Competition and covid weigh on Appen

Appen and other high-flying Australian tech stocks have fallen from their 2020 heights.

Julie Vonwiller couldn’t get a job as a linguist. Instead, she started a speech and language recognition company from her kitchen. Three years later in 1999, her husband left a senior role at Telstra to join her.

The company they founded, Appen, listed on the ASX on 7 January 2015 at 52 cents. By August last year it was trading above $40, a Dogecoin-like explosion of 6261.9 per cent.

The story since has been less rosy. Appen (ASX: APX) was down to $25.51 as 2021 began. It hit $11.11 on Thursday, a low not seen since 2018. It’s been a 74 per cent decline for investors who bought at the peak in August.

The Australian tech firm provides data and services to train the machine learning and artificial intelligence used by global technology companies, auto manufacturers and government agencies. It counts Microsoft among its clients.

Concerns arose last year that Appen was not going to meet revenue expectations, despite covid increasing the number of things done online. By the second half of the year evidence emerged that Appen's customers were pulling back on spending, according to ST Wong, CIO of Prime Value Asset Management.

"This started with smaller customers and then migrated to larger clients as well,” he says.

“Because of that narrative we felt that Appen's revenues against the valuation, which was very high, were at risk.”

“We sold in August last year. We had held it for a number of years but saw the profit downgrade come through,” he added later.

Appen, which is outside Morningstar coverage, missed revenue estimates for 2H 2020, reporting $212.1 million against the median estimate of $258.2 million, according to data from Pitchbook.

The pullback was partly driven by uncertainty among Appen’s US clients as covid cases rapidly accelerated there at the end of 2020.

The share price decline since last August has made some analysts bullish about the future. Buy recommendations now outweigh sells by 4:1, according to Pitchbook.

But for Wong, it will take some time to determine how an increasingly competitive landscape will affect the company’s future.

"On the sell-side there are a number of buys, given the share price has collapsed and its trading at a pretty decent valuation,” he says.

“But what the market is grappling with now is how more competition will affect margins.

“We won't know the answer to that for another four to five months, we need to see how the profits come out in the next two halves before the market will become more comfortable with Appen."

Prime Value held a position worth about $1.45 million in Appen last June according to Morningstar Direct. Another Aussie fund, Greencape Capital, held a $3.1 million position at the end of January 2021, they have also since sold.

Declines across WAAAX stocks

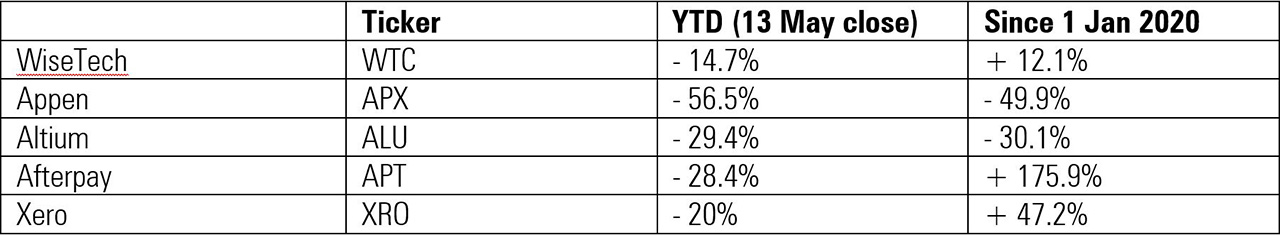

Appen isn’t the only technology stock to return to earth. The WAAAX, a group of high-flying Aussie tech stocks made up of WiseTech, Appen, Altium, Afterpay, and Xero, have all fallen this year.

WAAAX returns (YTD and Since 1 Jan 2020)

Source: Morningstar Premium

Morningstar equity analyst Gareth James recently upgraded the fair value estimate (FVE) for WiseTech (ASX: WTC) up 8 per cent to $9, thanks to higher-earning growth forecasts. The stock closed Thursday at $26.23, a 191 per cent premium on the FVE.

Afterpay (ASX: APT) is now trading in a range Morningstar considers fairly valued, after months of trading at a significant premium. It closed on Thursday at $84.50. The shift reflects the 88 per cent upgrade to its fair value (to $75) in late March. The share price has also declined 24 per cent in May.

