SMSF assets hit $1 trillion for the first time

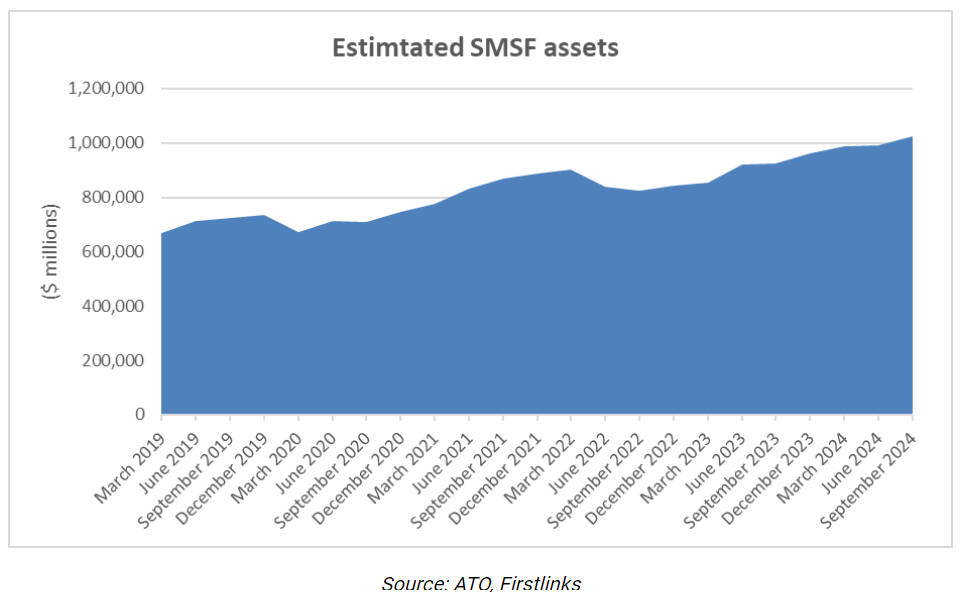

Latest figures reveal the estimated assets of SMSFs have topped $1 trillion for the first time. It’s quite an achievement for a sector not yet 40 years old, and it’s been driven by new members and recent asset returns.

Yesterday my colleague Mark LaMonica bemoaned the lack of transparency and high fees of industry and retail super funds. Increasingly Australians are turning to self-managed super funds ("SMSF") in response.

New ATO figures show the estimated assets of SMSFs have reached $1 trillion for the first time. The assets were up 3.2% during the September quarter and up 10.9% year-on-year.

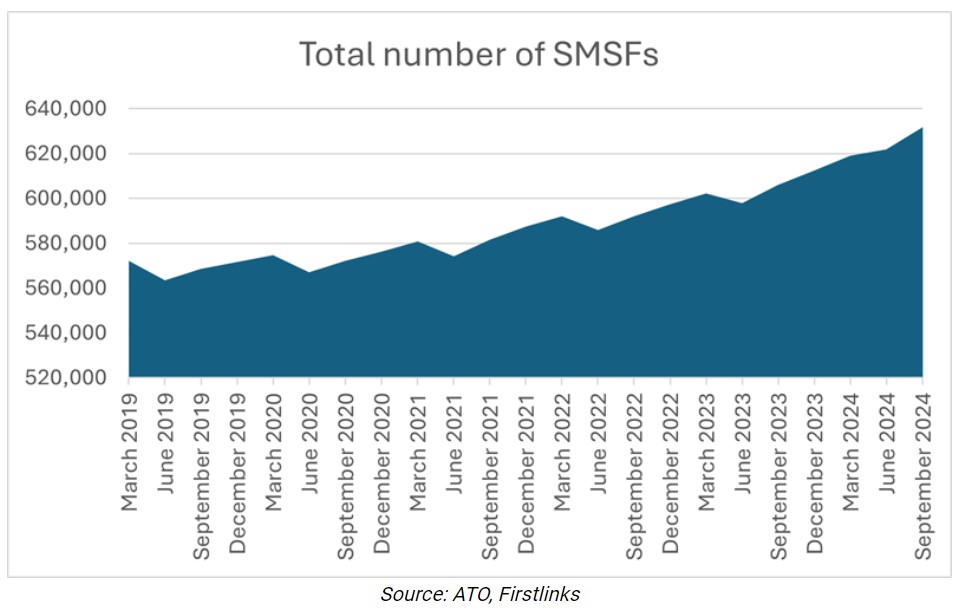

The increase in assets was partly driven by a rise in the number of SMSFs. That number has reached 621,809, up 1.6% on the quarter, and 4.3% for the year to September.

