Too big to hide: Australia’s largest SMSFs spark debate

A small number of self-managed 'mega-funds' are causing a stir, writes Anthony Fensom.

They are Australia’s biggest self-managed super funds, holding millions of dollars of assets. Are they emblematic of a failed system, or dinosaur funds that will soon be gone?

Twenty-seven of the nation’s biggest SMSFs held more than $100 million each in assets in fiscal 2019, including one as big as $544 million, according to data obtained by the Australian Financial Review.

The report highlighted that the biggest funds have grown even larger, with the previous biggest SMSF holding some $330 million.

Total assets held by the top hundred SMSFs has increased from around $8 billion in fiscal 2018 to over $9 billion a year later, the July 16 report said.

But these "mega-funds" are likely a dying breed, according to one industry specialist.

“The largest funds are now outliers and don’t really represent the SMSF sector,” says SMSF adviser Liam Shorte.

“We call them the ‘Dinosaur Funds’ as they will drop substantially with the death of current members because of the total super balance and transfer balance cap limits of $1.6 million to $1.7 million.

"This means the majority of the death benefits will have to leave the superannuation system."

Shorte believes the chance of having a huge SMSF in the future will be curtailed and restricted to those that pull off the investment of a lifetime.

"[Think of] someone who bought Fortescue Metal (ASX:FMG) at $0.02 in 2003, or initial investors in this year’s darling, Afterpay (ASX:APT)," he says.

The SMSF Association has proposed measures to discourage the retention of such balances indefinitely. In a submission to the Retirement Income Review, the industry body proposed "increased tax rate for extremely large superannuation balances" and "forced withdrawal of capital for extremely large superannuation balances".

Other proposals include that super be taxed both in the accumulation and pension phase at the rate of 10.5 per cent, or the entire system be taxed at a standard 15 per cent.

Alternatively, funds could be restricted in size to the transfer balance cap of $1.7 million per person, according to Rice Warner’s Michael Rice.

This follows suggestions that the existence of mega-funds could spark a crackdown on their multi-million-dollar tax concessions, potentially affecting all SMSFs, whether large or small.

“Critics are lining up to call foul – they suggest this is not what superannuation tax concessions were meant to create – and it’s an entirely reasonable criticism,” The Australian’s James Kirby says.

“The challenge is to solve the problem without undermining the wider success of the system which is greatly appreciated by self-directed investors who represent the backbone of the retail investment sector."

The SMSF Association believes extremely large superannuation balances are worthy of attention, both SMSFs and APRA-regulated funds.

"The Association acknowledges and supports that superannuation is primarily for the purpose of retirement and should not just be an estate planning tool to protect assets in a concessional environment," the body said in its submission to government.

"...Policy measures to discourage the retention of such [large] balances indefinitely within the superannuation system could be considered."

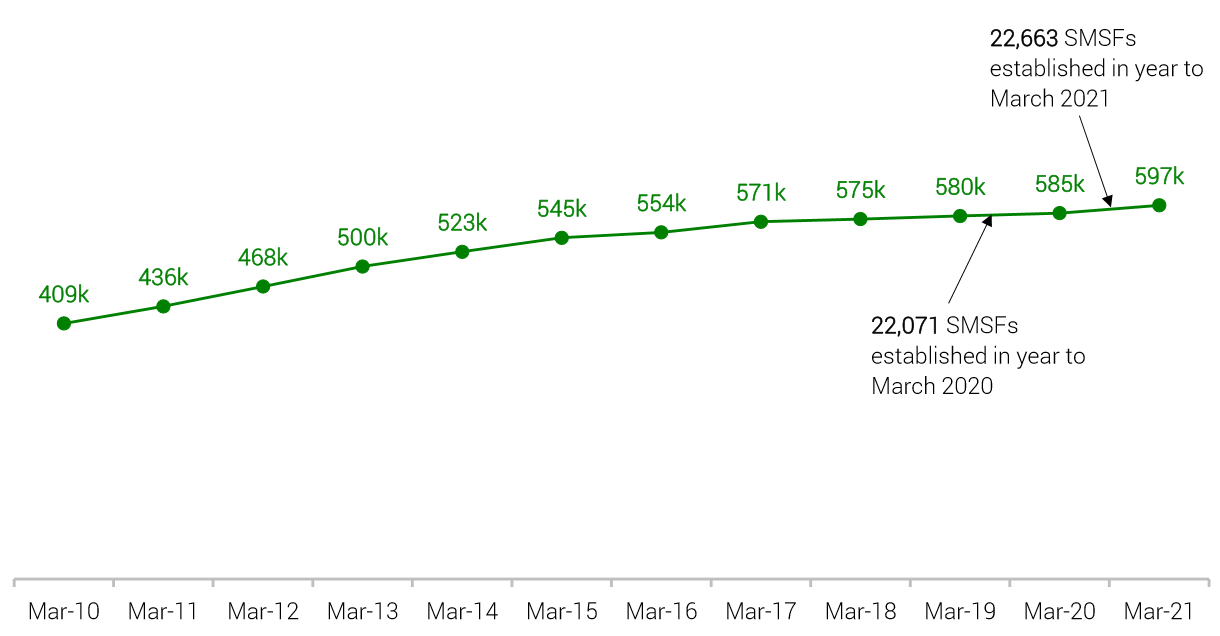

Number of SMSFs established, by year

Source: Vanguard/Investment Trends 2021 SMSF Investor Report, ATO Self-Managed Super Fund Quarterly Statistics Report

Overall, Australia’s nearly six-hundred thousand SMSFs held nearly $790 billion in net Australian and overseas assets, up from $566 billion five years earlier. The number of funds has also risen by around fifty thousand over the same period, with around half the increase occurring over the past year.

The number of SMSFs with more than $5 million in assets has also swelled, accounting for 3.6% of all SMSFs as of fiscal 2020, or approximately 20,000. This compares to the latest ATO data, which reported median assets per member of $414,912 and median assets per SMSF of $733,926 for the June quarter 2021.

Recent growth in residential property and stock prices suggests SMSFs will soon top the $800,000 median assets mark, with even more growth ahead for the larger funds.

Smaller balance funds are still viable

ASIC argues that SMSFs with balances below $500,000 “have lower returns after expenses and tax than funds regulated by the Australian Prudential Regulation Authority.”

Yet research conducted for the SMSF Association indicates that funds with balances over $100,000 can still be competitive with APRA-regulated funds.

Shorte, director at Verante Financial Planning, says those contemplating establishing an SMSF should not be deterred by the size of the mega-funds.

MORE ON THIS TOPIC: Cost of running an SMSF receives updated judgement

“The minimum required to run an SMSF will depend on the chosen strategy, assets and the level of involvement in managing the fund,” Shorte says.

“Using direct shares with data feeds to SMSF Administration software becomes viable around $200,000, but you would want to see very decent annual contributions with a view to being nearer $400,000 to $500,000 within five years.

“If you are going to start a fund and outsource some of the responsibility, or use property or non-standard investments that require more administration, then I believe you would need $350,000 to $500,000 in your fund, as the costs of running the fund are higher, as are the costs of holding and maintaining those assets."