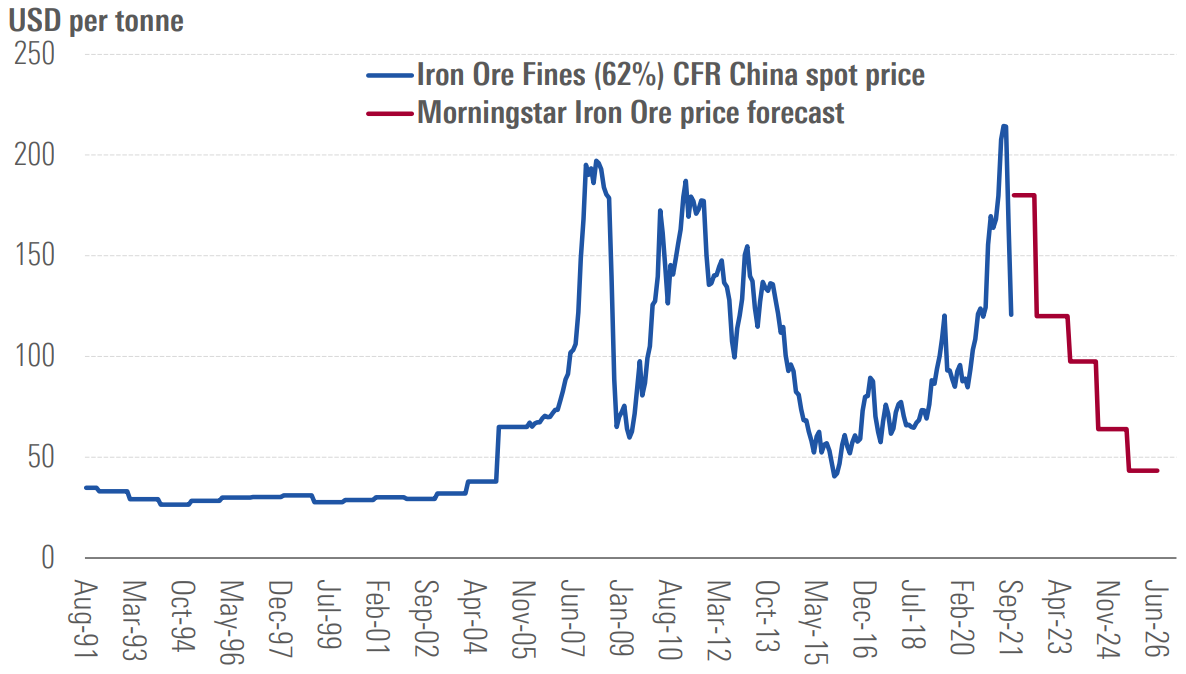

The dip comes amid a steep decline in the price of iron ore which almost halved in the third quarter. From a peak of US$230 per tonne in May, prices bottomed out at US$100 in September and closed yesterday at US$119.

Hodge attributes the steep falls to the slowdown in Chinese steel production as urbanisation and infrastructure needs fall. China makes up about three-quarters of traded iron ore demand and has account for almost off the growth. He says high prices also attracted new competitors, bringing on additional supply and pushing down prices. The growing influence of the scrap market in recycled steel is also a factor in the decline.

However, Hodge says at US$120 per tonne, iron ore is still well above the price required for the iron ore majors to make a reasonable return. He estimates that FMG can generate more than 30% after-tax returns on invested capital at an iron ore price of US$100 per tonne.

The iron ore price fell fast but there's fair value downside should it remain

Source: Morningstar

"The majority of steel goes into two things – housing and public infrastructure," he says.

"China has passed the peak of urbanisation. This is not like 2005 or 2008 when China had relatively immature infrastructure and a lot more people migrating to cities. Today, infrastructure per person is basically at developed world levels. Outsized investment has slowed – that's why the market had the correction it did.

"Optimism has returned somewhat but China has to reform the way it invests for a return and not just keep building things."