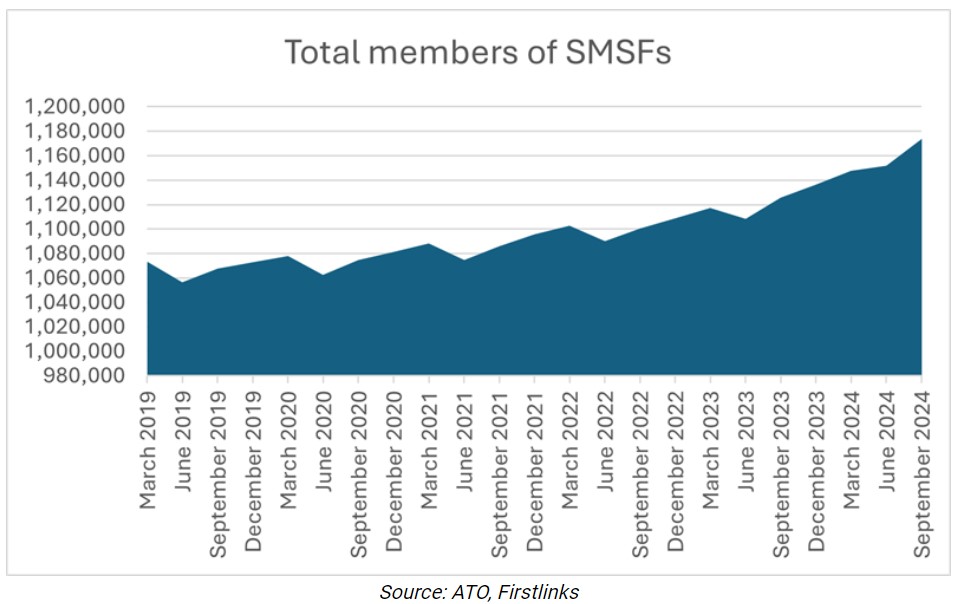

There are 1.15 million SMSF members, split 53%/47% between men and women. The average SMSF member continues to be middle aged or older, with 85% being 45 years or more.

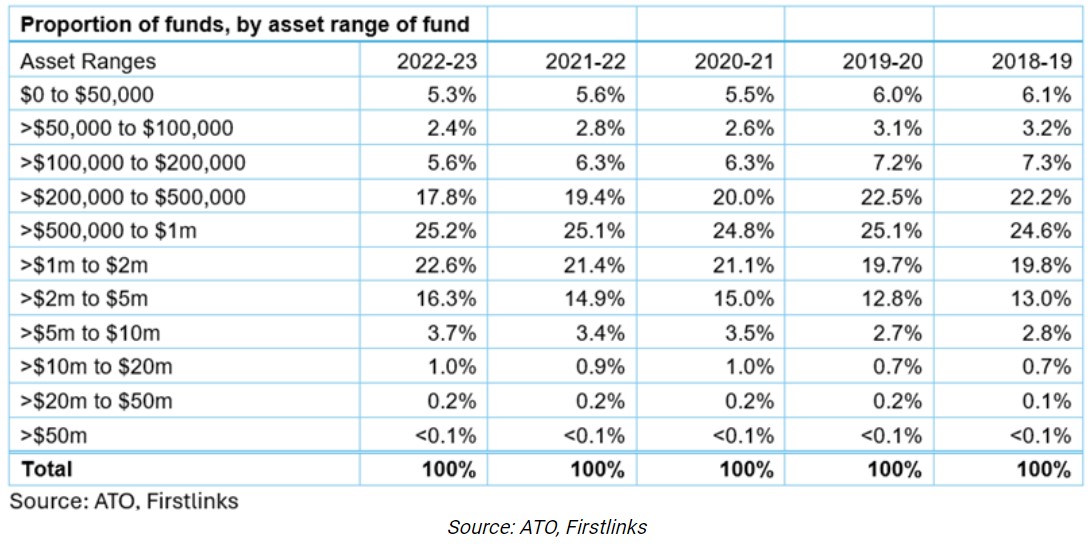

The data for SMSF asset ranges is somewhat dated, going back to June 2023. It shows two-thirds of SMSFs have assets between $500,000 and $5 million. About 5% are above $5 million.

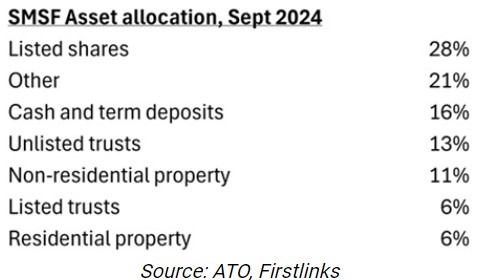

Figures for how SMSFS are allocating their assets are more up to date. The top asset types held by SMSFs are listed shares (28%) followed by cash and term deposits (16%) and unlisted trusts (13%).

That asset allocation hasn’t changed much since the start of the year. Listed shares have declined 1% over the first nine months, while cash has risen 1%, unlisted trusts are unchanged, and non-residential property is marginally down.

A separate report from APRA shows total assets in superannuation have topped $4 trillion. These assets increased 3.7% over the quarter to September and 13.4% year-on-year, driven by strong asset returns.

Most super assets are in APRA-regulated funds ($2.8 trillion out of $4.1 trillion), followed by SMSFs.

The five-year annualised rate of return for super funds was 5.9% to September this year.