Gold miners race ahead, but pockets of value exist

Some analysts see the price of the precious metal getting to US$3000.

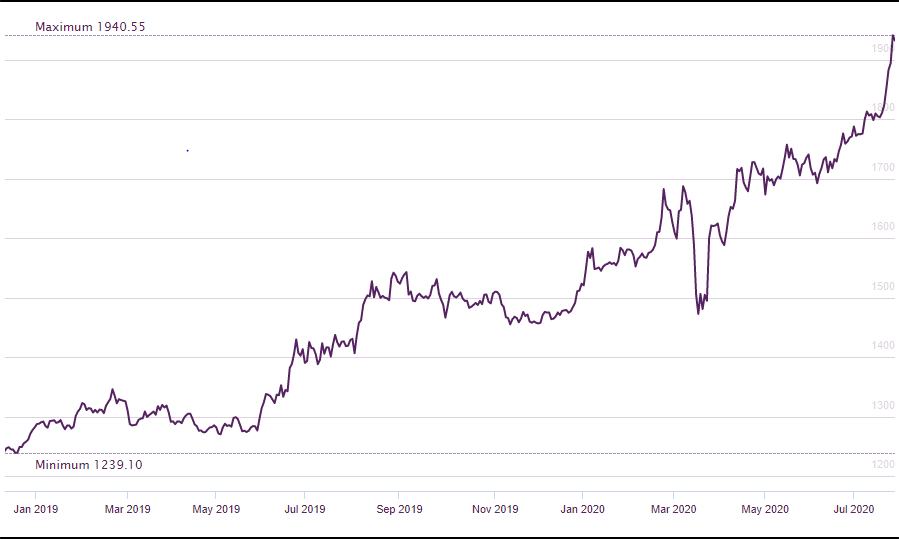

The gold price has just reached a new record high of US$1967 an ounce this month, eclipsing the record set in 2011 of US$1895, and Australian gold miners are riding the rally higher.

Finding value in the sector is becoming more difficult, but pockets still exist, strategists say.

Analysts have been upgrading their gold price forecasts, with one of the most bullish predictions coming from Bank of America, which sees gold trading as high as US$3000 as policy makers globally unleash huge spending and monetary stimulus programs to boost economies battered by the coronavirus. This has pushed capital into the relative safety of gold.

While gold equities fell about 40 per cent in March this year, they have risen around 70 per cent since, much more than the precious metal itself, according to investment bank UBS.

Some ASX stocks are up even more, with Regis Resources (ASX: RRL) 100 per cent higher since its March 2020 low. Evolution Mining (ASX: EVN) is up almost 80 per cent. Northern Star Resources (ASX: NST) by about 70 per cent. In comparison, gold has jumped about 32 per cent from its March low of US$1472 to almost US$2000.

“Where gold equities appeared inexpensive against gold (the commodity) in March, this is now no longer the case,” say UBS analysts in a new research note in July.

Gold going higher

Source: LBMA as at 29 July 2017

Mathew Hodge, resources analysts for Morningstar, says Newcrest Mining (ASX: NCM), Australia’s largest gold miner, remains one of the least expensive of the gold miners, compared to Regis Resources, which has raced hard this year.

“Regis has done well and investors assume it will continue to do well,” Hodge says. “But the company has a weakness of short mine life, which means it may look cheaper on metrics like price to earnings (P/E) but the sustainability of its earnings is more questionable.

“Regis’ gold mines do not represent in-perpetuity businesses, and this is a key reason we see the shares as overvalued.”

In contrast, Newcrest has a gold mine reserve life of more than 20 years, which is one of the longest of the global gold majors. Hodge puts a fair value on the company at $27.50, compared to its market price of about $36 as at 30 July 2020.

“We think this is appropriate given investor demand is inflated by low interest rates and a flight to safety. As external risks resolve and, longer-term, as interest rates normalise from very low levels, we expect investor demand to wane.”

Some other analysts are more bullish on Newcrest. UBS recently upgraded NCM to a ‘Buy’, the first time since August 2012, with a price target of $40.60. It has previously been sceptical of the stock, issuing a Sell rating just months ago.

“Both Evolution and Northern Star provide quality exposure to the gold price as evidenced by their year-to-date (YTD) performance of 58 per cent and 43 per cent [gains], respectively. But we think there is better value elsewhere,” says UBS, including Newcrest, Saracen Mining and Ocean.

UBS says Saracen offers the strongest production growth with five-year compound annual growth rate (CAGR) to 2025 estimated at 5 per cent. Newcrest, perceived by the market as having peak production in fiscal year 2020, still has potential to grow production with 1 per cent CAGR forecast to 2025.

“On both an absolute and relative basis, Newcrest’s valuation appears attractive … Evolution and Northern Star are our least preferred names because they are trading on premiums to peers that we think may be challenged during the upcoming August reporting season.”

Volatility remains, even for gold

Some analysts warn investors against putting too much money in gold or gold stocks. Dr Shane Oliver, chief economist at AMP Capital, says gold remains highly speculative and may drop at any time.

“It’s not grounded by an income stream like most shares, property, bonds and cash. Virtually all the gold ever produced still exists and can potentially come back on to the market,” Oliver says.

“Animal spirits can play a huge role in the determination of the gold price. This can make for a volatile ride and history has shown that the gold price goes through long term upswings and downswings.

“So, overall, we think there may be a role for gold in investors’ portfolios as a hedge against major paper currency weakness/inflation, but it should be limited to maybe no more than 5 per cent (depending on an investors’ circumstances).”

However, for now, the consensus amongst analysts is that gold will continue to rise. Shane Langham, senior private wealth adviser at Sequoia Financial Group and author of the Charting Wisdom technical report, says the sky is the limit for the precious metal. He predicted gold’s record climb last August on Morningstar.com.au.

“Gold is now in, what is known as, blue sky territory, as it’s at all-time highs where everyone who owns it is break-even or making a profit. This is a point where gold can run as there is no overhead resistance to stop it from advancing and puts gold in a very bullish position.”