3 defensive plays for a volatile market

Electricity and packaging are things we can’t do without, so too are airports—except when a pandemic forces them to halt operations.

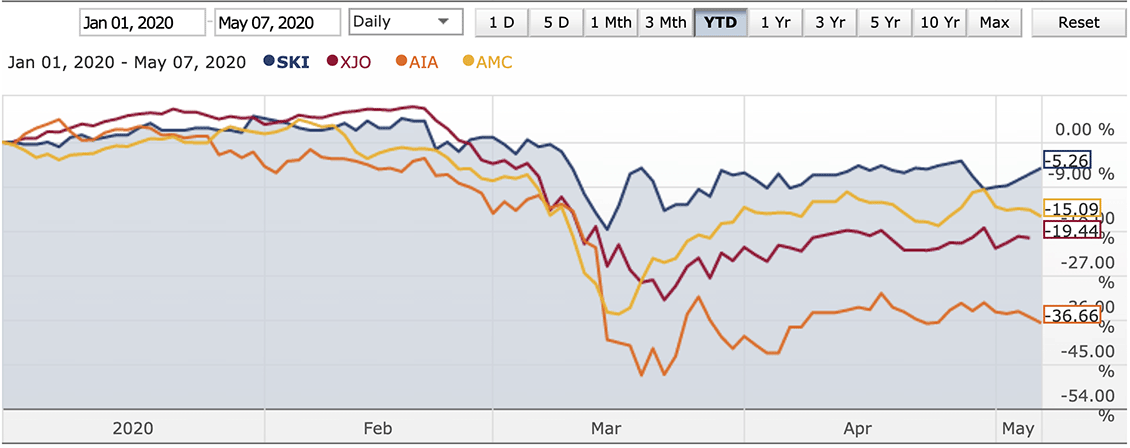

Compared to the 20 per cent year-to-date fall in the broader market, defensive plays Spark Infrastructure (ASX: SKI) and Amcor (ASX: AMC), a global packaging group, have withstood the worst of the covid-19 sell-off.

On the other hand, Auckland International Airport (ASX: AIA) has, along with travel and tourism stocks, suffered. The operator of New Zealand’s main gateway is off by about 35 per cent this year.

Year to date, Spark has fallen by about 5 per cent; Amcor is down 14 per cent. Despite its lack of moat, Spark is largely unaffected by the pandemic in the near term, says Morningstar equity analyst Adrian Atkins and is trading at a discount of 19 per cent.

Amcor, which makes packaging for essential items, has a strong balance sheet, which should help it weather the storm, says Morningstar equity analyst Grant Slade. Amcor is trading at a roughly 12 per cent discount to fair value.

And despite its plunge, AIA bears a wide moat—or 20-year competitive advantage—and is trading at a 16 per cent discount. If you’re prepared to be patient, AIA offers a compelling margin of safety for long-term investors, according to Morningstar director of equity research Adam Fleck.

Spark, Amcor and AIA share a medium uncertainty rating.

Benchmark v Spark, Auckland and Amcor YTD

Source: Morningstar

Spark Infrastructure SKI | 4 stars | No moat | 19pc discount | FVE: $2.40

Spark Infrastructure is a regulated utility. It owns 49 per cent of three electricity distribution networks: CitiPower and Powercor in Victoria (jointly known as Victoria Power Networks); and SA Power Networks in South Australia. It also owns 15 per cent of electricity transmission network TransGrid and 100 per cent of the Bomen solar farm development, both in NSW. Atkins says it offers a compelling margin of safety and should appeal to income investors.

“Despite lacking a moat, Spark is a defensive company, which shouldn’t be directly impacted by coronavirus or the economic fallout. It has its own headwinds from falling regulated returns but those are well understood and, we believe, priced in. While distributions will rebase lower, we forecast a sustainable 2021 distribution yield over 6 per cent, with franking averaging about 35 per cent over the medium term. Spark is relatively well insulated from the economy as the regulator will almost certainly increase network tariffs to offset any weakening of electricity demand.

“Its main headwind is that its tariffs are also linked to government bond yields, which are likely to remain depressed for the medium term. The two main assets—VPN and SAPN—are in good financial health and underpin distributions to investors. Smaller investment—TransGrid—provides the growth, with numerous attractive organic expansion opportunities, such as new transmission connections to wind farms and between States. These projects should provide significantly higher returns than its existing electricity networks.”

Amcor AMC | 4 stars | Narrow moat | 12pc discount | FVE: $15.30

Amcor’s global packaging operations have largely skirted the coronavirus fallout, having been deemed as life-essential services, and the company screens as attractive, says Slade, especially in light of its robust balance sheet.

“We’re attracted to Amcor’s defensive top line, balance sheet strength, and narrow economic moat. Furthermore, with plastic packaging tied intimately to the consumption of household staples, we anticipate Amcor’s packaging volume to be minimally affected by the impending economic fallout from COVID-19. Importantly, we believe Amcor’s balance sheet exhibits requisite strength. In the current, highly uncertain environment, we judge Amcor’s liquidity as sufficient and also expect financial leverage to remain well within internal targets.”

Auckland International Airport AIA | 4 stars | Wide moat | 16pc discount | FVE: $6.55

Auckland International Airport’s wide moat hinges on the amount of land it has available and the monopolistic status it enjoys as an airline hub. That said, it’s a wasteland at present amid the travel restrictions. The airport is now operating at about 10 per cent of its capacity, telling the ASX it had "no certainty in the near term of when the market would recover".

Total passenger numbers for March were down about 42 per cent on the March 2019 result. And the first 20 days of April this year show a decline of 95.3 per cent on the previous corresponding period in April last year.

Morningstar’s Fleck expects a 25 per cent decline in fiscal 2020 traffic, with a fall to nearly zero passengers from April to June 2020.

Despite the bleak near-term forecast, AIA offers a compelling margin of safety for long-term investors, Fleck says. The 52-week range of its share price tells the story of the bittersweet year it’s had: $9.45 to $4.17.

“We continue to forecast long-term movements growing at a low-single-digit average pace over the 10-year period from fiscal 2019, as global travel returns to normal through 2021, but envision Auckland Airport passenger traffic will only again hit fiscal 2019 levels in fiscal 2023. In response, management has opted to fly a safe path with a NZ$1.2bn equity raising, increasing shares on issue by roughly 21 per cent.

"This raising came at a 33 per cent discount to our prior valuation, which reduced our fair value estimate slightly. But the additional capital, along with other recent actions including debt covenant waivers, ceased dividends, reduced capital expenditures, and substantial operating cost cuts, should shore up Auckland’s financial position until conditions improve.”