Xero (ASX: XRO) closed Thursday $111.8, a 155 per cent premium on the fair value estimate of $46.

Altium (ASX: ALU) is not covered by Morningstar.

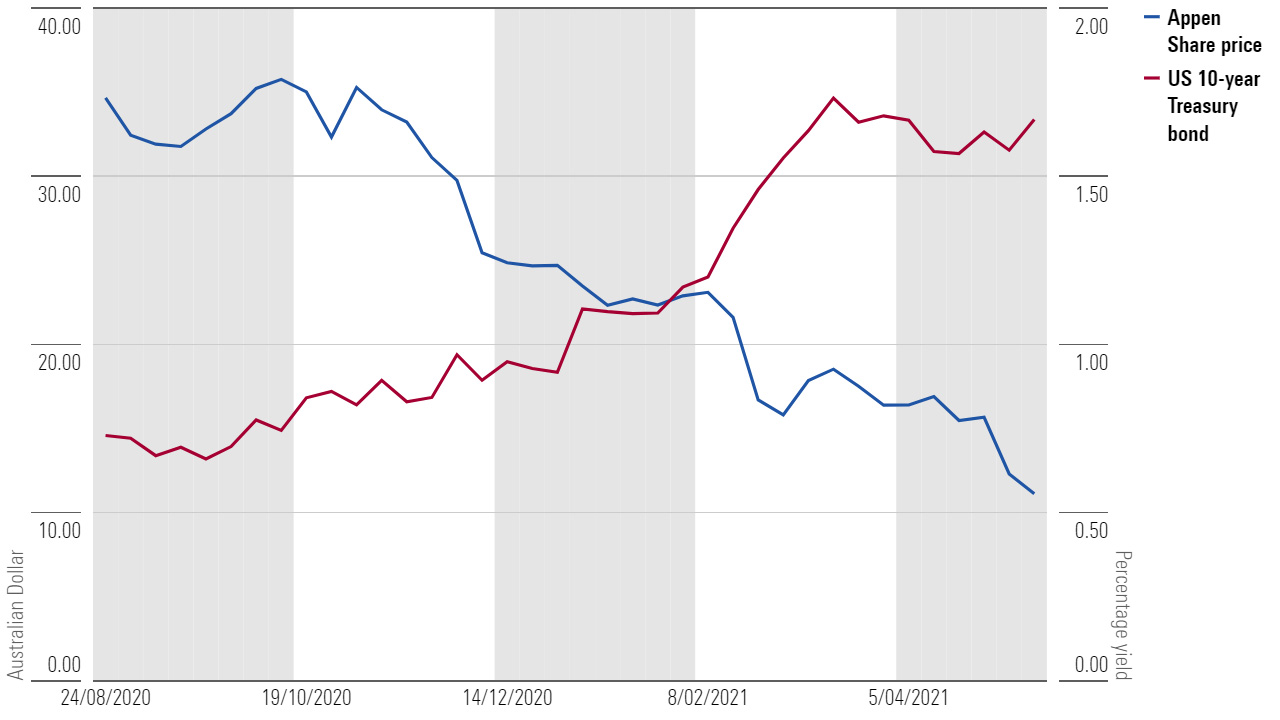

These tech stocks have fallen as bond yields have marched upwards on the expectation that the economic recovery will drive up inflation and interest rates sooner than expected.

Yields on US 10-year Treasury bonds rose from 0.917 per cent in January to a peak of 1.745 per cent at the end of March, a 90 per cent increase. It was a similar story for Australian 10-year government bonds.

Higher interest rates can affect the valuations of growth stocks reliant on discounted future cash flows.

Correlation isn't always causation, US 10-year bond yields vs. Appen (26 Aug 2020 to 10 May 2021)

Source: Yahoo Finance AU

High valuations ultimately come with high expectations for revenue growth. Whenever the latter looks shaky, so does the former, says Wong.

"WAAAX stocks were trading at very high multiples on the expectation of very strong growth.

“But when you pull away one leg of that thesis, with revenue growth starting to falter, a key support of the high valuation was pulled out."