The Chinese real estate sector uses 20% of global steel and 40% of domestic steel by some estimates.

Pinning hopes on green hydrogen

Unlike its competitors, Fortescue is almost entirely exposed to the price of iron ore. BHP, for example, has been able to offset the fall in iron prices with rising coking coal prices. But a series of recent announcements has shown the company’s eagerness to diversify its business.

Together with the Queensland government, Fortescue Metals founder Andrew Forrest unveiled plans for the world’s largest green hydrogen equipment manufacturing plants in October, committing $1 billion to the project via Fortescue Future Industries.

Hydrogen is firming as a major front in the race to decarbonise economies. It can be burnt for fuel without producing any carbon dioxide or other greenhouse gas emissions.

Fortescue Metals founder Andrew Forrest and the QLD premier unveiled the world’s largest green hydrogen manufacturing facility in early October.

Morningstar analysts are yet to incorporate value from Fortescue's investment in green hydrogen as they say uncertainty surrounds the projects. However, they say the move aligns with the iron ore price in decline and foresee upside if FMG can secure first-mover advantage.

"I think it's really early days," Hodge says. “They're investing $1 billion a year in Fortescue Future Industries. That's not huge relative to the valuation or cash flows. It becomes more material if the iron ore price is sub $100 but it's a big dream at this stage.

“They're not alone and hydrogen is going to be a big market that attracts a lot of players. It's not clear to me what they bring that others won't. Maybe it's impossible for that to be clear at this time because the industry is at such a land grab, early stage.

"At this stage, we assume neither value creation nor destruction, which is ultimately an assumption that they'll earn their cost of capital from the investments they make."

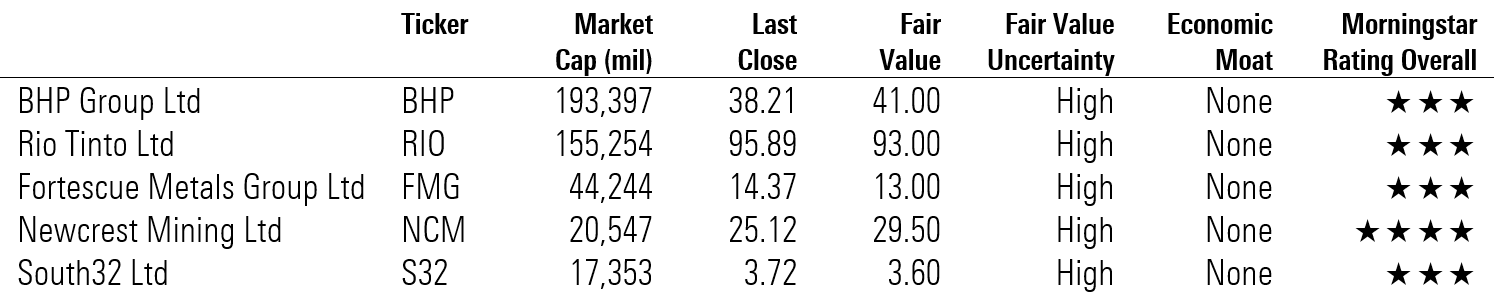

Materials sector slips in the September quarter

The materials sector significantly underperformed the broader index in the September quarter, falling 14% versus a 1% fall for the Morningstar Australia Index. This was due to the weak performance of the major iron ore miners. More than half of the market cap for the sub-index sits with the major iron ore miners, hence the iron ore price is the main performance driver.

Hodge says he's yet to see "bargains" amongst the major iron ore miners—Rio Tinto, BHP Group, and Fortescue—with all three trading at three-stars.

"We still see the copper- and iron ore-exposed miners as the greatest beneficiaries of China’s fixed-asset stimulus and as the most overvalued.

For opportunities, he recommends Newcrest trading at a 15% discount to fair value.

Morningstar basic materials coverage, top 5 by market cap

Source: Morningstar