Xero’s client knees-up dazzles but fails to account for sky-high Xero valuation

Ping-pong, skateboarding, all you can eat and drink. Don’t tell Xero that accountant software providers don’t know how to party.

Mentioned: Xero Ltd (XRO)

Ping-pong, skateboarding, all you can eat and drink. Don’t tell Xero that accountant software providers don’t know how to party.

Morningstar analyst Gareth James survived Xerocon, a sort of annual Woodstock for accountants in Brisbane last week, but came away no less convinced that the tech darling is trading at a premium – a 118 per cent premium to be exact.

James believes Xero (ASX: XRO) will continue to grow subscribers and generate strong profit growth over the next decade but says the implied earnings growth of its share price is increasingly unrealistic.

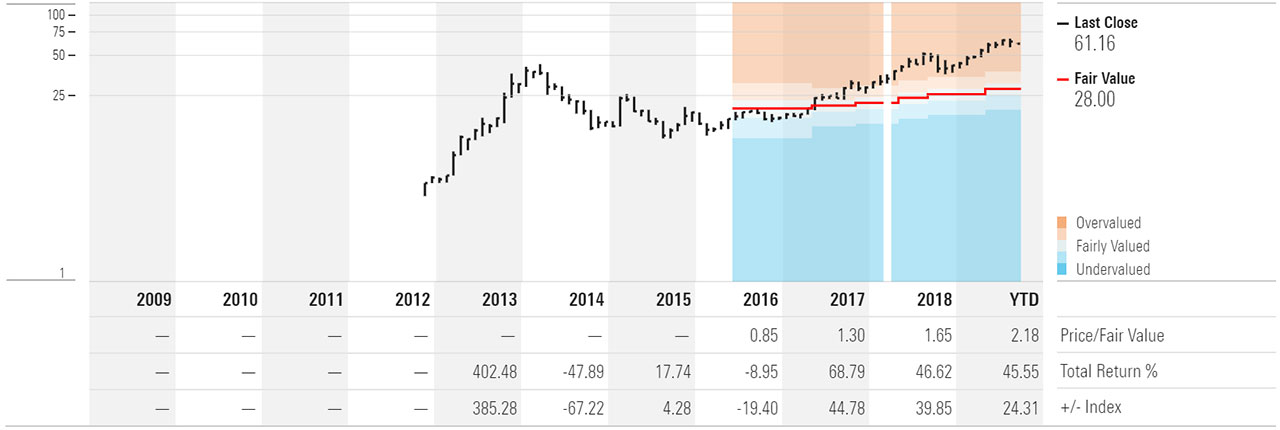

At today's price of $61.56, Xero is trading at a 118 per cent premium to James' $28 fair value estimate.

That said, the attendees at Xerocon - who pay for their own ticket, by the way – had reason to be festive. Shares in Xero have surged almost 50 per cent this year following a strong half-year earnings result, which included a 36 per cent boost in revenue and a 31 per cent jump in subscriber numbers.

The cloud accounting platform remains in great shape and customers still love Xero's software and culture - particularly as many endured poor products and customer service from MYOB before Xero entered the market.

"Although Xerocon can appear extravagant, it is primarily a sales conference designed to motivate and educate Xero’s accountant and bookkeeper ‘Partners’ who recommend Xero software to their small business clients," James says in his latest research note.

"Partners clearly enjoy attending Xerocon and many firms use attendance of it as a perk for employees. Importantly, the cost of the conference is borne by attendees."

Xero's cloud-based accounting software is primarily aimed at the small and medium enterprises, or SMEs, and accounting practice markets.

Xero has grown quickly from its base in New Zealand and surpassed local incumbent providers MYOB and Reckon to become the largest SME accounting provider in the region. Xero is also growing internationally, with a focus on the UK and the US. The company has a history of losses and equity capital raisings, as it has prioritised customer growth. 2019 marks the 11th consecutive year of losses for Xero.

Xero (XRO): Price vs. Fair Value

AUD | As of 16 Sep 2019 | Index: Morningstar New Zealand GR NZD. Source: Morningstar Premium

Research from Goldman Sachs Australia shows Australia's growth stocks, which include the “WAAAX” stocks – WiseTech (ASX: WTC), Altium (ASX: ALU), Appen (ASX: APX), Afterpay Touch Group (ASX: APT) and Xero (ASX: XRO) – are some of the most expensive in the world.

Lead researcher Matthew Ross found the premium for growth in Australia is 25 per cent above the second most expensive market for growth stocks, the US (31.5x).

Can Xero outpace the competition?

Morningstar’s James says Xero's business has strong momentum based on its subscriber and revenue growth and there is growing global awareness of its products and brand. At the same time, Xero's business is benefiting from its competitors' weakness.

"Reckon has lost market share and is beset by outdated software products which are unlikely to ever transition to the cloud," he says.

"MYOB is in better shape but also hindered by legacy software, in addition to the consequences of numerous private equity owners. The recent departure of MYOB’s CEO and the lack of a global offering also create challenges."

Xero’s main threat comes from American account software giant Intuit, the maker TurboTax and QuickBooks, James says.

But he warns the competition is not to be underestimated.

"Although Xero is winning, in Australia and New Zealand at least, we still think small business accounting software is reasonably commoditised and we expect competitors to copy the best attributes of Xero’s software," he says.

"We also think the commoditised nature of the product creates more price elasticity than the market assumes, evidenced by the widespread discounting in the industry.

"Fundamentally, we think the market is extrapolating current strong ANZ underlying profit margins and relatively young overseas markets, but ignoring the potential consequences of margin compression, including from a potential entry of MYOB into the United Kingdom market."

James says Xero management is aware of the threat from slowing subscriber growth in ANZ and has a plan to deal with it. It will seek to increase average revenue per user growth by upselling additional software to existing subscribers, and by increasing small business survival rates, via better cash flow management tools within its software.

However, he is not convinced either strategy will be particularly successful.

"In recent years, the company has only achieved low-single-digit average revenue per user growth, despite the launch of Xero Expenses and Xero Payroll, and we expect a large proportion of customers have little need for additional software," he says.

"Improving small business survival rates is also likely to be challenging considering the many factors which cause small businesses to fail."